FAQ’s on GST return via SMS by GSTIN

FAQ’s on GST return via SMS. These FAQ’s are released by GSTIN. We have already published the step by step process on the filing of GST return via SMS. These are detailed FAQ’s. You can read that process here.

Table of Contents

- When can Form GSTR-3B be filed as Nil?

- 2. Who can file Nil Form GSTR-3B?

- 3. Is filing of Form GSTR-3B as Nil return mandatory?

- 4. By when can I file Nil Form GSTR-3B?

- 5. Can I file Nil Form GSTR-3B through SMS, instead of filing online through GST Portal?

- 6. Who is eligible to file Nil Form GSTR-3B through SMS?

- 7. Who is authorized to file Nil Form GSTR-3B through SMS, on behalf of the taxpayer?

- 8. I am an Authorized Signatory and my mobile number has been registered for more than one GSTIN. Can I file Nil Form GSTR-3B, through SMS for all GSTINs?

- 9. My Authorized Signatories have been reset by the Tax Official. Can I file Form GSTR- 3B Nil return through SMS?

- 10. How do I get help on Nil Form GSTR-3B filing through SMS?

- 3. How can I file Nil Form GSTR-3B through SMS?

- I have filed Nil Form GSTR-3B through SMS. Do I need to login again to the GST Portal to file Nil Form GSTR-3B?

- I have filed Nil Form GSTR-3B through SMS. Can I revise the filed return for the requested tax period?

- From where can I track the status of my filed Form GSTR-3B return?

- What are the various error messages, their description and solution?

When can Form GSTR-3B be filed as Nil?

Form GSTR-3B can be filed as a nil return if there are no outward supplies as well as a liability (including reverse charge liability) in the month, for which the return is being filed for. This form can be filed nil, in both online modes and in offline mode (by SMS)

2. Who can file Nil Form GSTR-3B?

Form GSTR-3B for a tax period can be filed if you:

- Have NOT made any Outward Supply and

- Do NOT have any reverse charge liability

- Do NOT intend to take any Input tax credit and

- Do NOT have any Liability for that particular or earlier Tax Periods.

For example, if your answer to any of below questions is in affirmative, your GSTR-3B return for a particular tax period will not be a nil return:

- Have you made any supply of goods/services (including nil rated, exempt and non-GST supplies) or received any supplies liable to reverse charge or exempt, nil rated and non-GST inward supplies during this tax period?

- Have you made any inter-state supplies to unregistered persons, composition taxable persons or UIN holders?

- Do you intend to reverse Input Tax Credit (ITC)?

- Do you have any interest or late fee (including carry forward late-fee) liability to be paid?

- Do you have any tax liability, due to Form GST TRAN-1?

- Any other liability which is liable to be paid by you, while filing your return?

3. Is filing of Form GSTR-3B as Nil return mandatory?

Filing of Form GSTR-3B is mandatory for all normal and casual taxpayers, even if there is no business activity in any particular tax period. So, for such tax period(s), the return can be filed as NIL (if all conditions for filing Nil return is satisfied).

4. By when can I file Nil Form GSTR-3B?

A taxpayer may file Nil Form GSTR-3B, anytime on or after the 1st of the subsequent month for which the return is being filed for. For example, for the month of April 2020, nil return can be filed only on or after 1st May 2020.

About Filing Nil Form GSTR-3B through SMS

5. Can I file Nil Form GSTR-3B through SMS, instead of filing online through GST Portal?

Yes, you can file Nil Form GSTR-3B through SMS, instead of filing it through online mode on GST Portal.

6. Who is eligible to file Nil Form GSTR-3B through SMS?

Any taxpayer who fulfills the below conditions, are eligible to file Nil Form GSTR-3B, through SMS:

Taxpayer must be registered as Normal taxpayer/ Casual taxpayer/ SEZ Unit / SEZ Developer and must have a valid GSTIN.

Authorized signatory and his/ her phone number must be registered on the GST Portal.

There is no pending liability of previous period tax, interest or late fee while filing Nil Form GSTR-3B. All GSTR-3B return of previous tax periods must be filed.

There must not be any data in saved stage, in online version of Form GSTR-3B, on the GST Portal.

7. Who is authorized to file Nil Form GSTR-3B through SMS, on behalf of the taxpayer?

All the authorized representatives, for a particular GSTIN, are allowed to file Nil Form GSTR-3B through SMS.

