GST Due Dates List Updated

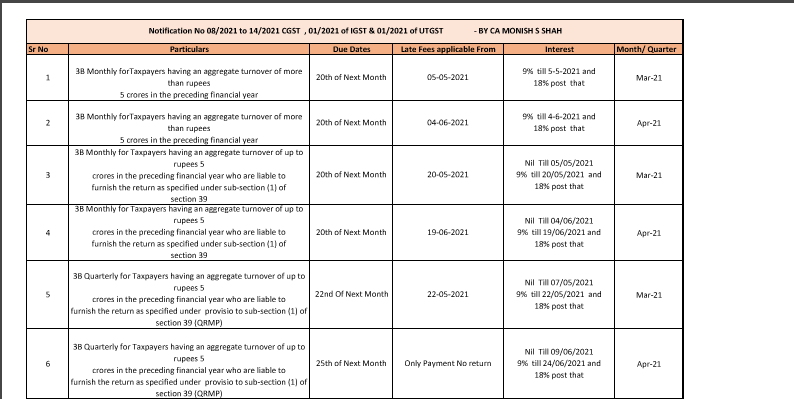

Notification No 08/2021 to 14/2021 CGST, 01/2021 of IGST & 01/2021 of UTGST

| Sr No. | Particulars | Due Date | Late fee applicable from | Interest | Month/Quarter |

| 1. | 3B Monthly for Taxpayers having an aggregate turnover of more than rupees 5 crores in the preceding financial year | 20th of next month | 05-05-2021 | 9% till 5-05-2021

and 18% post that |

March-2021 |

| 2. | 3B Monthly for taxpayers having an aggregate turnover of more than rupees 5 crores in the preceding financial year | 20th of next month | 04-06-2021 | 9% till 4-6-2021

and 18% post that |

April-2021 |

| 3. | 3B Monthly for Taxpayers having an aggregate turnover of up to rupees 5 crores in the preceding financial year who are liable to furnish the return as specified under sub-section (1) of section 39 | 20th of next month | 20-05-2021 | Nil Till 05/05/2021

9% till 20/05/2021 and 18% post that |

March-2021 |

| 4. | 3B Monthly for Taxpayers having an aggregate turnover of up to rupees 5 crores in the preceding financial year who are liable to furnish the return as specified under sub-section (1) of section 39 | 20th of next month | 19-06-2021 | Nil Till 04/06/2021

9% till 19/06/2021 and 18% post that |

April-2021 |

| 5. | 3B Quarterly for Taxpayers having an aggregate turnover of up to rupees 5 crores in the preceding financial year who are liable to furnish the return as specified under proviso to sub-section (1) of section 39 (QRMP) | 22nd of next month | 22-05-2021 | Nil Till 07/05/2021

9% till 22/05/2021 and 18% post that |

Mar-21 |

| 6. | 3B Quarterly for Taxpayers having an aggregate turnover of up to rupees 5 crores in the preceding financial year who are liable to furnish the return as specified under proviso to sub-section (1) of section 39 (QRMP) | 25th of Next Month | Only payment no return | Nil Till 09/06/2021

9% till 24/06/2021 and 18% post that |

April-2021 |

| 7. | 3B for Taxpayers who are liable to furnish the return as specified under sub-section (2) of section 39 i.e. Composition Scheme | 18th April 2021 | 3B not applicable | Nil Till 03/05/2021

9% till 18/05/2021 and 18% post that |

Qtr Ending March 2021 |

| 8. | GSTR-4 | 31st May 2021 | – | – | 2020-21 |

| 9. | ITC-4 | 31st May 2021 | – | – | Jan-Mar 2021 |

| 10. | GSTR-1 | 26th May 2021 | – | – | Apr-21 |

| 11. | Rule 36(4) | Cumulative to be calculated for April & May 2021 | |||

| 12. | IFF | 28th May 2021 | Apr-21 | ||

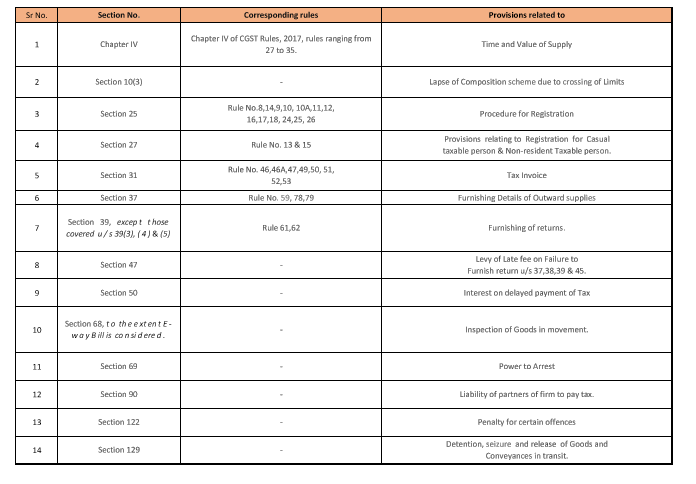

| 13. | All Proceedings, Passing of Orders, Issue of Notice, Intimation, Notification, Sanction, Approval, Appeals, Reply or Application of any report, document, returns, statements or such other records under this Act if falls within 15/4 to 30/5 and if completion not done then can be done by 31/5/2021. However, if the deadline is between 01/5/2021 to 31/5/2021 and if completion not done then can be done by 15/06/2021. However this will not apply to

(a) Chapter IV (b) sub-section (3) of section 10, sections 25, 27, 31, 37, 47, 50, 69, 90, 122, 129; (c) section 39, except sub-section (3), (4) and (5); (d) section 68, in so far as e-way bill is concerned; and (e) rules made under the provisions specified at clause (a to d ) |

||||

Now you can read full PDF without downloading.