GST Returns Due Dates for GTSR 1 and GSTR 3b

Table of Contents

- GSTR 3B New Updates:

- General GST due dates chart

- Various GST returns due dates:

- Due dates to file GSTR 3b without interest for the month of February to July 2020

- Due date pf GSTR 3b without late fees: Notification no. 52/2020

- What are the various due dates for GSTR 1 for FY 2020?

- What is the due date for Composition returns for 2020?

- Related Topic: GST Audit Checklist

- What is the due date for the Annual return in form GSTR 9 for FY 2018-19?

- What will be the consequences of missing GST returns due dates:

- These provisions are also explained in this video.

- Read the copy:

GSTR 3B New Updates:

July 2022: 5 important changes incorporated into GSTR 3b

#1. Filling the date related to inter state supply to unregistered person, COmposition dealer and UIN holders

This information is required in table 3.2 of GSTR 3b. But many taxpayers skip this information. Now it is mandatory to fill this information also. CBIC has wared the taxpayer to not to skip this data. As this data is required for centre and state segregation of taxes.

#2. Auto populating Data in GSTR 3b

Now on most of data in GSTR 3b will be auto populated. Data related to sales will be auto populated from GSTR 1. The input tax credit in Table 4 of GSTR 3b will be fetched from GSTR 2B. This will make return filing very easy. Most of the data is already available in the return itself.

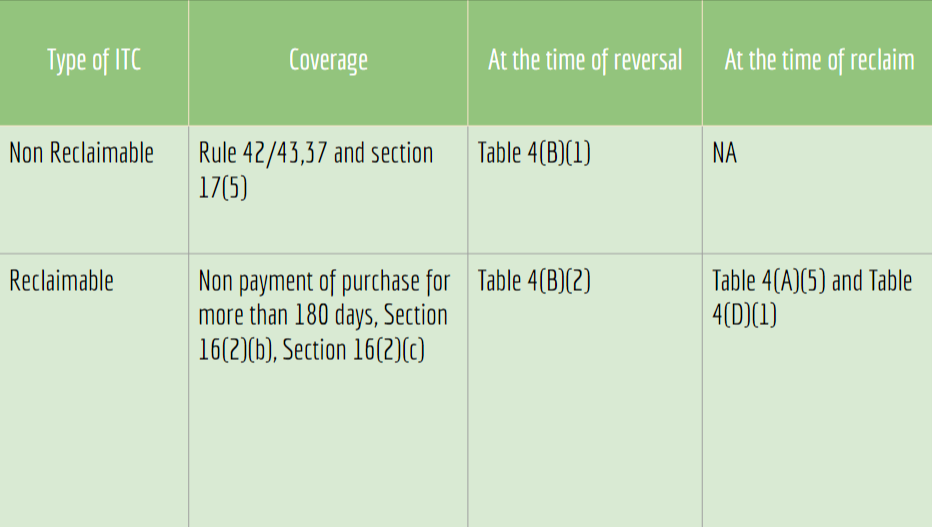

#3. Disclosure of non reclaimable reversals

All the non reclaimable reversals will be disclosed on Table 4(B)(1). ITC reversal under 42/43 and 17(5) are covered here. They are non reversible ITC’s.

#4. Disclosure of reclaimable reversals

Reclaimable ITC’s will have two entries. The first is of reversal and the second of reclaim.

The reversal for delay in payment beyond 180 days is covered here. You can reclaim when the purchase is finally paid off. ITC reversed for nonreceipt of goods is another example. You will take it when the goods/service will receive.

In these cases first of all, reversal is made in table 4(B)(2). We can reclaim that ITC when we fulfill the condition. At that time we can show it in table 4(A)(5) and 4(D)(1).