Note:

If more than one Authorized Signatories/ Representatives have the same mobile number registered on the GST Portal, such Authorized Signatories cannot file Nil Form GSTR-3B through SMS. In such scenario, Authorized Signatory first need to

update their mobile number on the GST Portal, through non-core amendment process, by giving unique mobile number for

every authorized signatory for that requested GSTIN.

Other Authorized Signatories/ Representatives with unique mobile number registered on the GST Portal, can file Nil Form GSTR-3B through SMS.

8. I am an Authorized Signatory and my mobile number has been registered for more than one GSTIN. Can I file Nil Form GSTR-3B, through SMS for all GSTINs?

Yes, you can file Nil Form GSTR-3B, through SMS for all GSTINs, for whom you are an Authorized Signatory, from the same mobile number.

9. My Authorized Signatories have been reset by the Tax Official. Can I file Form GSTR- 3B Nil return through SMS?

In case, your Authorized Signatories have been reset by the Tax Official, you need to first reactivate your User ID by navigating to

GST Portal > Login > here link. Click here to know more about it.

Post reactivating your User ID, you can file Nil Form GSTR-3B through SMS.

Help SMS Format

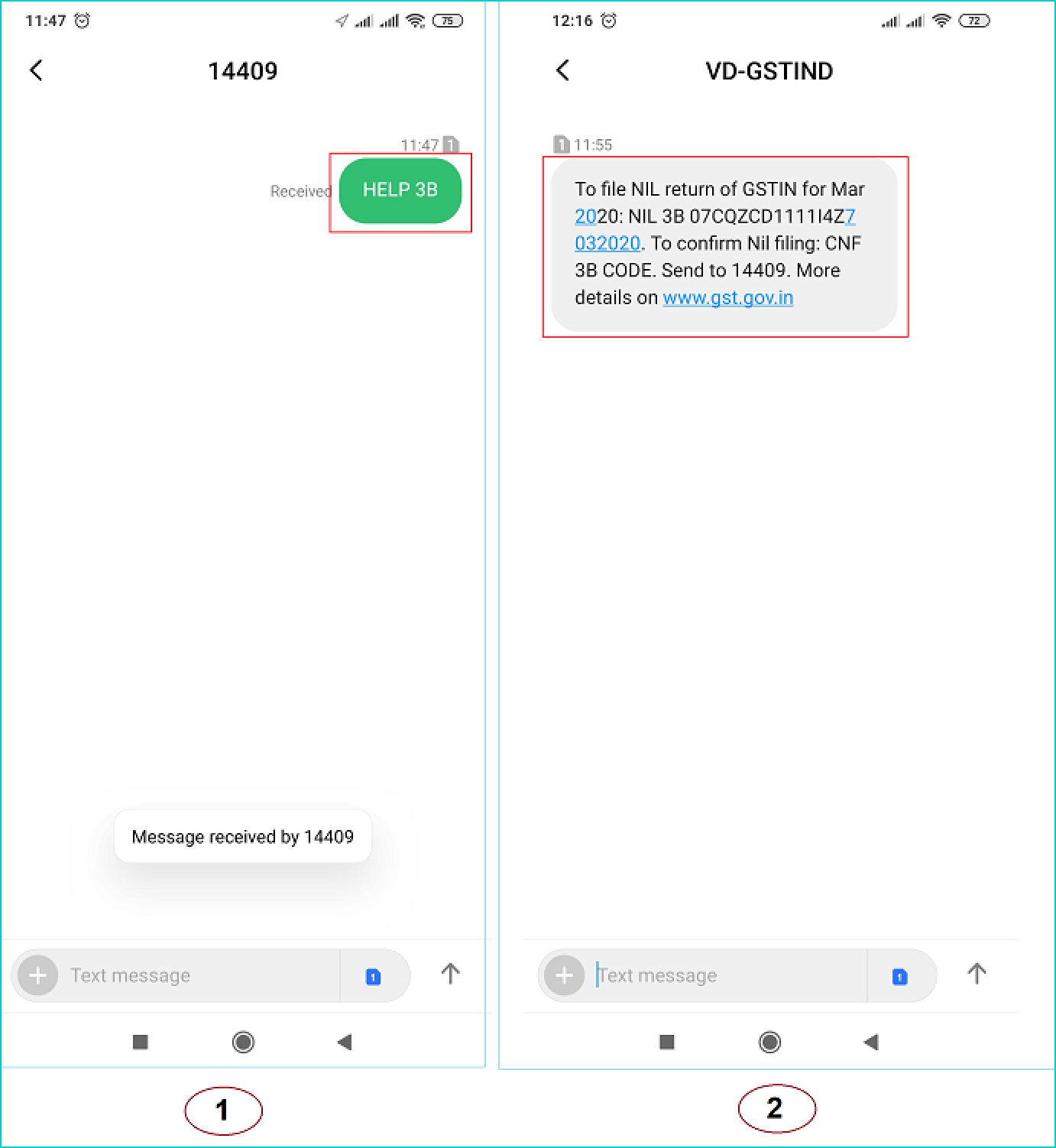

10. How do I get help on Nil Form GSTR-3B filing through SMS?

You need to send SMS in below format to get help related to filing Nil Form GSTR-3B through SMS:

SMS Format : HELP space<Return Type>

Example: HELP 3B

3. How can I file Nil Form GSTR-3B through SMS?

To file Nil Form GSTR-3B through SMS, follow the below mentioned steps. Let’s take an example that you need to file Nil Form GSTR-3B through SMS for a GSTIN 33AACCA1121EAZE for tax period (monthly filer) February 2020.

|

S.No. |

Step-List |

SMS Format |

Example |

|

1. |

Send SMS to 14409 number to file Nil |

NIL space<Return |

NIL 3B |

|

|

Form GSTR-3B. |

Type>space<GSTIN>space<Return Period> |

07AQDPP8277H8Z6 022019 |

|

2. |

After receiving the SMS, GST Portal will check for the validations. Note: If validations for filing Nil Form GSTR-3B are satisfied, you will receive a “ Verification CODE” on the same mobile number from which you have sent the SMS to complete the filing. If validations for Nil filing are not satisfied, you will receive appropriate response/ error message to the same mobile number from which you have sent the SMS. Note: Verification Code is usable only once and will expire within 30 minutes. Please do not share this with anyone. |

