15 suggestions on GST RETURNS, PROCEDURES, LAW & POLICIES – December 2019

PART A – Suggestions on IDEAL RETURN FILLING PROCEDURE under GST

PART B – SUGGESTIONS for SIMPLIFICATION OF GST LAW & POLICIES

PART C – SUGGESTIONS FOR Increase in Government Revenue

___________________________________________________________________________________________________________

PART A – Suggestions on IDEAL RETURN FILLING PROCEDURE

which provide ease in return filling , get Speedier procedures , Boost compliance level & & suggestion on sub rule 36(4) so that dealers can avail seamlessly ITC without any restrictions & Also suggestions to deal with Fake claim of ITC. These SUGGESTIONS together can assure lot of Simplifications for routine return filling process, Provide big relief to Small Taxpayer from lengthy procedure currently happening in GST return filling process….

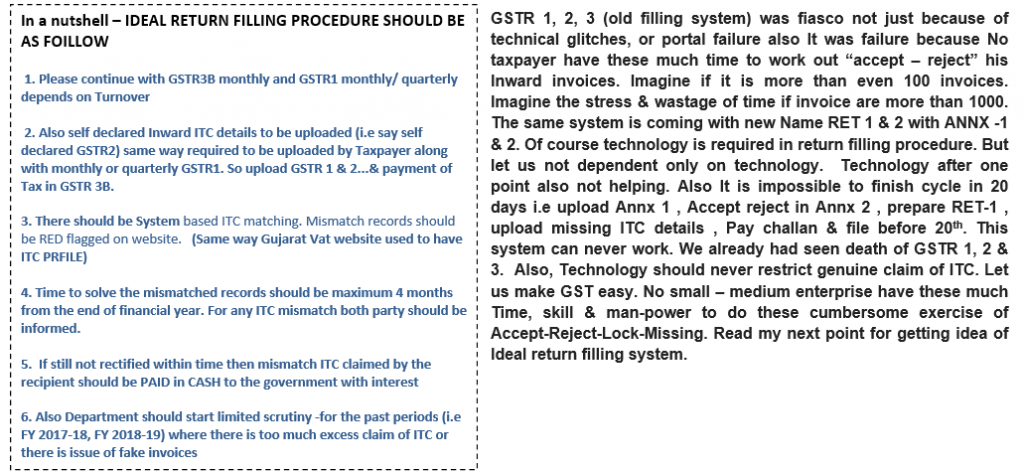

1. HOW IDEAL GST RETURN FILLING SYSTEM SHOULD BE?? INTRODUCE SELF-DECLARED INWARD SUPPLIES RETURN- Instead coming with old formula of GST returns with new names, Please continue with GSTR 1 and GSTR 3B. Also Allow to upload ITC details in a new simple self- declared Form. Same like Outward supplies we upload as of now. Allow to upload INWARD SUPPLIES ALSO. Let system makes GSTR 3B automatically from all self declared OUTWARD & INWARD supplies.

2. For, ITC matching – A self declared Inward ITC details to be uploaded (i.e say self declared GSTR-2) same way required to be uploaded by Taxpayer along with monthly or quarterly GSTR1. So upload GSTR 1 & GSTR 2 and payment of Tax in GSTR 3B. And there should be System based ITC matching. Since GST Act should allow uploading INWARD SUPPLIES on self- declared basis, should show mismatch ITC i.e ITC matched & Mismatched. System should intelligently match invoices evenif there Rounding off issue or Invoice number not matching just because of “comma” “/” , “,” “-“ etc signs . Hopefully Portal can show RED FLAG for such Supplier’s list in ITC profile who have not filed returns. This will be ITC mismatch. (Same way Gujarat VAT website used to have ITC PROFILE) .System ITC profile should be continuously updated same way GSTR 2A gets updated after supplier file his returns. Max. Time to file returns should be 4 months from end of Financial Year. After these 4 months time period from end of FY, Then only Action required to be taken .Nothing to worry till 4 months of end of FY. Suppliers who had financial crunch and could not uploaded their GSTR1 and GSTR 3B, they may have sometime so that they may get some relief and their recipients will also can take breath. So no more financial pressure and mental pressure.

