Gst Compliances for Goods Transport Agency

Table of Contents

Introduction:

Goods transport agencies are the backbone of the Indian Industry. Here we have compiled the full list of compliances for Goods transport agency.

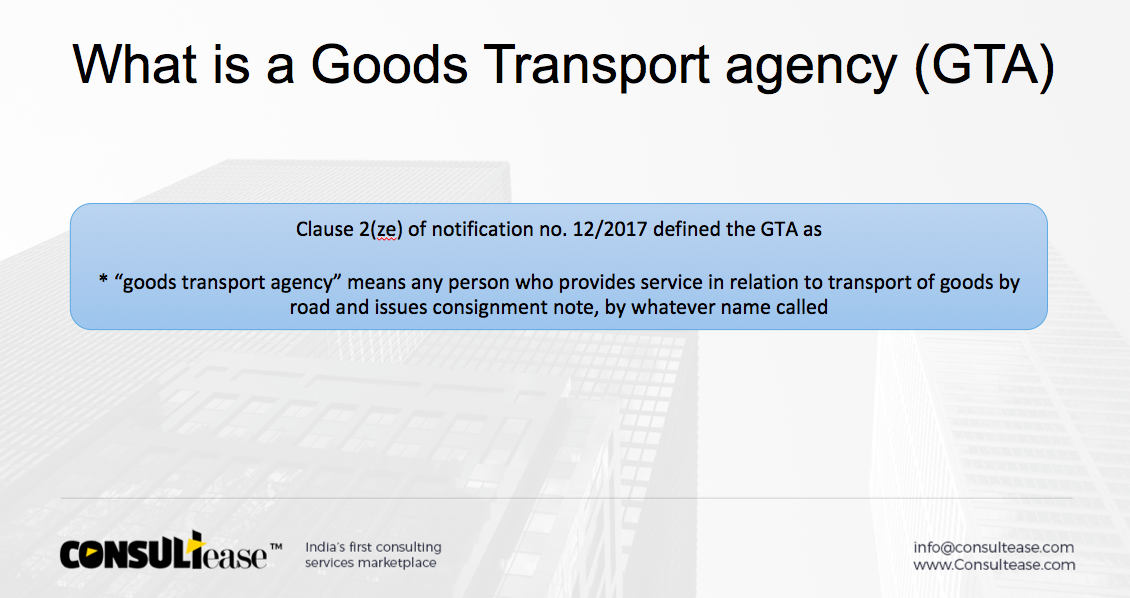

What is GTA?

A GTA or a goods transport agency means transporters. They move the goods from one place to another place. But to be precise let us look at how it is defined in the GST law.

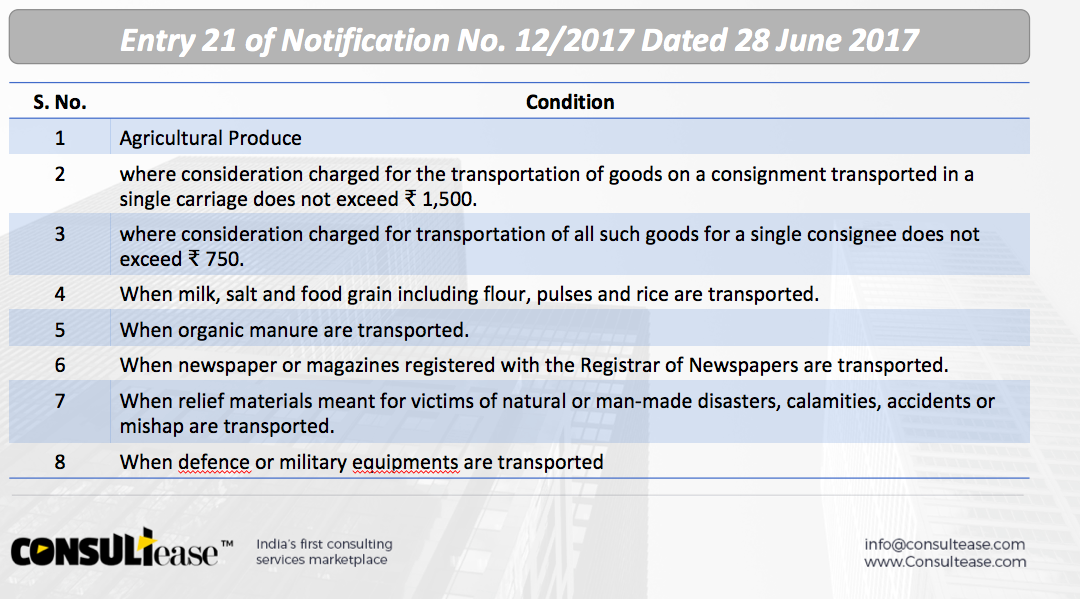

Exemptions to Goods transport agencies from GST

There are some exemptions for Goods transport agency in GST. These exemptions are given in notification no. 12/2017. – – Transportation of the following materials is exempted from GST.

- In case of a single load bill up to Rs. 1500 and in case of multiple loads bill up to Rs. 750 is also exempted.