Type of ITC

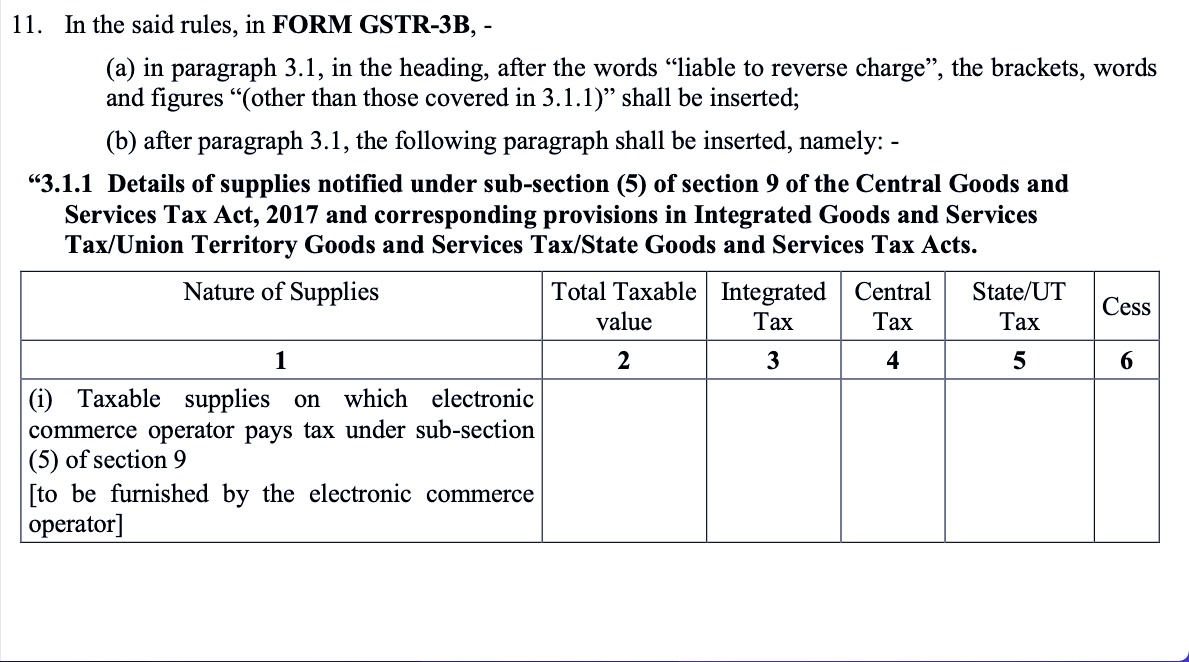

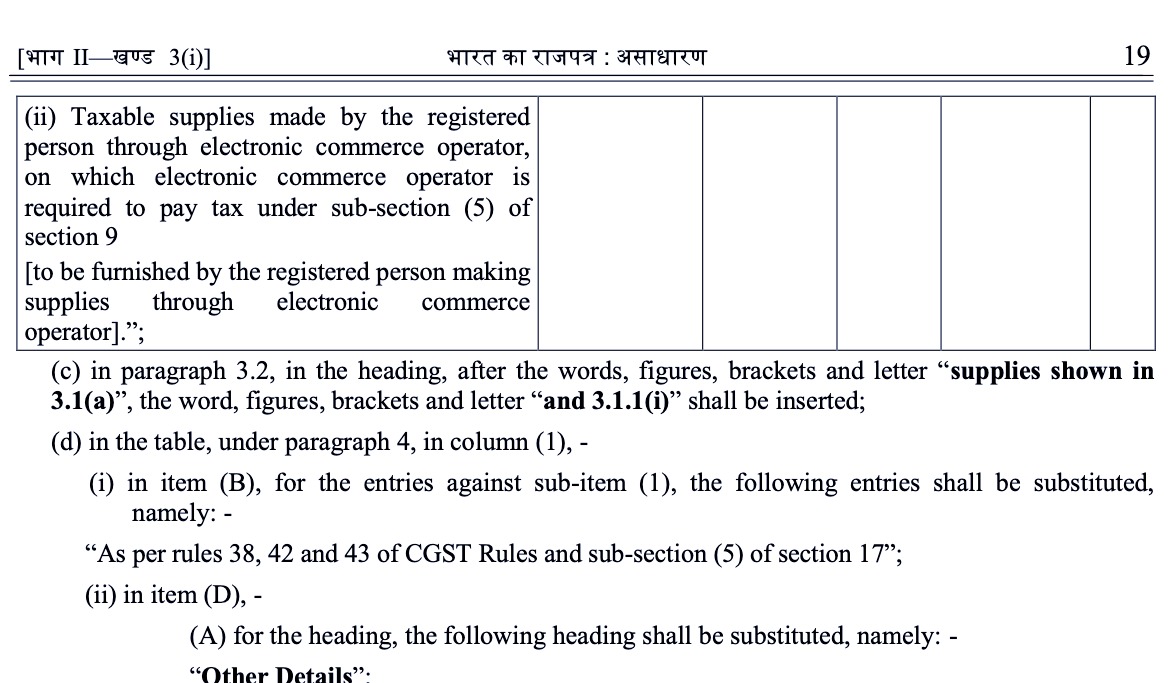

#5. Data to be filled by an E-commerce operator and vendor where the supply is covered u/s 9(5)

Two new tables are part of GSTR 3b now. The first is for an E-commerce operator and another is for E-commerce vendor. The first table will cover the supply of notified services under section 9(5) of CGST Act by ECO. The second table will be filled by the vendor. The format of both tables is given below.

Table Format (1)

Table Format (2)

General GST due dates chart

Now GST due dates have been rationalized. We have two main returns of GST. Namely GSTR 1 and GSTR 3b. They can be filed monthly or quarterly.

GSTR-3B Due date

GSTR 3b due dtae where the turnover in preceding financial year is more than Rs. 5 crores is 20th of next month. e.g. for the month of June 2021, the due date is 20th July 2021.

