Cant make E-way bill if GST returns are not filed

Cant make E-way bill if GST returns are not filed

Quantum of non filing of returns to fall in this provision

Rescue from this default

consequences on non -filing of return

Cant make E-way bill if GST returns are not filed

Now you cant make E-way bill if GST returns are not filed for a specified duration.Notification No.22 /2019 – Central Tax New Delhi, dated 23rd April, 2019 has made rule 138E active. In this notification the date of applicability is given as 21st June 2019. It made the rule 12 of notification no. Notification No. 74/2018 – Central Tax New Delhi, 31st December, 2018. This rule contained the provisions related to E-way bill. This rule restrict the filing of part A of E-way bill in case of default in return filing. The details cant be filed by anyone, like transporter, courier agency, E-commerce operator , consignor or consignee. This will result in shut down of business. You cant move goods without an e-way bill in GST.

Quantum of non filing of returns to fall in this provision

The provisions of rule 138E reads as:

(a) being a person paying tax under section 10, has not furnished the returns for two consecutive tax periods; or

(b) being a person other than a person specified in clause (a), has not furnished the returns for a consecutive period of two months:

Thus non filing of returns for a composition dealer for 2 tax period , is a quarter will make the default. In case of normal taxpayer the duration of default is 2 months. After this period you will not be able to get your information in part A of E-way bill.

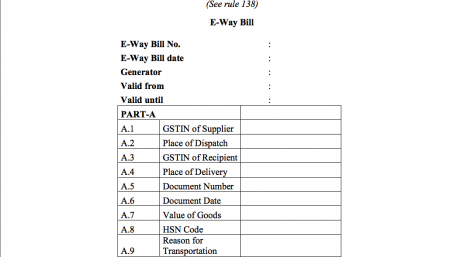

What is Part A of E-way bill:

Part A of an E-way bill is the details of consignor. The person who is making the movement of business. It is important to note that an E-way bill is not only for sale. It is for any movement of goods in GST. Even if are not making sale you will have to make E-way bill.

e.g.1: A machinery is given on rent. Although it is not a sale but still E-way bill will be required.

2: Goods moving for job work is not a sale or supply still E-way bill is required.

You can see the data required in part A of an E-way bill in following image.

Cant make E-way bill

Rescue from this default:

Although the provision give a right to commission to condone the default. The provision says that

Provided that the Commissioner may, on sufficient cause being shown and for reasons to be recorded in writing, by order, allow furnishing of the said information in PART A of FORM GST EWB 01, subject to such conditions and restrictions as may be specified by him:

Provided further that no order rejecting the request of such person to furnish the information in PART A of FORM GST EWB 01 under the first proviso shall be passed without affording the said person a reasonable opportunity of being heard:

Provided also that the permission granted or rejected by the Commissioner of State tax or Commissioner of Union territory tax shall be deemed to be granted or, as the case may be, rejected by the Commissioner.

Explanation:– For the purposes of this rule, the expression ―Commissioner‖ shall mean the jurisdictional Commissioner in respect of the persons specified in clauses (a) and (b).‖.

consequences on non -filing of return:

Non filing of GST returns will now shut your business down. Traders or manufacturers cant continue their business without entering their data E-way bill. This provision will block you form that. It will be impossible to run the business.

The date of applicability of this provision is 21st June 2019.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.