2. For, ITC matching – A self declared Inward ITC details to be uploaded (i.e say self declared GSTR-2) same way required to be uploaded by Taxpayer along with monthly or quarterly GSTR1. So upload GSTR 1 & GSTR 2 and payment of Tax in GSTR 3B. And there should be System based ITC matching. Since GST Act should allow uploading INWARD SUPPLIES on self- declared basis, should show mismatch ITC i.e ITC matched & Mismatched. System should intelligently match invoices evenif there Rounding off issue or Invoice number not matching just because of “comma” “/” , “,” “-“ etc signs . Hopefully Portal can show RED FLAG for such Supplier’s list in ITC profile who have not filed returns. This will be ITC mismatch. (Same way Gujarat VAT website used to have ITC PROFILE) .System ITC profile should be continuously updated same way GSTR 2A gets updated after supplier file his returns. Max. Time to file returns should be 4 months from end of Financial Year. After these 4 months time period from end of FY, Then only Action required to be taken .Nothing to worry till 4 months of end of FY. Suppliers who had financial crunch and could not uploaded their GSTR1 and GSTR 3B, they may have sometime so that they may get some relief and their recipients will also can take breath. So no more financial pressure and mental pressure.

3. FOR ITC mismatching – Mismatch time should be maximum 4 months from the end of financial year. For any ITC mismatch, both parties should be informed firstly. Reasonable time of one more month should be given by department for any Suppliers who have not uploaded its returns. If still not filed within time then mismatch ITC claimed by the recipient should be PAID in CASH to the government with interest. A compulsory reversal of ITC for all mismatched Inward records. In future if any such Suppliers file return (who earlier not filed return within stipulated time), Then recipient should be allowed to take credit again for this.

4. FOR IRREGUALR GSTIN & for catching Defaulters – Do not harass the suppliers who have made purchases from irregular suppliers. It is important that Department should catch these kind of irregular supplier. Send notices to those who don’t file returns & don’t pay taxes. Also there should be departmental Raids / Search / Surveys for such defaulters. Block for uploading GSTR 1 & GSTR 3B of such GSTIN of taxpayers who does not furnish their return for than 4 months (unless & until they pay full tax with interest & late fees). Suspend their GST Number. Freeze their Bank accounts only after 4 months. Show a warning flag when one search his GSTIN on portal. Display a list on website that are not filling since last 4 months. So that other honest taxpayers can have idea of not doing business with such parties. That’s how they can safeguard them.

5. REMOVE SUB RULE 36(4) – Please remove sub rule 36(4) added for 20% cap on ITC not shown in GSTR 2A. This is ultra –vires to section 17 for seamless availability of ITC. It’s against right to claim full ITC. It’s not just possible to calculate on every 11th. It’s financially burdening as well as Business killing decision. Rather than harassing all taxpayers to calculate tedious work to decide the max eligible ITC available each month and deny GENUINE ITC even if He has Invoices in hand…This will give Relief to all small taxpayer. No denial of ITC even if it falls short then 83.33% even if taxpayer has valid tax invoice. There won’t be any hassle to those whose ITC have only minor difference in their 2A and 3b. . A big relief to small taxpayer for calculating cumbersome eligible ITC as per sub rule 36.4 in every month in a year…no more required to do a mismatch exercise every month. No more calculation required to decide eligible ITC and no more injustice to those who falls little short in getting credit more than 83.33%. Its better department go for limited Scrutiny of ITC for FY 17-18 and 18-19. This point is explained in detail in next suggestion.

6. Concept of Limited Scrutiny for verification Claim of ITC for past periods FY 17-18 & FY 18-19- How should department find such cases?? – Now this should be system driven. System should Find the difference of GSTR 2A and GSTR 3B ITC (ONLY All other ITC) for the above period for the all Taxpayers. And GST officers should be assigned to this task of verification of claim of ITC in cases where there is huge mismatch.

