GST Case 3- Merit Hospitality Services (P) Ltd.

Case GST 3- Merit Hospitality Services (P) Ltd.

Following is the GST case in which the taxliability id questioned regarding the food distributed to the employees:

Facts: The applicant has entered into a contract with a company situated in SEZ. The supply of foods is done by the applicant to the employees of SEZ Unit and the payment of the supply of food is made by employees directly to the applicant.

Query 1:

Whether applicant can claim that since food is supplied directly to SEZ Area, hence GST is not applicable.

Observation: Hon’ble AAAR observed that as per provisions of Section 16 of IGST Act, 2017; Zero Rated supply of goods or services means supply of goods or services or both to a SEZ Unit. Supply of food has been made by the appellant to the employees of the units located in SEZ Area and it cannot be construed as zero rated supply as employees cannot be treated as SEZ Unit.

Held: GST would be applicable as per the relevant classification of services.

Comment: The critical factor in the above decision seems to be the fact that payment of food was being made by the employees to the appellant therefore supply of food has been held to be supply to employees and not to SEZ Unit even though the contract for supply has been entered with SEZ Unit. Otherwise Circular No. 48/22/2018-GST Dated 14th June 2018 provides that; if hotel, accommodation services, consumables etc. are received by a SEZ unit for authorised operations, as endorsed by the specified officer of the Zone, the benefit of zero rated supply shall be available in such cases to the supplier.

Related Topic:

RESTAURANT AND OUTDOOR CATERING SERVICE

RESTAURANT AND OUTDOOR CATERING SERVICE

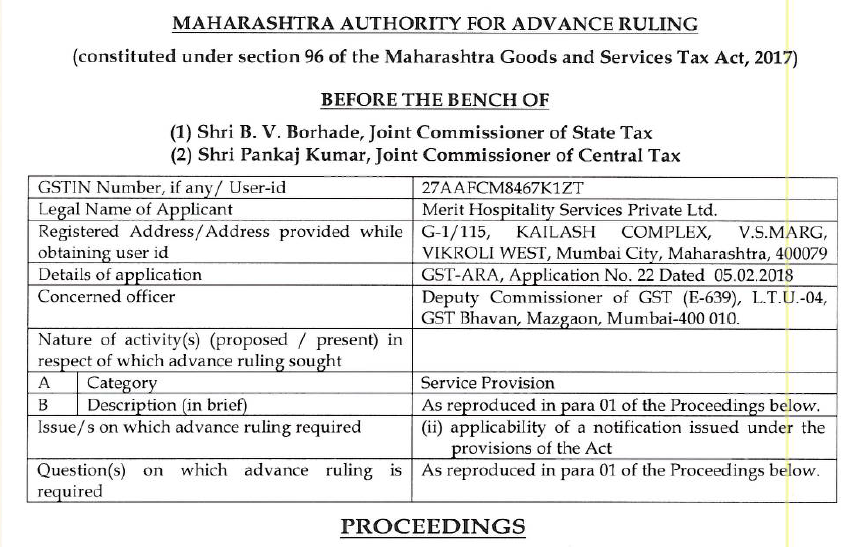

Download the copy of AAR’s order regarding the GST Case, by clicking the below image:

Query 2:

Whether applicant can claim that since they are running a restaurant in SEZ Area, hence applicable rate is 5% only.

Observation: Hon’ble AAAR observed that the term Restaurant has not been defined under the GST Law. Under Cambridge Dictionary, Restaurant has been defined as a place where meals are prepared and served to the customers. Hon’ble AAAR observed that the appellant himself has provided that they are registered as “Outdoor Caterers”, they prepare the food in their own kitchen and then distribute it to various companies at different locations with whom they have entered the contract.

Held: Therefore since the food is not being cooked where it is served, therefore this event is not covered under the definition of restaurant. Further as it is held that appellant is not running restaurant, therefore tax rate of 5% is not applicable in the instant case.

Comment: Many other dictionaries have taken a much broader meaning of the word restaurant. Thus, reason for taking meaning of restaurant in restricted sense may have been elaborated. Hon’ble AAAR limited itself to the question whether appellant is a restaurant or not and its consequential rate. The question regarding applicability of Tax Rate of 5% being a caterer without being a restaurant under Explanation 1 of Entry 7(i) of Notification No. 11/2017 was not raised otherwise it might have been a much broader question.