GST registration : liability, exemption and process

Table of Contents

Basic provisions related to GST Registration

GST registration can be taken in two scenarios. The first is mandatory and the second is voluntary.

When a person is liable to take registration in GST?

Mandatory registration in GST:

In the following scenarios taking registration is mandatory in GST. Although a voluntary registration can also be taken. But in these cases, it is mandatory to apply for registration within 30 days of liability.

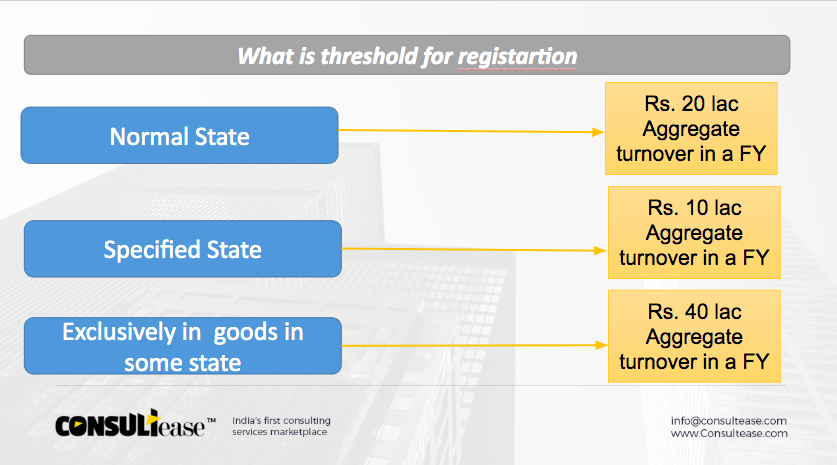

The threshold of Rs. 20 Lac:

Section 22 of the CGST Act prescribes the threshold of turnover limit for GST registration. Every person making a taxable supply is required to take registration in each state from where they are making a supply if they cross the threshold. When supply is made from a normal state. The supplier is required to take registration if his turnover crosses Rs. 20 lac.

Related Topic:

List for state-wise threshold for registration in GST

The threshold of Rs. 10 lac:

But if he is operating from any of the specified states, his turnover limit will be reduced to Rs. 10lac. In that case, he will be liable to take registration in each state from where he is making a supply if turnover crosses Rs. 10 lac. The following are the specified states at present:

“special category States” shall mean the States as specified in sub-clause (g) of clause (4) of article 279A of the except The state of Jammu Kashmir and states of Arunachal Pradesh, Assam, Himachal Pradesh, Meghalaya, Sikkim, and Uttarakhand.

The threshold of Rs. 40 lac

When a supplier is engaged exclusively in the supply of goods. They can take registration when their turnover has crossed a turnover of Rs. 40 lacs. This threshold will apply only to the states who have adopted this provision. Please check state notification before waiting for this threshold. If your states have not opted for this your threshold will be 20/0 lac only. Also if you are making the supply of services then also you will not be eligible for this relaxation.

- When any of the following criteria are fulfilled:

Section 24 of the CGST Act prescribe the following criteria for mandatory registration. Even if your threshold is not crossing the above limit, you may be liable to take registration in GST.

- Interstate supply of Goods. (Service providers got relaxation via notification)

- Casual taxable person

- Covered in reverse charge to pay tax as a recipient

- Required to pay tax u/s 9(5).

- Non Resident taxable person

- Tax deductor u/s 51 of CGST Act. i.e a TDS deductor

- Agent

- ISD

- ECO vendor (will get the benefit of 20 lac threshold, relaxation via notification)

- ECO liable for TCS u/s 52

Related Topic:

Updated provisions of Registration under GST

A person exempted from taking GST registration:

The following persons are exempted from taking registration in GST. Section 23 of CGST Act covers this.

- A person engaged exclusively in exempted GST supplies

- An agriculturist to the extent of agriculture produce

What is the process of taking a GST registration?

The supplier is required to apply online on the GST portal. FIll their basic details and generate TRN. Then full details will be filled and registration will be granted in 3 days.

Step 1 – Create TRN- Enter your email id and phone number along with your Pan. Generate TRN through verification.

Step-2 Enter the desired documents

Step-3 Apply online for registration

Thus you can easily make registration online. There is no need to go to any department or submit any hard copies of documents.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.