Document-wise Download Facility of Table-8A of GSTR-9

Table of Contents

- Document-wise Download Facility of Table-8A of GSTR-9

- Key Points

- 1. New/Improvised Components in Table 8A in addition to GSTR-2A

- 2. Possible reasons for non-accounting of ITC in Table 8A which although appears in GSTR-2A

- 3. The cut-off date for considering ITC as 31st October 2019

- 4. ITC not auto-populated if GSTR-1 only uploaded but not filed

- 5. Issues

- Disclaimer:

- Read the Copy:

Document-wise Download Facility of Table-8A of GSTR-9

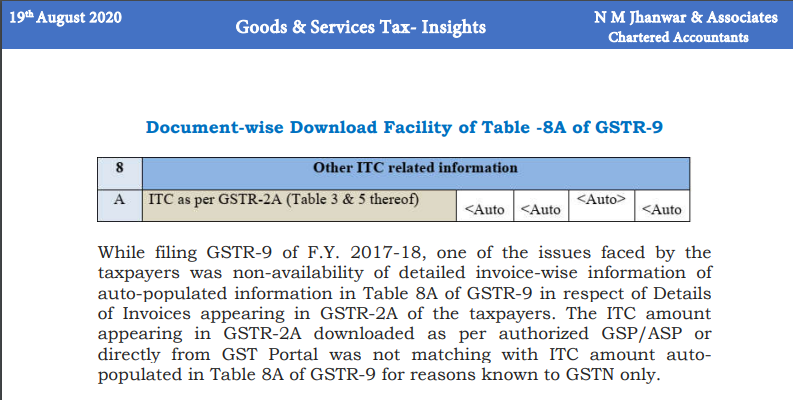

| 8 | Other ITC related Information | ||||

| A | ITC as per GSTR-2A (Table 3 & 5 thereof) | <Auto | <Auto | <Auto | <Auto |

While filing GSTR-9 of F.Y. 2017-18, one of the issues faced by the taxpayers was the non-availability of detailed invoice-wise information of auto-populated information in Table 8A of GSTR-9 in respect of Details of Invoices appearing in GSTR-2A of the taxpayers. The ITC amount appearing in GSTR-2A downloaded as per authorized GSP/ASP or directly from GST Portal was not matching with ITC amount auto-populated in Table 8A of GSTR-9 for reasons known to GSTN only.

Now a very welcome facility has been provided to the taxpayers to download document wise details of Table 8A of Form GSTR-9, from GST portal in Excel format by using a new option of ‘Document wise Details of Table 8A’ given on the GSTR-9 dashboard, from Financial Year 2018- 19 onwards. This is not available for F.Y. 2017-18.

The new document is basically a filtered version of the GSTR-2A document after excluding certain transactions from ITC claim for various reasons. It will contain B2B Invoices, Credit Notes, Debit Notes along their amendments if any.

Key Points

1. New/Improvised Components in Table 8A in addition to GSTR-2A

| Particulars | Description |

| GSTR-2A Period | The period in which the document features in your GSTR-2A. |

| Invoice type |

Invoice type can be derived based on the following types: R- Regular (Other than SEZ supplies and Deemed exports supplies) SEZWP- SEZ supplies with payment of tax SEZWOP- SEZ supplies without payment of tax DE- Deemed exports |

| E-commerce GSTIN |

If your purchases are through E-commerce operators then E-commerce operator GSTIN will be displayed. |

| Counterparty GSTR-1 Filing Date (DD/MM/YYYY) |

This field shall capture GSTR-1 tax period in which the invoice has been uploaded; filing date (DD/MM/YYYY) |

| ITC available |

This filed to capture the status of invoice on being considered for table 8A |

| Reason for Non-accounting* |

This field captures the reason for non-accounting |

2. Possible reasons for non-accounting of ITC in Table 8A which although appears in GSTR-2A

| Reason | Details of the reason |

| Reverse charge document | When the supplier has filed the document in GSTR-1 indicated the supply as a reverse charge. |

| POS lies in the supplier’s State | When the supplier’s State code and POS lie in the same State, but the recipient’s State is different. |

| GSTIN is amended | When the supplier has amended the GSTIN, Credit shall be available to amended GSTIN only. |

| Taxpayer opted for composition scheme | When the document date is during the period when the supplier was under the composition scheme. |

| The invoice date is after the supplier’s cancellation date | When the document date is after the effective date of cancellation of the supplier. |

3. The cut-off date for considering ITC as 31st October 2019

Whereas GSTR-2A is a dynamic document and keeps updating as and when GSTR-1 is filed by the suppliers even if filed belatedly. However, for considering ITC in Table 8A, the system will consider the cut-off date as 31st October 2019 i.e. an invoice uploaded in GSTR-1 filed after 31st October 2019 for F.Y. 2018-19 will not be considered.

4. ITC not auto-populated if GSTR-1 only uploaded but not filed

Since the criteria for Table 8A is filing of GSTR-1, any invoices which are uploaded and status showing in GSTR-2A as ‘Not Yet Filed’ i.e. GSTR-1 has not been filed yet and details have only been uploaded on the GST Portal will not be considered in Table 8A calculation.

5. Issues

Yet another data, yet another reconciliation, yet another mismatch. Earlier, since no details were available about the amount appearing in Table 8A, there was nothing much which assesse could do, but with introducing new document for Table 8A of GSTR-9, the Government has passed the ball to assessee’ court to play with and will give rise to one more manual reconciliation exercise to be done by the taxpayers which further trims down the total amount of ITC appearing in GSTR-2A. It is now for software vendors to provide a facility to reconcile GSTR-2A with Table 8A of GSTR-2A.

Disclaimer:

The information in this document is for educational purposes only and nothing conveyed or provided should be considered as legal, accounting, or tax advice.

Read the Copy:

CA Nikhil M Jhanwar

CA Nikhil M Jhanwar

Nikhil M Jhanwar is a practicing Chartered Accountant based in North India having a vast experience of 8 years in taxation advisory/compliances, litigation support, drafting replies to Show Cause Notices, and representing clients before the Department in Indian GST and UAE VAT. He has closely worked on GST implementation in India and UAE VAT implementation in particular impact analysis, regulatory support, implementation support, I.T. support, tax advisory, and compliances. Being a Faculty Member of GST by ICAI, he regularly speaks at forums and seminars on various topics of GST. He is a keen writer and his articles have been published in prominent tax journals and websites.