File GST return using SMS in three steps

Table of Contents

File GST return using SMS in simple steps:

Great news for all GST registered person. Now you can file GST return using SMS facility. At present we are filing two main returns in GST. First is GSTR 3b, It is monthly. Then there is a statement of sale. It is called GSTR 1. It is quarterly for taxpayers with turnover upto 1.5 Cr. In other cases, it is monthly. You can read about returns in detail in this article. This facility is going to help over 22 lac taxpayers in India. FAQ’s on filing of GST returns are issued by GSTIN. You can read it here.

Which GST return can be filed using SMS facility?

Monthly GST returns in form GSTR 3b can be filed using SMS. Only a NIL return can be filed via SMS.

What is a NIL return?

A NIL return is a return where there is no data in any table. Even ITC is not there. Thus if a taxpayer is not having the sales. But want to take the input tax credit in GSTR 3b. He is not eligible to file return via SMS. Only a NIL return can be filed using SMS facility.

How to file GST return using SMS facility?

The authorized signatory can file return via SMS using their registered number.

It is very easy and simple. We can divide it into three parts.

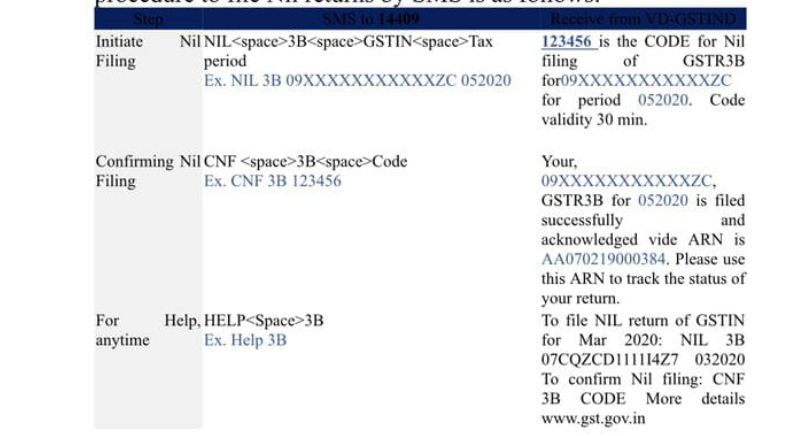

Step 1: Initiate Filing

Type the following:

NIL<space>3B<Space>GSTIN<Space>Period

e.g. NIL 3B 09XXXXXXXXZC 032020

Send it to 14409

Then you will receive an SMS with an OTP. This code will contain 6 digits. Its validity will be of 30 minutes Let us assume code is 123456.

Step 2: Confirm Filing

CNF<Space>3b<Space>Code

e.g. CNF 3b 123456

Once you confirm filing you will receive an acknowledgment number.

For any help

Send this text to the same number.

Help 3b

Track the status of return filed using SMS facility

The status of the return filed using SMS can be done on the portal. Go to Service> return> track return status. You need to enter the acknowledgment number here. Then you can confirm the filing status.

Latest: Expecting to file GSTR 1 facility via SMS will also be available by the month-end.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.