How to File GST return without any software

Table of Contents

- List of all GST returns with due dates after all recent changes

- The latest feature of GSTR 3b- auto-population of data

- QRMP Scheme of GST return filing-

- The latest update for GST returns-

- Process for filing GST return in minutes:

- Which returns do you need to file?

- Compile data for GST retrun

- How to adjust input tax credit in GST return?

- Due dates for various GST returns:

- Consequences of late filing of GST return:

- Special waiver of late fees for GSTR 3b from July 2017 to Jan 2020:

List of all GST returns with due dates after all recent changes

| Type of Registered person | Turnover | Regular returns |

| Normal | Up to 5 Cr ( opted for quarterly return) | GSTR 1– 13 th of the month after the end of the quarter |

| GSTR 3b– 22nd of the month succeeding the quarter for Group 1 states (See note 1 below the table)

24th of the month succeeding the quarter for the Group 2 states (See note 2 below the table) |

||

| Monthly filers (T/O may be less than 5 crores or more than 5 crores) | GSTR 1– 11th of the following month

GSTR 3b– 20th of the following month |

|

| Casual Taxable Person | NA | GSTR 1– 11th of next month

GSTR 3b -20th of next month |

| Composition Dealer | 1.5 Cr | GSTR-4 (30th April following the end of the Financial year

GST CMP-08 (18th of the month succeeding the quarter) |

| NRTP | NA | GSTR 5– Earlier of :

1. 20th of the following month or 2. within 7 days after expiry of the registration |

| NR OIDAR | NA | GSTR 5A– 20th of the following month |

| ISD | NA | GSTR 6-13th of the following month |

| TDS deductor u/s 51 | NA | GSTR 7-10th of the following month |

| TCS u/s 52 | NA | GSTR 8- 10th of the following month |

Note -1= Catagory 1 states

States of Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman, and the Nicobar Islands or Lakshadweep)

Note-2= Catagory 2 states

States of Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh or Delhi).

The latest feature of GSTR 3b- auto-population of data

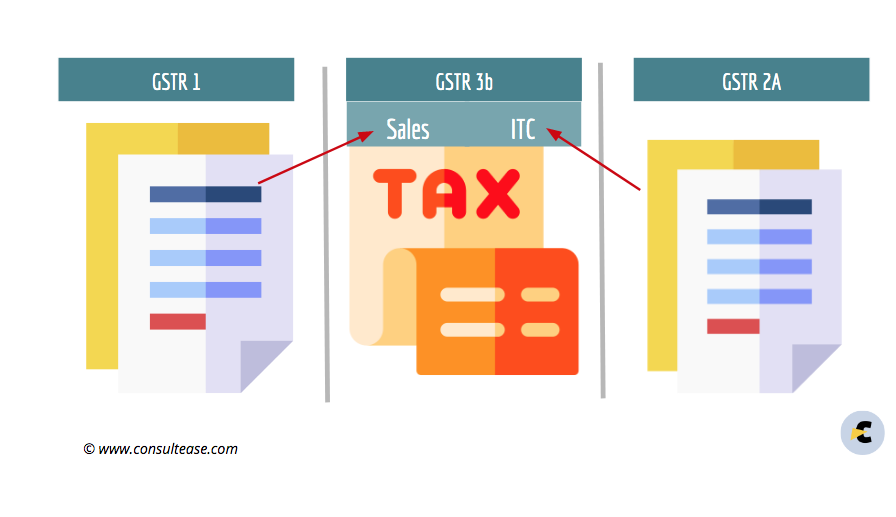

The data in various tables of GSTR 3b is auto-populated now. This is a new feature in GSTR 3b. Also, a flag is displayed at the variation of 10% more or fewer data in GSTR 3b. These features will make it very easy and error-free. The sales are auto-populated from the GSTr 1 filed by the same taxpayer and ITC is auto-populated from the GSTR 2b. It also auto-populates the reverse charge tax. although there is an error in this feature. an advisory from GSTIN has said that this figure is not correct. The taxpayer is suggested to file the return with the actual figure of Reverse charge tax. You can ignore the auto-populated data of reverse charge. A GST registered person is required to pay the reverse charge on these inward supplies.

Related Topic:

Important changes in GST returns, GSTR 3b and 1

QRMP Scheme of GST return filing-

This is a new scheme of GST return filing. In this scheme, you can file both GSTR 1 and GSTR 3b quarterly. The facility to file quarterly returns is available only to small taxpayers. The eligibility criteria for that scheme is that the turnover of the taxpayer shall be less than Rs. 5 crores in the previous financial year. It is applicable from 1st January 2020. The portal will auto migrate the taxpayers to this scheme. Now the GST returns are filed in this manner. The data gets auto-populated from GSTR1 of others to claim ITC and GSTR 1 of the same person to show turnover.

Related Topic:

How to File GST return without any software

The latest update for GST returns-

In the 42nd Meeting of the GST council, it is decided to allow the quarterly filing of GST return. Data of Sales will auto-populate from GSTR 1 and ITC in GSTR 2b.

