Free excel utility for annual return

Features of Free excel utility for annual return:

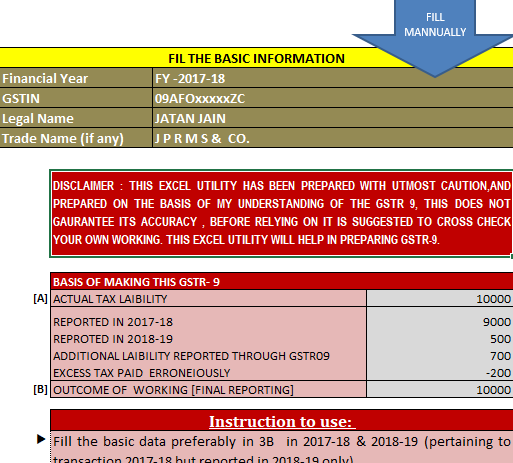

Here you can understand and download this free excel utility for annual return. I have tried to make it perfect but still in case of any issue pls ping me. The GST Annual Return is to be filled for the first time and the details to be filed and to be submitted is confusing. So, we have made an excel sheet for the calculation of Annual Return under GST.

DISCLAIMER : THIS EXCEL UTILITY HAS BEEN PREPARED WITH UTMOST CAUTION,AND PREPARED ON THE BASIS OF MY UNDERSTANDING OF THE GSTR 9, THIS DOES NOT AURANTEE ITS ACCURACY , BEFORE RELYING ON IT IS SUGGESTED TO CROSS CHECK YOUR OWN WORKING. THIS EXCEL UTILITY WILL HELP IN PREPARING GSTR-9.

BASIS OF MAKING THIS GSTR- 9

| (A) ACTUAL TAX LAIBILITY | 10000 |

| REPORTED IN 2017-18 | 9000 |

| REPROTED IN 2018-19 | 500 |

| ADDITIONAL LAIBILITY REPORTED THROUGH GSTR09 | 700 |

| EXCESS TAX PAID ERRONEIOUSLY | -200 |

| (B) OUTCOME OF WORKING [FINAL REPORTING] | 10000 |

Instruction to use Free excel utility for annual return

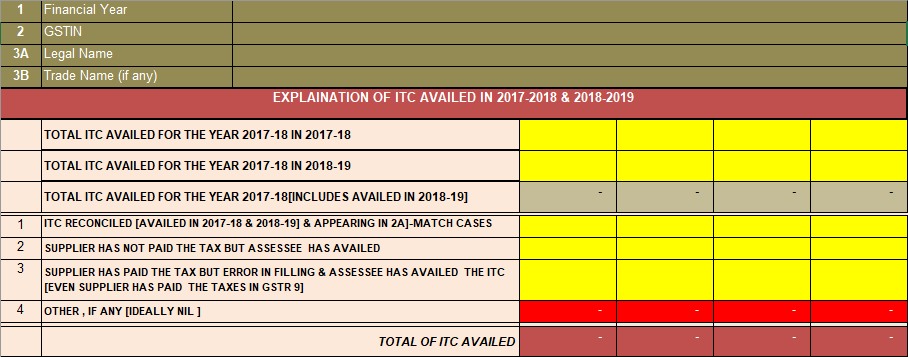

- Fill the basic data preferably in 3B in 2017-18 & 2018-19 (pertaining to transaction 2017-18 but reported in 2018-19 only)

- Post to Actual

- It is presumed that some error/mistake in filing 3B so correct actual figure in books

- After this process, we will have comparables and GSTR-9 outward & inward summary will be prepared

- For this working, GSTR-1 may be used for reference only

- Don’t use the amount is negative.

- Always save the file as *.xml

FOR EXAMPLE – OUTWARDS SUPPLY TO BE COMPILED AS BELOW:

- Either place the data in the GSTR 3B outward sheet or in outward book sheet (prereably in 3B)

- After placing the data in any sheet run the macro as follows:

In book outward sheet from ”3B to Book/Actual”your book will be prepared as if both are same and make necessary correction in Books /Actual by correct figureIn 3B-2017-18 outward sheet from ”Books to 3B”your 3B-2017-18 will be prepared as if both are same and make necessary correction in 3B-17-18 and 18-19 as per return filed

| Data punched | Macro to run | Remarks: |

|

3B outward detail (2017-18 & 2018-19) |

||

|

In books outward |

- GSTR-9 Outward part will be prepared by doing above exercise.

The report will give :

- As additional liability, if any, is being discharged through GSTR 9. (through DRC 03)

- As additional liability, if any, is being discharged through GSTR 9C. (through DRC 03)

- In few cases there may be indication of refund but through GSTR-9 refund can’t be taken

- FOR INWARD SUPPLY: SAME METHEDOLOGY TO BE APPLIED AS APPLIED FOR OUTWARD SUPPLY COMPILATION , ADDITIONAL REVERSAL MAY BE MADE WHICH WAS NEVER BEEN MADE , IN SHEET “ACTUAL ITC” – TABLE POST WORKING REVERSAL

This excel is for overall calculation.

CA Jatan Jain

CA Jatan Jain

Delhi, India

CA Jatan Jain is a partner of a firm M/s J P R M S & Co. and practicing in the field of direct and indirect taxes since 25 years. He is well versed with handling of assessment and litigation. He is known for his practical approach towards implementation of law harmoniously. He made various utilities to ease the working of professionals.