How to adjust ITC in 3b to reduce cash outflow?

Auto adjusted ITC in GSTR 3b: Need to adjust ITC properly

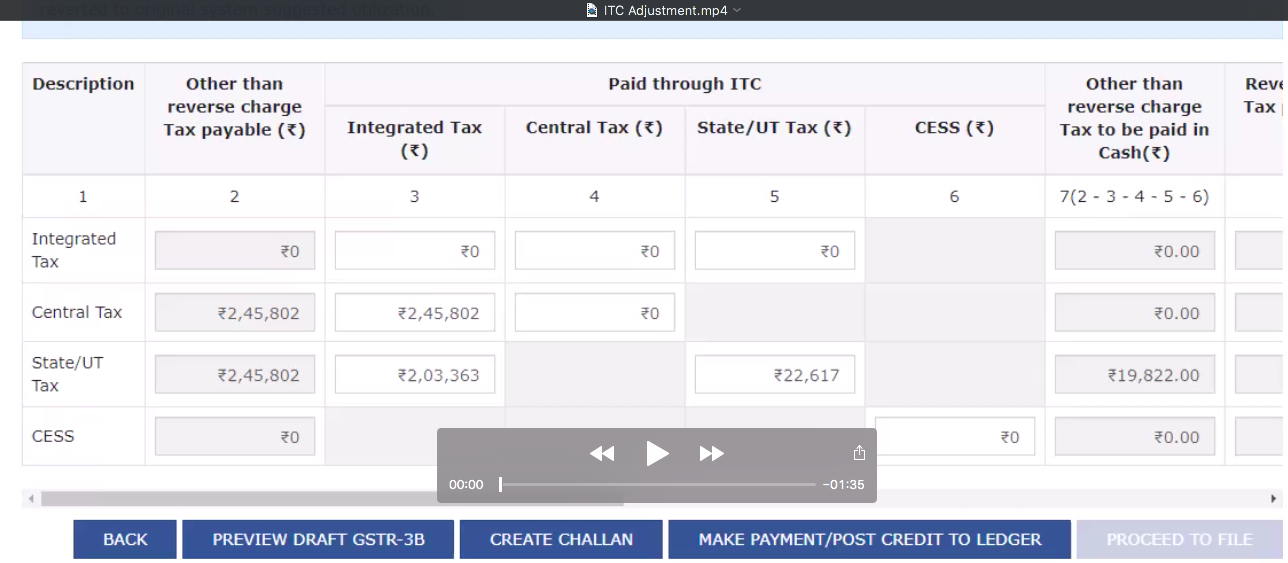

In GSTR 3b you enter the sale and ITC for the month. It calculates the amount of payment required for the month. don’t rely on that figure. This calculation is not as per GST provisions. It may be showing payment liability. But in reality, proper adjustment can save this outflow. We will discuss how to adjust ITC in 3b in an optimum manner to save outflow. It is clarified by rule 88a of CGST rules.

e.g.

Optimum adjustment as per GST provisions can save you tax outflow in cash

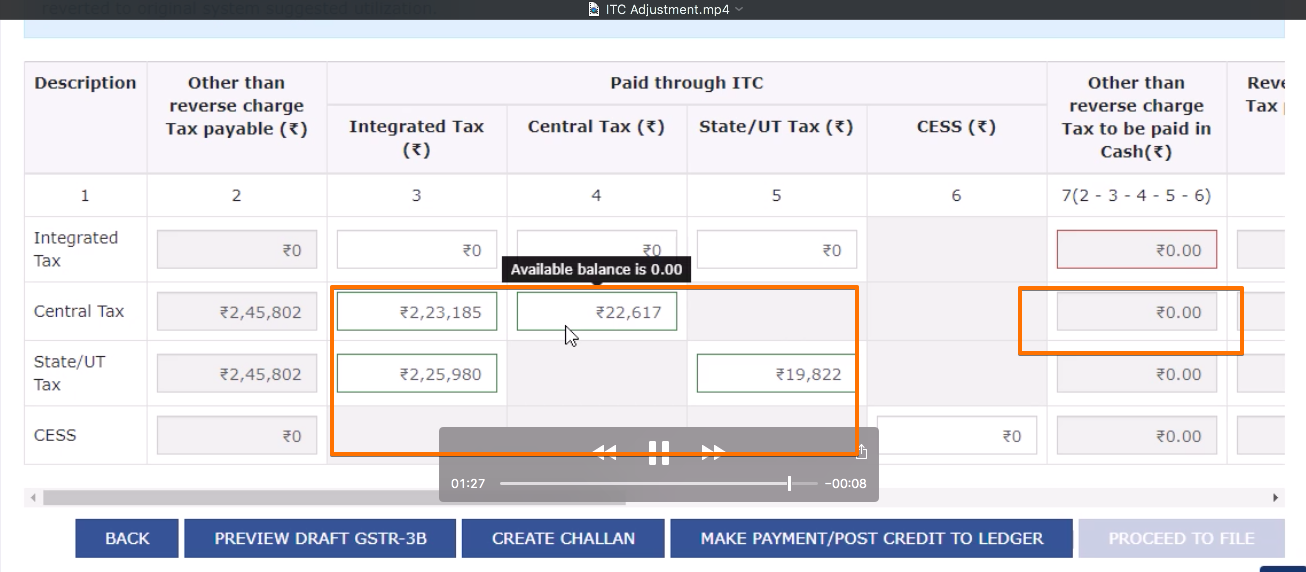

This tax liability is there because the portal is adjusting the 100% IGST first for CGST liability. CBIC made it clear that you can adjust IGST partly for CGST liability and partly for SGST liability. Thus you need to use ITC of IGST in optimum manner. You need to use part in CGST so that balance of CGST and SGST ITC can be used to pay balance.

As you can see in the image above. We adjusted the lesser amount of IGST with CGST. The balance is adjusted with SGTS. The tax liability portal was showing earlier is vanished in the second image. You can follow the following steps to do this properly:

- Check if IGST is completely adjusted with CGST and SGST is payable via cash ledger. Only in this condition it will help you.

- You need to reduce the amount of IGST adjusted with CGST by payable in SGST less SGST ITC.

- Then adjust the only required amount with IGST.

- Now use balance IGST with SGST liability.

- Adjust balance with SGST.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.