GSTR 3b & 1 Quarterly

The taxpayer can file GSTR 3b quarterly. This is decided in the 39th GST council meeting. But it is available only to the taxpayers with turnover up to 5 crores. The filing of GSTR 1 is also quarterly. Also, the due date of GSTR 1 for quarterly filers is extended to the 13th of the month succeeding the quarter. These changes will apply from 1.1.2021.

Related Topic:

15 suggestions on GST RETURNS, PROCEDURES, LAW & POLICIES – December 2019

Process for filing GST return in minutes:

GST return is the basic compliance of GST. As per section 59 of the CGST Act, it is a mechanism for self-assessment. Compliances are a very important part. I believe the proper compliances can save you from notices and litigation. In some cases, we have seen the taxpayer ends up in a huge payment of interest or late fee. It is completely online. You don’t need to visit any department or office. If you are new to GST please read this post on basic concepts. The only thing you need is a system with the internet. I have divided the entire process into some small steps.

Step 1: Log in to your dashboard at the GST website.

Step2: Select the return you need to file.

Step 3: Enter the data and click on the file. It will create the challan of payable (GSTR 3b). Check the amount payable to match your data. Click on it and make payment.

Step 4: Enter the OTP you receive. Now corporates can also file returns via EVC. Earlier use of DSC was mandatory for corporates.

Related Topic:

10 common mistakes while filing GST returns

Now you can also file NIL return via SMS. You can see the procedure to file NIL return via SMS here. Also, you can read the FAQs issued by GSTIN on return filing via SMS here. Only NIL returns can be filed via SMS.

Related Topic:

Which returns do you need to file?

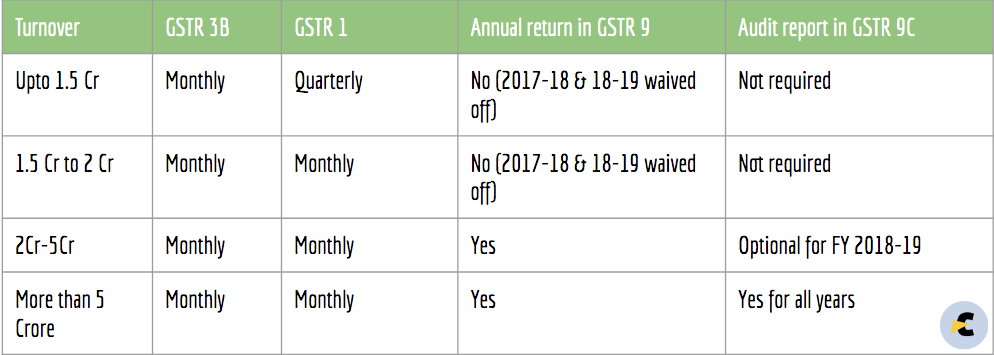

We can divide a taxpayer based on turnover. This list is for a normal taxpayer. In the case of a composition dealer, there are two returns. One is quarterly, CMP 08, and the other is yearly in form GSTR 3A.

Compile data for GST retrun

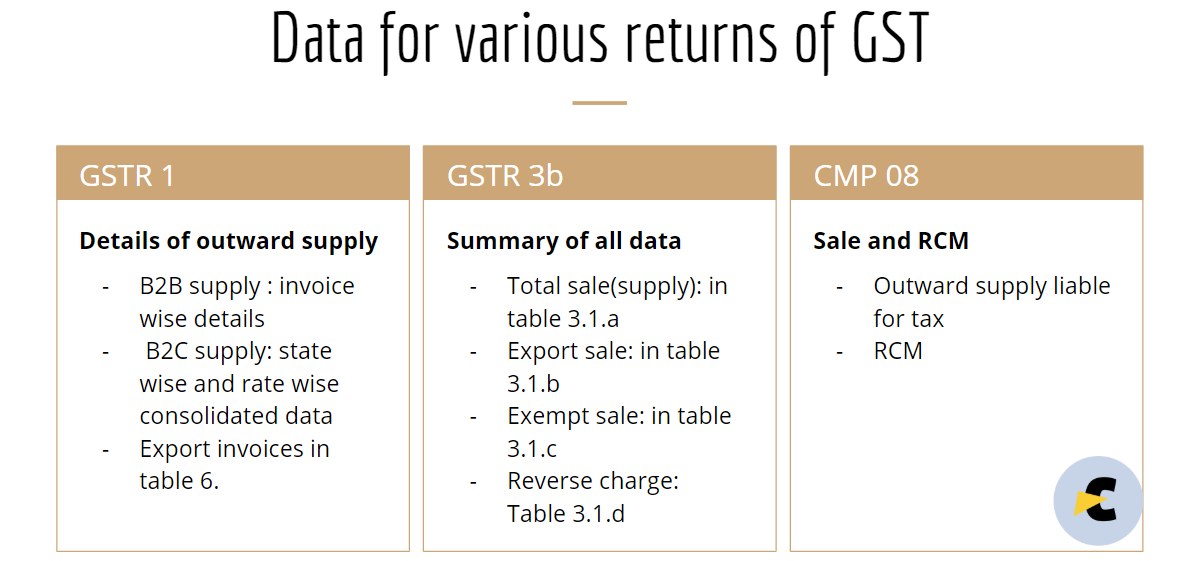

The first thing you need to compile is your data. It depends on how you maintain your accounting. Tally, busy, and marg are most famous in MSME in India for data maintenance. It is easy to export data for the return of GST. But this facility is there in their latest version. But in other cases, data can be manually compiled. Let us see what all you need to enter in the GST return.