|

|

|

3. |

Send SMS again on the same number 14409 with Verification Code (For Example: Verification Code received here is 107543) to confirm filing of Nil Form GSTR-3B. Note: Taxpayers are required to compose a new text message to 14409. |

CNF space<Return Type>space<Code> |

CNF 3B 107543 |

|

4 |

After successful validation of “ Verification Code”, GST Portal will send back ARN to same mobile number and on registered e-mail ID of the taxpayer to intimate successful Nil filing of Form GSTR-3B . |

|

In case, incorrect Verification Code is provided, more than three times during a day, the GSTIN and Mobile number

combination for that particular day, will be blocked for filing of Nil Form GSTR-3B through SMS ONLY. You can try filing Nil Form GSTR-3B, through SMS, after 24 hours. However, you can login to the GST Portal to continue filing of Nil Form GSTR-3B, through online mode.

I have sent correct Verification Code, but I have received SMS that the code is not Why?

It is possible that your Verification Code has expired. You can send the SMS again, in the desired format, to receive a new Verification Code. Please wait for at least 5 minutes after generating any new Verification Code.

Note: When you generate fresh Verification Code, previous Verification Code becomes invalid. In such case, you will have to provide new Verification Code to file Nil Form GSTR-3B through SMS.

Post Filing of Nil Form GSTR-3B through SMS

What will happen after successful filing of Nil Form GSTR-3B, through SMS?

After successful filing of Nil Form GSTR-3B, through SMS: ARN will get generated.

The status of Form GSTR-3B is changed to Filed on GST Portal.

An SMS and e-mail will be sent to the e-mail and mobile number of the primary authorized signatory. In case, sender is authorized signatory, SMS will be sent to his/her mobile number also.

I have filed Nil Form GSTR-3B through SMS. Do I need to login again to the GST Portal to file Nil Form GSTR-3B?

Once you have filed Nil Form GSTR-3B through SMS, you do not need to login to the GST Portal again to file Nil Form GSTR-3B. After successful filing of Nil Form GSTR-3B, through SMS, the status of Form GSTR-3B is changed to Filed on GST Portal.

I have filed Nil Form GSTR-3B through SMS. Can I revise the filed return for the requested tax period?

No, you cannot revise filed Nil Form GSTR-3B, for the requested tax period, after filing it through SMS.