If Yearly difference is more than Rs 1 lac under any head (CGST /SGST /IGST), then and then only Go for limited scrutiny.

How to select cases in Limited scrutiny?? Answer – Divide Taxpayers based on % Gap of GSTR 2A & GSTR 3B

Where variation of GSTR 2A and GSTR 3B is more than 1 lac and in percentage if it is

More than 40% Gap in 2A & 3B – Select all cases

More than 20% Gap in 2A & 3B – select only 50% cases

A compulsory limited scrutiny of such cases will lead to fear to those who are claiming fake ITC for issuing fake invoices. Limited scrutiny will solve the problem of fake ITC claim. Departmental revenue will increase if they find out fake ITC claimants & penalise them.

PART B SUGGESTIONS FOR SIMPLIFICATION OF GST LAW & POLICIES

To provide ease of business to dealers & to make GST “simple” and Help to clear mess created under GST so that compliance level can be increased. These SUGGESTIONS can assure lot of relaxation to businessmen against in-genuine hardships & provide ease of doing business.

7. FOR REMOVAL RCM – REMOVE IT COMPLETELY. Both section 9(3) and 9(4). Retrospectively from 01/07/2017. As in most case, it is revenue neutral.

8. FOR REMOVAL OF PRVOISION REVERSAL OF ITC IF NON-PAYMENT in 180 DAYS – Delete the provisions of Reversal of ITC in case of non payment to Creditors within 180 days and interest thereof if late reversal. Or make it applicable to only Dealers having Turnover more than 100 Crores.

9. FOR CASH LEDGER – ELECTRONIC CASH LEDGER should be one basket…Merge all heads into one ASAP. Cash Ledger Should Be Made With No More Tax Heads like IGST , CGST , SGST , Cess And Also No More Sub-Types Like Tax , Interest , Fees , Penalty & Others.. It should be only one single cash balance approach. This was also decided in One GST meeting. Balances of Cash Ledger should be under single head so that it can be utilised for any purposes as deemed necessary.

10. FOR LATE FEES collected in FY 17-18 & 18-19 – Refund of all late fees for all GSTR 3B filled up to period March 2019. It was anyways waived for some very late fillers lately. Otherwise it will be injustice to those who have been late in filling only few days & paid LATE FEES. Its genuine demand from all small –businessmen. Please recredit in Bank accounts of dealers.

11. FOR MAXIMUM LATE FEES – late fees should be capped at Minimum of these three criterias. [1. per day @RS. 10. NET Tax Payable 3. Rs. 1000] whichever is lower under CGST & SGST. So as to ensure that it will not be higher than NET TAX payable in any case. (Moreover, late fees should be only from 2019-20. Please Refund late fees collected for FY 17-18 and 18-19).

12. FOR PENDING ITC OF PREVIOUS YEAR – The Dealers should be allowed to take eligible ITC before filing the Annual Return for every coming FYs. Again its genuine demand in initial years.

13. FOR PORTAL – The capacity and speed of GST website should be increased. State wise Portal can be made to have smooth functioning. Also change in User interface to allow to view more than 5 line items on one screen and able to see all invoices even if more than 500 invoices. Punish the vendor if website hangs on 19th / 20th again like every month. Increase portal capacity 5 times of existing one.

14. FOR GSTR 9 & 9C –. GSTR 9 should COMPUTE ADDITIONAL LIABILTIES. It should be like Annual GSTR 3B of 12 months combined. A dealer can make changes whatever changes not done during monthly filling. Also it should impact on LEDGERS the way GSTR 3B filed.

PART C – SUGGESTIONS FOR for Increase in Government Revenue

15. FOR INTEREST ON LATE PAYMENTS in GSTR 3B – Let system do calculations of Interest payable on GSTR 3B late filling. Same like it calculates late fees. Of course Interest on NET TAX Liability. & retrospectively this provision should be amended so as to make Interest liability only on NET tax liability. This can generate lot of Revenue for Government. It will be a punishment to late tax payer.