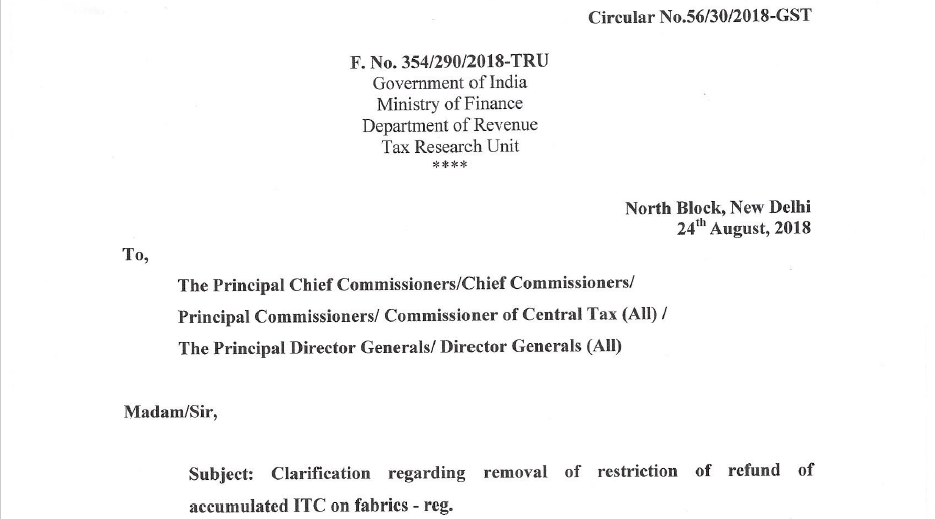

Circular No. 56/30/2018-GST

Circular No. 56/30/2018-GST

Circular No. 56/30/2018-GST

F. No. 354/290/2018-TRU

Government of India

Ministry of Finance

Department of Revenue

Tax Research Unit

North Block, New Delhi

24th August 2018

To,

The Principal Chief Commissioners/Chief Commissioners/

Principal Commissioners/ Commissioner of Central Tax (All) /

The Principal Director Generals/ Director Generals (All)

Madam/Sir,

Subject: Clarification regarding removal of restriction of refund of accumulated ITC on fabrics – reg.

Certain doubts have been raised regarding the applicability and intent of notification No. 20/2018-Central Tax (Rate) dated 26th July, 2018 (which seeks to amend notification No. 5/2017-Central Tax (Rate) dated 28.06.2017) relating to the provision for lapsing of input tax credit on account of inverted duty structure on fabrics for the period up to the 31st July,

2018.

2. The said notification No. 5/2017-Central Tax (Rate) was issued in exercise of powers vested under section 54 of the Central Goods and Services Tax Act, 2017(CGST Act, 2017). It notifies the items on which refund of accumulated input tax credit on account of inverted duty structure is not allowed. Some of the items notified under this notification are fabrics. A

total 10 categories of fabrics covered in the notification are as follows:

Related Topic:

Circular No. 147/03/2021-GST

The same has been issued as the draft circular: Draft Circular on refund of accumulated ITC on fabrics

Download the Full Circular No. 56/30/2018-GST by clicking the below Image:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.