From where can I track the status of my filed Form GSTR-3B return?

Navigate to Services > Returns > Track Return Status option to track the status of your filed Form GSTR-3B return on the GST Portal.

Error Messages, Description and Solution

What are the various error messages, their description and solution?

|

S.No. |

Error/Information |

Error/ Information Description |

Solution |

|

|

message |

|

|

|

1 |

Invalid input. For Help, please SMS HELP<space><Return Type> E.g. Help for Nil filing GSTR3B send HELP 3B. Send to 14409 |

This message is received when the Keyword (NIL, CNF or HELP) is not as per standard format i.e. there is an issue with keyword NIL, CNF or HELP. |

Once you receive this message, you need to send the message in correct format for keyword NIL, CNF or HELP, as given below. NIL space<Return Type>space<GSTIN>space<Return Period> CNF space<Return Type>space<Code> HELP space<Return Type> |

|

2 |

Request failed. Incorrect message format. Retry as: NIL <Return Type> <GSTIN> <Period> To file NIL 3B for Mar 2020: NIL 3B 07CQZCD1111I4Z7 032020 Send to 14409. |

This message is received when message contents sent for filing NIL Form GSTR-3B are not as per standard format, like: a. GSTIN structure; or b. Return period; or c. Return type is not correct |

Once you receive this message, you need to send NIL message again as per below format: NIL space<Return Type>space<GSTIN>space<Return Period>

And send it with correct GSTIN Structure, Return Period or Return Type. |

|

3 |

Request failed. Mobile number not registered for 11AAAAA1111A1AA. Please retry with registered mobile number or update mobile number on GST Portal. |

This message is received when Mobile number is not registered as authorized signatory for that particular GSTIN. |

Once you receive this message, you need to send SMS from registered mobile number of the authorized signatory of that particular GSTIN. |

|

4 |

Request failed. Same mobile number is registered for multiple signatories of 11AAAAA1111A1AA. Please retry post updating mobile number on GST portal. |

This message is received when Mobile number is registered for more than one authorized signatory for that particular GSTIN. |

Same mobile number can’t be used by multiple authorized signatories, for the requested GSTIN, for filing Nil Form GSTR-3B. In such scenario, you first need to update the mobile number of the authorized signatory on the GST Portal, through non-core amendment process, by giving unique mobile number for every authorized signatory for that requested GSTIN.

Note: Same mobile number can be used for filing Nil Form GSTR-3B for other GSTINs. |

|

5 |

Request failed. Invalid GSTIN. Please retry with valid GSTIN as below: To file NIL return for Mar 2020: NIL 3B |

This message is received when GSTIN format is correct, but GSTIN is not registered on the GST Portal. |

Once you receive this message, you need to send SMS with valid GSTIN, which is registered on the GST Portal. |

|

|

07CQZCD1111I4Z7 032020. Send to 14409. |

|

|

|

6 |

Request failed. Incorrect format or Code Mismatch. Retry as: CNF 3B <CODE> Send to 14409. Mobile no. would be blocked for 24hrs in case of 3 continuous failure. |

This message is received when taxpayer sends SMS in invalid format or code. |

Once you receive this message, you need to send the SMS in prescribed format and with correct Validation Code, to file Nil Form GSTR-3B. In case, mismatch for Verification Code happens for 3 times continuously, then that particular mobile number will be blocked for 24 hours. |

|

7 |

Request failed. GSTR3B already filed for 11AAAAA1111A1AA and tax period 012020. Please retry with different GSTIN or tax period. |

This message is received when GSTIN provided has already filed return for the tax period provided. |

If the taxpayer has already filed Form GSTR-3B (online/ SMS) for the requested tax period, then Nil Form GSTR-3B can’t be filed again through SMS for that particular return period. |

|

8 |

Request failed. GSTR3B for previous tax period not filed for 11AAAAA1111A1AA. Please retry after filing return for previous tax period. |

This message is received when GSTIN provided has not filed the previous tax period Form GSTR-3B return. |

Once you receive this message, you need to file all previous Form GSTR-3B returns, to file Nil Form GSTR-3B through SMS, for that particular tax period. |

|

9 |

You have exceeded maximum number of attempts for the day. Please try again after 24hrs. You may continue to file your return on |

This message is received when repeated SMS in incorrect format is sent from same mobile number and then mobile number gets blocked for 24 hours. |