Data for GSTR1:

Now let us have a look at the data required in GSTR 1.

Sales(outward supply): All invoices for sales during the month. We can divide all invoices into two parts.

- B2B: Sales to the registered person.

- B2C: Sales to the unregistered person.

These all invoices details are required in GSTR1. It is a statement of outward supply. Any kind of outward supply is covered in GSTR 1. Details of all B2B invoices are required at the invoice level.

Zero-rated supply: Here zero rates don’t mean a supply bearing “0” rate. But it means to export and supply to SEZ developer or unit. Many taxpayers file it wrong. This is required in both GSTR 3b and GSTR 1. In GSTR 1 invoice wise details are required. Then those details are matched with ICEGATE to issue a refund.

Data for GSTR 3b:

GSTR 3b is a summary of all data. Net tax liability is calculated with all the data entered. Consolidated sales and ITC on purchase is entered. Also, the ITC on RCM basis is included. Then the net tax liability is calculated.

Tax on total sales (except exempted and export without payment of Tax) xxxxx

Less: Eligible ITC: xxxxx

Add: ITC reversed for past months: xxxxx

Less: ITC claimed for past months: xxxxx

Net tax payable xxxxx

A challan is generated automatically with tax liability. You can simply pay it via net banking and file GSTR 3b.

How to adjust input tax credit in GST return?

The input tax credit can be adjusted in the following manner.

Manner of the utilization of ITC

First Utilize the IGTS and then CGST & SGST. Although IGST can be adjusted in any proportion with CGST & SGST.

The balance tax will be adjusted by CGST & SGST respectively. It means that you cant CGST with SGST or vice versa.

Reflection in 2A:

Now reflection of ITC in 2A is also mandatory. Rule 36A is inserted in CGST Rules. You can take only reflected ITC +10% in a particular return. It gets reflected in 2A when the Supplier files his GSTR 1. In case he skips your invoice, You can take that ITC.

Due dates for various GST returns:

The due date for GSTR 1 when turnover is less than 1.5 cr: 11th of next month

When turnover is more than Rs. 1.5Cr: last day of next month

GSTR 3b: (All cases): 20th of next month.

In 2020, due to COVID 19 special due dates are announced. Please refer to this post to see the due date of various months of 2020.

Consequences of late filing of GST return:

In case of late filing of GST return, there are consequences. Return is a mechanism for self-assessment in GST. Department can send you a notice for non-filing. The general penalty can also be there. Other than that late fees and interest is also liable.

Late fee:

A late fee of Rs. 200 per day up to Rs. 10000 is prescribed in the CGST Act. But it was reduced to Rs. 50 in case of normal return. In the case of NIL return, late fees are Rs. 20 per day. Now you can file a NIL return using SMS.

This late fee is separately leviable for both GSTR 3b and GSTR 1.

Note: late fees on return for the month of Feb to May 2020 is waived off if filed by June 2020. Due to the COVID lockdown, the late fee was waived off. Thus you can file a return for these months by June 2020

Special waiver of late fees for GSTR 3b from July 2017 to Jan 2020:

A special waiver is provided by CBIC. If your GSTR 3b is pending from July 2017. You can file it now. There is zero late fees for the NIL return and up to Rs. 500 for Others.

Illustration

Mr. Filed his GSTR 1 and GSTR 3b for the month of March 2018 on 30 June 2018. What are the late fees he is liable to pay?

| GSTR 3b | GSTR1 | |

| Due date | 20th April | 11th of April |

| Delay | 20th April to 29th June | 12th April to 29th June |

| Days of delay | 70days | 79days |

| Late fee | 25*70= 1750 Rs. | 1975 Rs. |

latest: The waiver of the entire late fee is also possible. This issue is raised to CBIC and FM. GSTR 3b late fees are waived off. You can file GSTR 3b from July 2017 to Jan 2020 without a late fee. But file it from 1st July to September.

Interest:

Interest at the rate of 18% is also leviable on the late payment of tax. We make payment of tax with GSTR 3b. Thus interest is leviable on the late filing of GSTR3b.

In the same case let us say the amount of tax payable is Rs. 20000. Interest calculation is: 20000*18%*70/365= 690 Rs.

Cancellation of registration:

The GST department can cancel your registration for the non-filing of returns. Section 29 of the CGST Act covers it. GST department can cancel registration if the returns are not filed for three consecutive months.

Blocking E-way bills generation:

Non-filing of GSTR 3b may also result in blockage of E-way bills.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.