GST on Directors Remuneration: Circular No: 140/10/2020

Table of Contents

- What will be the liability under GST on Directors Remuneration

- Circular No: 140/10/2020 – GST

- 2. The issue of remuneration to directors has been examined under the following two different categories:

- Leviability of GST on remuneration paid by companies to the independent directors or those directors who are not the employee of the said company

- Leviability of GST on remuneration paid by companies to the directors, who are also an employee of the said company

- Read the circular:

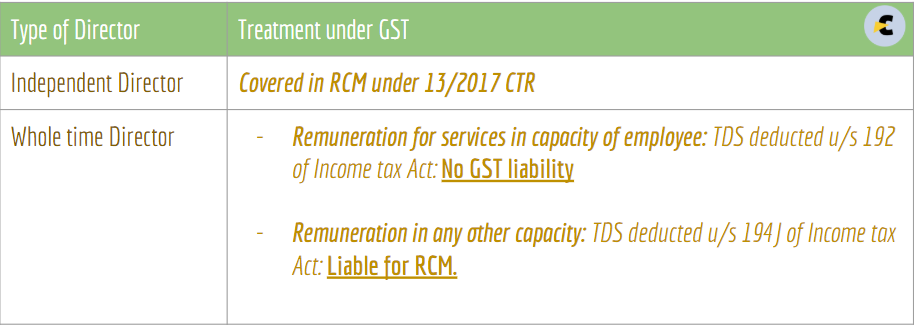

What will be the liability under GST on Directors Remuneration

It is one of the complicated issues of GST. Recent AAR’s made it even more complex. AAR in case of Clay craft rejected it as a part of schedule III. GST on Directors Remuneration is clarified by CBIC via circular no. 140/10/2020. The following resolution is provided by the circular.

Now you can easily assess the liability in GST on Directors Remuneration. We need to focus on income tax treatment also. If the TDS is deducted u/s 192 of income tax. It is a part of schedule III. No GST liability. But if the TDS is deducted in 194J, It is covered under RCM

Following is the text of circular to clarify GST on Directors Remuneration.

Circular No: 140/10/2020 – GST

New Delhi, dated the 10th June 2020

Subject: Clarification in respect of levy of GST on the Director’s remuneration – Reg.

Various references have been received from trade and industry seeking clarification whether the GST is leviable on Director’s remuneration paid by companies to their directors. Doubts have been raised as to whether the remuneration paid by companies to their directors falls under the ambit of entry in Schedule III of the Central Goods and Services Tax Act, 2017 (hereinafter referred to as the CGST Act) i.e. “services by an employee to the employer in the course of or in relation to his employment” or whether the same are liable to be taxed in terms of notification No. 13/2017 – Central Tax (Rate) dated 28.06.2017 (entry no.6).

2. The issue of remuneration to directors has been examined under the following two different categories:

(i) leviability of GST on remuneration paid by companies to the independent directors defined in terms of section 149(6) of the Companies Act, 2013 or those directors who are not the employees of the said company; and

(ii) leviability of GST on remuneration paid by companies to the whole-time directors including a managing director who are employees of the said company.

3. In order to ensure uniformity in the implementation of the provisions of the law across the field formations, the Board, in the exercise of its powers conferred under section 168(1) of the CGST Act hereby clarifies the issue as below:

Leviability of GST on remuneration paid by companies to the independent directors or those directors who are not the employee of the said company

4.1 The primary issue to be decided is whether or not a „Director‟ is an employee of the company. In this regard, from the perusal of the relevant provisions of the Companies Act, 2013, it can be inferred that:

a. the definition of a whole time-director under section 2(94) of the Companies Act, 2013 is an inclusive definition, and thus he may be a person who is not an employee of the company.

b. the definition of „independent directors‟ under section 149(6) of the Companies Act, 2013, read with Rule 12 of Companies (Share Capital and Debentures) Rules, 2014 makes it amply clear that such director should not have been an employee or proprietor or a partner of the said company, in any of the three financial years immediately preceding the financial year in which he is proposed to be appointed in the said company.

4.2 Therefore, in respect of such directors who are not the employees of the said company, the services provided by them to the Company, in lieu of remuneration as the consideration for the said services, are clearly outside the scope of Schedule III of the CGST Act and are therefore taxable. In terms of entry at Sl. No. 6 of the Table annexed to notification No. 13/2017 – Central Tax (Rate) dated 28.06.2017, the recipient of the said services i.e. the Company, is liable to discharge the applicable GST on it on reverse charge basis.

4.3 Accordingly, it is hereby clarified that the remuneration paid to such independent directors, or those directors, by whatever name called, who are not employees of the said company, is taxable in hands of the company, on reverse charge basis.

Leviability of GST on remuneration paid by companies to the directors, who are also an employee of the said company

5.1 Once, it has been ascertained whether a director, irrespective of name and designation, is an employee, it would be pertinent to examine whether all the activities performed by the director are in the course of employer-employee relation (i.e. a “contract of service”) or is there any element of “contract for service”. The issue has been deliberated by various courts and it has been held that a director who has also taken employment in the company may be functioning in dual capacities, namely, one as a director of the company and the other on the basis of the contractual relationship of master and servant with the company, i.e. under a contract of service (employment) entered into with the company.

5.2 It is also pertinent to note that similar identification (to that in Para 5.1 above) and treatment of the Director‟s remuneration is also present in the Income Tax Act, 1961 wherein the salaries paid to directors are subject to Tax Deducted at Source (‘TDS’) under Section 192 of the Income Tax Act, 1961 (‘IT Act’). However, in cases where the remuneration is in the nature of professional fees and not salary, the same is liable for deduction under Section 194J of the IT Act.

5.3. Accordingly, it is clarified that the part of Director‟s remuneration which is declared as „Salaries‟ in the books of a company and subjected to TDS under Section 192 of the IT Act, are not taxable being consideration for services by an employee to the employer in the course of or in relation to his employment in terms of Schedule III of the CGST Act, 2017.

5.4 It is further clarified that the part of employee Director‟s remuneration which is declared separately other than „salaries‟ in the Company‟s accounts and subjected to TDS under Section 194J of the IT Act as Fees for professional or Technical Services shall be treated as consideration for providing services which are outside the scope of Schedule III of the CGST Act, and is, therefore, taxable. Further, in terms of notification No. 13/2017 – Central Tax (Rate) dated 28.06.2017, the recipient of the said services i.e. the Company, is liable to discharge the applicable GST on it on reverse charge basis.

6 It is requested that suitable trade notices may be issued to publicize the contents of this circular.

7. The difficulty, if any, in the implementation of the above instructions may please be brought to the notice of the Board. The Hindi version would follow.

Read the circular:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.