You can try filing Nil Form GSTR-3B, through SMS, after 24 hours. However, you can login to the GST Portal to continue filing of Nil Form GSTR-3B, through online mode. |

|

10 |

123456 is the CODE for Nil filing of 3B for 11AAAAA1111A1AA for period 012020. Code validity is 30 min. Confirm return filing by sending: CNF 3B <CODE> to 14409 |

This message is received when you send a SMS in format as NIL space<Return Type>space<GSTIN>space<Return Period> to initiate filing of Nil Form GSTR-3B. |

Once you receive this message, you need to send a SMS in format as CNF space<Return Type>space<Code> to confirm filing of Nil Form GSTR-3B. |

|

11 |

Request failed. Invalid or expired Code. Re- initiate Nil filing. Retry as: To file NIL return of GSTIN for Mar 2020: NIL 3B |

This message is received in case you have sent SMS: With Verification Code without creation of the request for filing Nil Form GSTR-3B or |

Once you receive this message, you need to send a SMS in format as NIL space<Return Type>space<GSTIN>space<Return Period> to initiate filing of Nil Form GSTR-3B. |

|

|

07CQZCD1111I4Z7 032020 Send to 14409 |

With Verification Code post expiration of the code for filing Nil Form GSTR-3B |

In case, mismatch for Verification Code happens for 3 times continuously, then that particular mobile number will be blocked for 24 hours. |

|

12 |

Request failed. Pending liabilities exist for tax period 042020 for 11AAAAA1111A1AA. Please continue return filing on |

This message is received in case GSTIN provided is not eligible for filing Nil Form GSTR-3B for that particular return period, as there is pending tax, interest, late fee or any other liability pending. |

Once you receive this message, it means that there are pending liabilities which needs to be paid by you. Therefore, you need to continue filing of your Form GSTR-3B through online mode on GST Portal. |

|

13 |

Your last request for 11AAAAA1111A1AA for period 042020 is still under progress; generation of code may take up to 5 mins. |

This message is received when another request for Verification Code is sent by you within 5 minutes of an earlier request sent for generation of code. |

Code generation will take around 5 minutes. Once you receive this message, you need to wait for 5 minutes to send another request for Verification Code. Even after waiting for 5 minutes, if you have not received code, then you can request for a new code. |

|

14 |

To file NIL return of GSTIN for Mar 2020: NIL 3B 07CQZCD1111I4Z7 032020. To confirm Nil filing: CNF 3B CODE. Send to 14409. More details on |

This message is received when you send message for getting help related to filing Nil Form GSTR-3B. |

Once you receive this message, you can send a SMS in format as NIL space<Return Type>space<GSTIN>space<Return Period> to initiate filing of Nil Form GSTR-3B. |

|

15 |

Request failed. An existing request is under process for 11AAAAA1111A1AA and tax period 032020. Please try again later. |

This message is received, in case, two authorized signatories send parallel request to file Nil Form GSTR-3B for same GSTIN and return period and the previous request is still being processed. |

Once 2nd authorized signatory receives this message, he/she must wait for some time until the previous request sent by 1st authorized signatory is processed to file Nil Form GSTR-3B.

You can also check with other authorized signatories, in case, they have sent the request for filing Nil Form GSTR-3B from their mobile number. |

|

16 |

Your, 11AAAAA1111A1AA, GSTR3B for tax period 042020 is filed successfully and ARN is AAAAAAAAAAAAAAA. Please use this ARN to track the status of your return. |

This message is received on successful verification of code and filing of Nil Form GSTR-3B. |

Once you receive this message, it means that you have successfully filed Nil Form GSTR-3B through SMS. You can login to the GST Portal for tracking the status of your filed return. |

|

17 |

Nil filing request for 11AAAAA1111A1AA for period 042020 could not be processed. Please try again or continue to file return on www.gst.gov.in. |

This message is received when Verification Code validation fails due to technical issues on GST Portal. |

Once you receive this message, wait for some time and try filing Nil Form GSTR-3B again, if you do not receive any ARN for Nil Filing of Form GSTR-3B. |

|

18 |

Incorrect message format. For Help, please SMS HELP<space><Return Type> E.g. Help for Nil filing GSTR3B send HELP 3B Send to 14409 |

