New features- How to file GSTR 3b? Step by step process after all amendments

Use auto-populated data to file GSTR 3b

Now you don’t need to remember or reconcile the data of GSTR 3b manually. GSTIN has enabled this new feature in which you can use the auto-populated data of GSTR 3b. Turnover and ITC both will be auto-populated from the GSTR 1 and GSTR 2b respectively. This feature will make it easy. But yes it also shows a red flag on a variation of more than 10%.

Related Topic:

Excess tax paid in Form GSTR-3B of F.Y. 2017-18, an effect not given in Form GSTR-3B of F.Y.2018-19

Whether I can show the excess figure in GSTR 3b?

Yes, but a red mark is indicated. You will also get a caution at the time of filing. Your data is not matching but still, you can file the return with mismatched data. In the case of RCM, you can take the excess ITC also.

Latest update- Quarterly GSTR 3b

Now GSTR 3b can be filed quarterly. This facility will start from 1-1-2021. It is a new scheme called the QRMP scheme. In this scheme, GSTR 3b is made quarterly for taxpayers with less than Rs. 5 crore turnover. But the tax payment will be monthly only. There is an option to pay a fixed sum or on a self-assessment basis. The facility to opt for this scheme will start very soon on the GST portal.

Introduction-

How to file GSTR 3b after all recent amendments. Now, most of the part of GSTR 3b is auto-populated. Fewer chances of errors. But more reconciliation is required.

What is GSTR 3b?

GSTR 3b is the monthly return of GST in India. It is required to be filed by a normal taxpayer. GSTR 3b is the main return of GST. It contains the declaration of turnover, ITC, and tax payable for a particular period. Then payment of tax is also made while filing GTSR 3b.

Related Topic:

Excess tax paid in Form GSTR-3B of F.Y.2017-18 and F.Y.2018-19 both years and given effect of the same in F.Y.2019-20 (Assuming).

Who is required to file GSTR 3b?

Every registered taxable person except the following is required to file GSTR 3b.

- ISD

- TDS

- TCS

- Composition dealer

- OIDAR service provider as they have a separate return to file.

Related Topic:

Excess tax paid in Form GSTR-3B of F.Y. 2017-18, an effect not given in Form GSTR-3B of F.Y.2018-19

What are the due dates for filing the GSTR 3b?

How to file GSTR 3b – Step by step after all recent amendments?

Recent amendments have changed the GSTR 3b. You can file it yourself.

Step -1: Compile the data of the month from the sales register and purchase register.

Step 2- Reconcile the data of Input tax credit/purchase with GSTR 2b. GSTR 1 data is auto-populated in GSTR 3b. You can reconcile it with the sales register.

Related Topic:

CBIC warn for mismatch in GSTR 3b and GSTR 1

Step 3- Feed the data in GSTR 3b.

Step 4. Adjust the ITC and click on the file. A window will prompt you for payment of tax. Pay it online via NEFT. Then you can file the return.

Step 5. FIle it with EVC or digital signature.

Related Topic:

4 BIG COMMON Mistakes in GSTR- 3B

What are the Common mistakes in GSTR 3b?

Although it is 3 years old now many taxpayers fail to file it properly. There are some common mistakes.

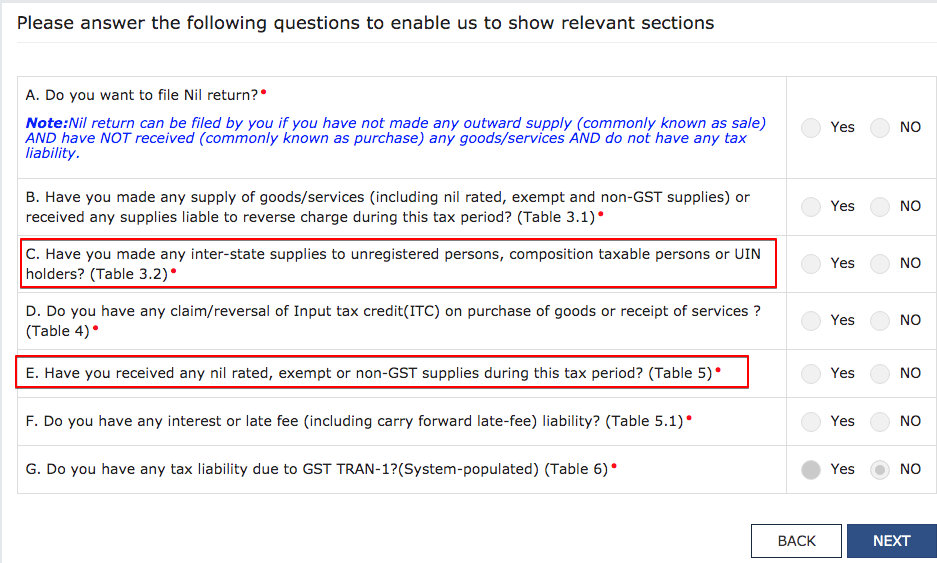

- Not selecting all the relevant tables. There is a window prompting to select the tables when we click on GSTR 3b. But most of the taxpayers select only two tables. Table 3 and Table 4 are the only tables taxpayers fill. See the image below.

- Mention of supply in the wrong head. For example- Export is disclosed in exempted supply.

- Reverse charge on purchases- Many taxpayers skip to fill the reverse charge supply.

What are the consequences of not filing the GSTR 3b?

- Notice

A notice can be issued to the taxpayer asking him to file a return. A standard operating procedure was released via circular no. 129/48/2019.

- Text message- Department will send a text message on the 21st if the return is not filed up to the 20th.

- But if the return is not filed even after the message. Department will issue GSTR 3A. It will have the self-assessed tax. A time of 15 days is provided to the taxpayer to pay this amount.

- If the payment is not made within the time limit, the department may attach his bank account to recover the proceedings. Department can also cancel his registration.

- Late fees

A late fee is payable on a per-day basis for the late filing of GSTR 3b. It is for Rs. 50 per day for a normal GSTR 3b. In the case of NIL GSTR 3b, the late fees are Rs. 20 only. This amount can accumulate. But the maximum limit is Rs. 10000 for a month.

- Interest

An Interest @18% is leviable on the late payment of GST. We record the payment of tax only via GSTR 3b. Thus late filing of GSTR 3b will make you liable for interest.

- Penalty

A general penalty is leviable for the late filing of return. But a mala fide intention is required to levy the penalty.

- Blockage of E-way bill portal

Now the non-filing of GST return can also block your E-way bill portal. If the GSTR 3b is not filed for 2 consecutive months. The E way bill portal will block that taxpayer. Although it will unblock as soon as the return is filed.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.