Casual Taxable Person (CTP) (Section 2(20) of CGST Act)

Table of Contents

- Casual Taxable Person (CTP) (Section 2(20) of CGST Act)

- Registration Requirements: –

- Advance Deposit of Tax: –

- The validity of Registration Certificate Granted to CTP: –

- Return:-

- Refund by Casual taxable person:-

- Registration Process: –

- FAQ:-

- Question 1:- Can a Casual Taxable Person opt for Composition?

- Question 2:- When should I apply for a Registration as a Casual Taxable Person?

- Question 3:- Can I extend my Registration as a Casual Taxable Person?

- Question 4:- Can a Casual Taxable Person take multiple registrations in a State?

- Question 5:- I have deposited advance tax but do not want to continue the business. How shall I get my money back?

- Read the copy:

Casual Taxable Person (CTP) (Section 2(20) of CGST Act)

Casual Taxable person means a person who

- Occasionally undertakes transaction involving the supply of goods or services or both

- In the course or furtherance of business

- Whether as a principal, agent or in any other capacity,

- In a state /union territory where he has no fixed place of business.

Note: – A casual taxable person does not have a fixed place of business in the State/Union Territory where he undertakes supply though he might be registered with regard to his fixed place of business in some other state/union territory.

For Example- Anil & Co. engaged in supplying taxable goods is registered in Rajasthan. It wishes to participate in a business exhibition being held in Delhi. However, it does not have a fixed place of business in Delhi. In case Anil & Co. has to obtain registration as a casual taxable person in Delhi.

Exemption: – According to Notification No. 32/2017-CT dated 15th September 2017 has exempted Casual Taxable persons making the supply of specified handicraft goods need to register only if their aggregate turnover crosses Rs. 20 Lakh (Rs. 10 lakh for in case of Special Category States)

- A casual taxable person cannot exercise the option to pay tax under composition levy

Registration Requirements: –

- A casual taxable person has to apply for registration at least five days prior to the commencement of business.

- There is no special form to register as a casual taxable person.

- The normal FORM GST REG-01 which is used by other taxable persons can be used for obtaining registration by a casual taxable person also.

- A casual taxable person, before applying for registration, should declare his

- Permanent Account Number

- Mobile number

- E-mail address

Advance Deposit of Tax: –

While submitting the registration application, a Casual Taxable person is required to deposit tax in advance equivalent to the estimated amount of tax liability for the period for which registration is sought.

For Example:- Mr. X estimated his tax liability service at 100000. He is required to make an advance payment of tax of Rs. 18000 (100000*18%) to obtain temporary registration.

Such a person will get a TRN (temporary reference number) for making an advance deposit of tax which shall be credited to his Electronic cash ledger. An acknowledgment of receipt of the application for registration is issued only after the said deposit.

Where an extension of time is sought, CTP will deposit an additional amount of tax equivalent to the estimated tax liability for the period for which the extension is sought.

The validity of Registration Certificate Granted to CTP: –

- The registration certificate obtained by CTP shall remain valid for the period specified in the registration application or 90 days from the effective date of registration, whichever is earlier.

The time period of 90 days can be extended further by a period not exceeding 90 days by making an application before the end of the validity of the registration.

- CTP will make taxable supplies only after the issuance of the certificate of registration.

Return:-

The casual taxable person is required to furnish the following returns electronically through the common portal, either directly or through a Facilitation Centre notified by the Commissioner:

a) FORM GSTR-1 giving the details of outward supplies of goods or services to be filed on or before the tenth day of the following month.

b) FORM GSTR-2, giving the details of inward supplies to be filed after tenth but before the fifteenth day of the following month.

c) FORM GSTR-3 to be filed after the fifteenth day but before the twentieth day of the following month.

d) FORM GSTR-3B to be filed but before the twentieth day of the following month.

It may be mentioned that presently only FORM GSTR-1 and Form GSTR-3B are required to be filed.

Note: – A casual tax person is not required to file an annual return as required by a normally registered taxpayer.

Refund by Casual taxable person:-

The casual taxable person is eligible for the refund of any balance of the advance tax deposited by him after adjusting his tax liability.

Registration Process: –

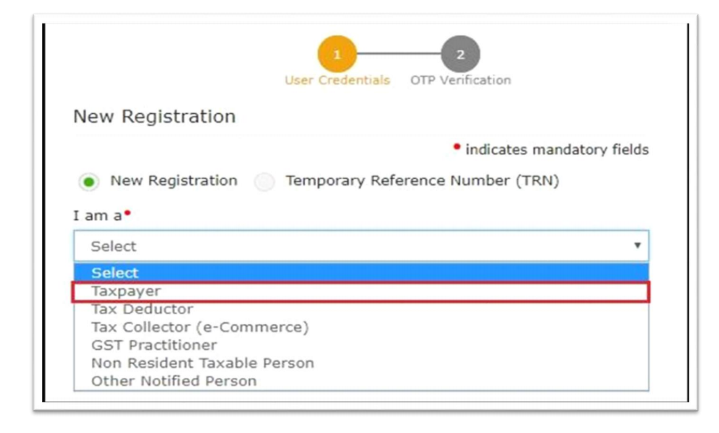

Part-A: –

The option to register is in the New Registration Application for a normal taxpayer. In PART A of the New Registration Application, select the Taxpayer.

Apply for registration by declaring PAN, mobile number and email in part A of Form GST REG-1

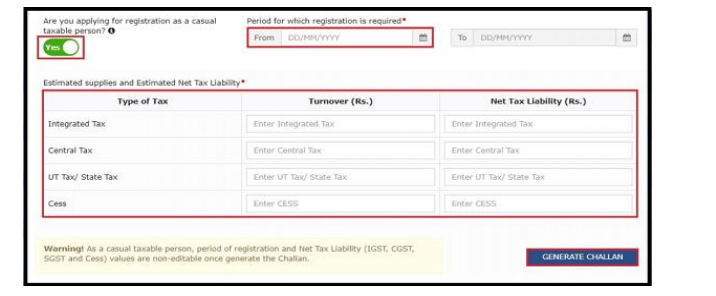

Part-B: –

2. In PART B of the New Registration Application in the Business Details section, select Yes under ‘Are you applying for registration as a casual taxable person?’ as shown in the screenshot below:

➢ Enter the estimated values of supplies and estimated net tax liability as CGST + SGST / IGST and cess for the period for which registration is applied and click the GENERATE CHALLAN button. This option is also available after all tabs of Part B of the Registration application is filled up.

➢ Make the advance tax payment using the payment modes available on the GST Portal and then complete Part B of the registration application and submit it.

➢ Your registration will be granted after due processing by the concerned Tax Official.

FAQ:-

Question 1:- Can a Casual Taxable Person opt for Composition?

A casual Taxable Person cannot opt for composition.

Question 2:- When should I apply for a Registration as a Casual Taxable Person?

You should apply for Registration as a Casual Taxable Person at least 5 days prior to the commencement of business.

Question 3:- Can I extend my Registration as a Casual Taxable Person?

Yes, you can extend your Registration as a Casual Taxable Person once for an additional period of 90 days, if you apply for an extension of registration before the expiry of the initial period for which registration was granted.

Question 4:- Can a Casual Taxable Person take multiple registrations in a State?

In case a Casual taxable person has multiple business verticals within one state, the Casual taxable person can apply for multiple registrations within the state.

Question 5:- I have deposited advance tax but do not want to continue the business. How shall I get my money back?

You can apply for a refund of advance tax deposited at the time of filing of an application for surrender of registration.