This message is received, in case HELP keyword is sent in incorrect format to get Help related to filing Form GSTR-3B. |

Once you receive this message, you need to send a SMS in format as HELP space<Return Type> to get Help related to filing Nil Form GSTR-3B. |

|

19 |

Request failed. 11AAAAA1111A1AA is not a regular taxpayer during the requested tax period. Please retry with another GSTIN or tax period. |

This message is received if GSTIN mentioned in SMS is not registered as regular taxpayer for that particular return period, on GST Portal. |

To file Nil Form GSTR-3B through SMS, GSTIN has to be registered as a regular taxpayer, for that particular return period. You can check on the GST Portal, if the GSTIN, during the requested tax period is registered as regular (normal/casual/SEZ) taxpayer. If not, you can try filing Form GSTR-3B for another tax period where taxpayer is registered as regular (normal/casual/SEZ) taxpayer. |

|

20 |

Request failed. 11AAAAA1111A1AA was cancelled prior to requested tax period 042020. Please retry with another GSTIN or tax period. |

This message is received, if the GSTIN registration was already cancelled, from a date prior to return period for which the Nil Form GSTR- 3B is being filed. |

Nil Form GSTR-3B cannot be filed for a particular tax period, if GSTIN registration was cancelled from a date prior to the requested tax period. Try filing Nil Form GSTR- 3B, for some other tax period, when GSTIN registration was active. |

|

21 |

Request failed. Requested tax period 042020 is prior to date of registration for 11AAAAA1111A1AA. Please retry with another GSTIN or tax period. |

This message is received, if the period for which Nil Form GSTR-3B is being filed, is before the date of registration for the GSTIN. |

Nil Form GSTR-3B cannot be filed for the period, if the requested tax period is prior to date of registration. Try filing Nil Form GSTR- 3B, for some other tax period, on or after the date by when registration was active. |

|

22 |

Request failed. Please activate your User ID on GST portal. Retry as below: To file NIL 3B of GSTIN for Mar 2020: NIL 3B |

This message is received in case the taxpayer has not activated/reactivated their USER ID on the GST Portal. |

If taxpayer has changed the authorized signatory, then he/she has to reactivate the USER ID on GST Portal, to file Nil Form GSTR-3B through SMS. Further, for a new taxpayer also, USER ID has to be activated on the GST Portal, before |

|

|

07CQZCD1111I4Z7 032020 Send to 14409 |

|

attempting to file Nil Form GSTR-3B through SMS. |

|

23 |

Request failed. 11AAAAA1111A1AA not eligible to file nil return for tax period 0402020 via SMS. Please continue return filing on the www.gst.gov.in |

This message is received in case the GSTIN is not eligible for filing Nil Form GSTR-3B. |

Once you receive this message, you need to check eligibility criteria required for filing Nil Form GSTR-3B. Post meeting all the requirements, you can initiate filing Nil Form GSTR-3B through SMS. |

|

24 |

Request failed. Saved data exists for GSTR3B for 11AAAAA1111A1AA for tax period 042020. Please continue to file return on |

This message is received in case: GSTIN provided is not eligible for filing Nil Form GSTR-3B, due to saved data in your Form GSTR-3B, on GST Portal during NIL request or GSTIN provided is not eligible for filing Nil Form GSTR-3B due to saved data in your Form GSTR-3B, on GST Portal during CNF request |

Once you receive this message, it means that you have some saved data in your Form GSTR-3B, on GST Portal. Therefore, you need to continue filing of your Form GSTR-3B through online mode on GST Portal. |

|

25 |

Request failed. GSTR3B can be filed only on or after 1st of month following the tax period 042020. Please try with another GSTIN or tax period. |

This message is received in case you try to file Nil Form GSTR-3B before 1st of the subsequent month for which the return is being filed for. |

Once you receive this message, you need to Nil Form GSTR-3B on or after 1st of the subsequent month for which the return is being filed for. For example, for the month of April 2020, nil return can be filed only on or after 1st May 2020. |

|

26 |

Please confirm the Nil filing using code received. In case of non- receipt of code please try again after 5 min. |

This message is received when the request for Verification Code is sent again by you within 5 minutes of sending the SMS for generation of code and code is still being processed. |

Code generation will take around 5 minutes. Once you receive this message, you need to wait for 5 minutes. Even after waiting, if you have not received code, then you can request for generation of new code (after 5 minutes). |

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.