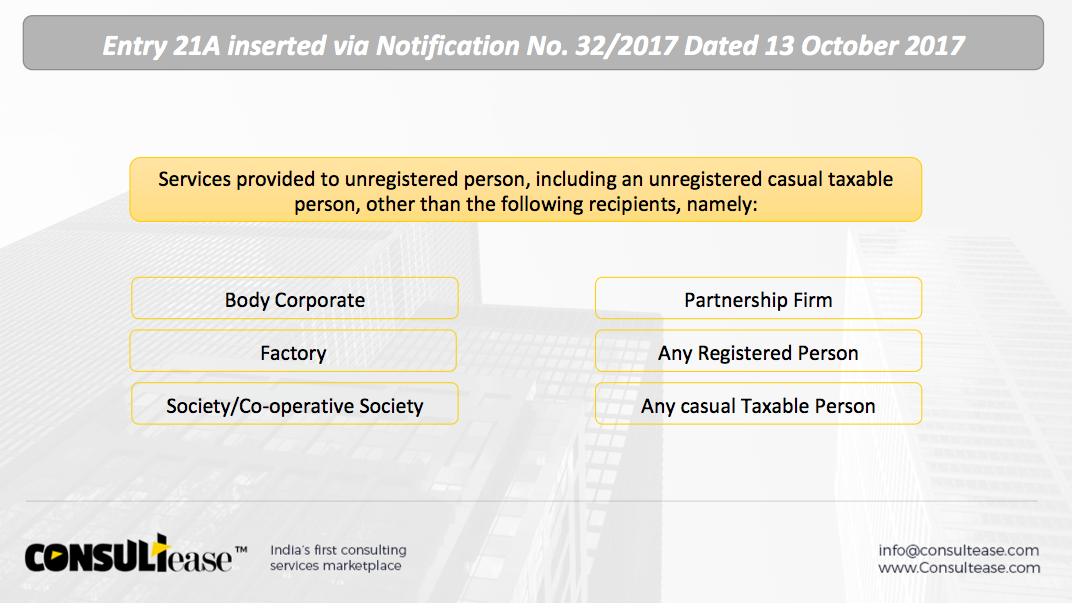

- Services provided to an unregistered person other than the following are also exempted.

Rate of tax on services by Goods transport agency (GTA) in reverse charge

The services of GTA are covered in reverse charge in GST. It means that in this case the recipient of services is required to pay the tax instead of the supplier of services. Thus a GTA is not required to pay tax.

The rate of tax in RCM on GTA services by 5%. The recipient can pay the tax and claim its ITC. In this case, the goods transport agency will not be able to claim input tax credit.

Rate of tax on services by Goods transport agency(GTA) in forward charge:

GTA is also allowed to pay in forwarding charge. In this case, the recipient will not be liable to pay GST in reverse charge.

The rate of tax for forwarding charge tax payment by a GTA is 12%. But they can adjust ITC, which is tax paid on purchases in this case.

However, As per the Notification No. 20/2017-CTR, the GTA will have to opt in at the beginning of the Financial year

GST compliances for Goods transport agency:

Invoice for each load: A GTA is required to raise an invoice for each supply. The invoice shall be serially numbered. The invoice number cant repeat during the year in a single series. Although the taxpayer can keep various series.

Related Topic:

RCM ON FREIGHT PAID FOR EXEMPT PRODUCTS

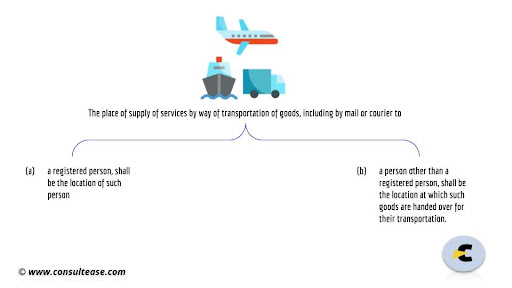

Place of supply for GTA:

Here are few examples to help you determine the place of supply in such cases-

- Praveen a registered dealer in Haryana, hires a GTA to deliver gods in Rajasthan. In this case, Place of supply will be the location of the recipient i.e. Haryana

- Annu is an unregistered dealer in Maharashtra & she hires a GTA to deliver goods to Rajasthan. In this case, the place of supply will be Maharashtra where Annu hands over the goods to the transporter.

- Roshan is registered in both Mumbai and Bangalore. He hires a transporter (based in Mumbai) to deliver from Bangalore to Delhi. CGST & SGST will be applicable. If the transporter is based in Chennai, then IGST will be applicable.

Returns:

They are required to file the following returns:

- GSTR 1: It can be filed monthly or quarterly. Although monthly filing is more recommended. It helps in reflecting of ITC in 2A & 2B of the recipient. They can take ITC monthly. In the case of a quarterly return, they will have to wait for the filing of the quarter. Some recipients may avoid buying in this case. In GSTR 1 they need to click on reverse charge in case of RCM invoices.

- GSTR 3b: Monthly GSTR 3b is required to be filed by the goods transport agency.

- Supply, where the tax is charged in FCM, will be shown in table 3.1 (Domestic only)

- Where the tax is paid by the recipient in RCM then they may fill it in exempt or may reflect it in GSTR 1 only.

This article is compiled for common compliances by GTA. Once the new return of GST will be applicable. This compliance will change.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.