Related Topic:

Late Fee Calculator For filing GSTR-3B free download

Where the turnover is less than Rs. 5 crores, due dates are given state-wise.

- Chhattisgarh, Madhya Pradesh, Gujarat, Dadra and Nagar Haveli and Daman and Diu, Maharashtra, Karnataka, Goa, Lakshadweep, Kerala, Tamil Nadu, Puducherry, Andaman, and Nicobar Islands, Telangana, and Andhra Pradesh- The due date is 22nd of next month.

- Jammu and Kashmir, Ladakh, Himachal Pradesh, Punjab, Chandigarh, Uttarakhand, Haryana, Delhi, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand, and Odisha- 24th of next month.

Related Topic:

Check GST return status of any taxpayer without logging in

GSTR 1 due dates-

Due Date Form to be filed Period

11/07/2021 GSTR-1 June-2021

13/07/2021 GSTR-1 (QRMP) Apr-2021 to June-2021

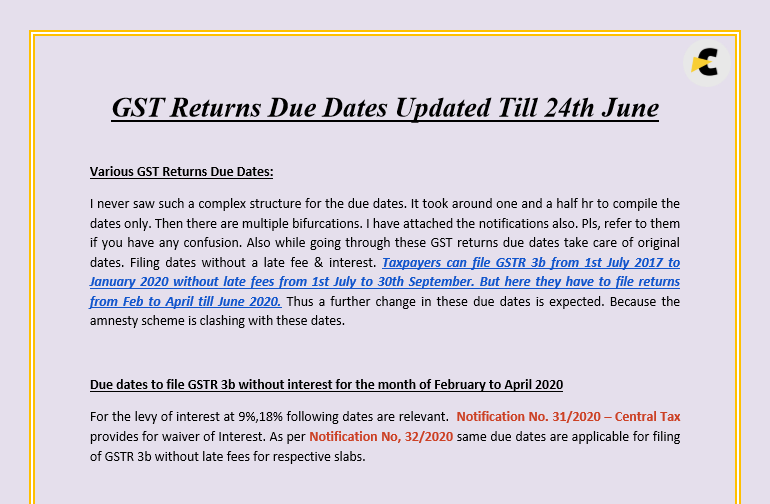

Various GST returns due dates:

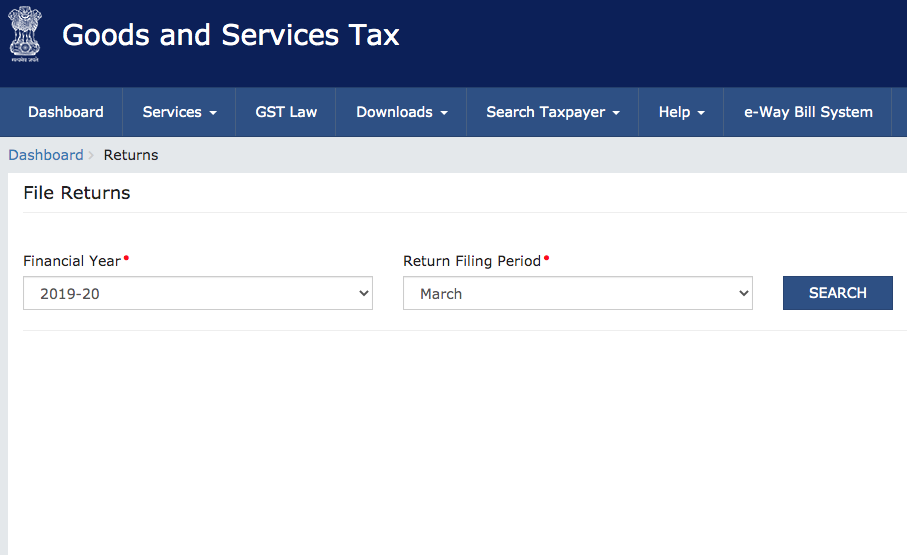

I never saw such a complex structure for the due dates. It took around one and a half hr to compile the de dates only. Then there are multiple bifurcations. I have attached the notifications also. Pls, refer to them if you have any confusion. Also while going through these GST returns due dates take care of original dates. Filing dates without a late fee & interest. The taxpayer can file GSTR 3b from 1st July 2017 to January 2020 without late fees from 1st July to 30th September. But here they have to file returns from Feb to April till June 2020. Thus a further change in these due dates is expected. Because the amnesty scheme is clashing with these dates.

Related Topic:

4 BIG COMMON Mistakes in GSTR- 3B

Due dates to file GSTR 3b without interest for the month of February to July 2020

For the levy of interest at 9%,18% following dates are relevant. Notification No. 31/2020 – Central Tax provides for waiver of Interest. As per Notification no, 32/2020 same due dates are applicable for filing of GSTR 3b without late fees for respective slabs.

Related Topic:

Important changes in GST returns, GSTR 3b and 1

Further notification no. 51/2020 made the following changes in GSTR 3b due dates.

| State | Turnover in PFY | Month | Without Interest | 9% Interest | 18% Interest |

| Any State | Turnover is more than Rs. 5 Crore | February to April 2020 | 15 days from the due date | If filed by 24th June 2020 | If filed after 24th June 2020 |

| Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, or Andhra Pradesh

Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman, and Nicobar Islands Lakshadweep |

Turnover is up to 5 Cr | February 2020

March 2020 April 2020 May 2020 June 2020 July 2020 |

30th June 2020

3rd July 2020 6th July 2020 12th September 2020 23rd September 2020 27th September 2020 |

30th September 2020 for all months

|

After 30th September 2020 for all months

|

| Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha or the Union territories of Jammu and Kashmir, Ladakh, Chandigarh, and Delhi | Turnover is up to 5 Cr |

February 2020 March 2020 April 2020 May 2020 June 2020 July 2020 |

30th June 2020 5th July 2020 9th July 2020 15th September 2020 25th September 2020 29th September 2020 |

30th September 2020 for all months |

After 30th September 2020 for all months |

Related Topic:

How to File GST return without any software

Due date pf GSTR 3b without late fees: Notification no. 52/2020

| State (a) | Class of registered persons(b) | Month(c) | Last date to file without a late fees |

| Any State | Turnover is more than Rs. 5 Crore | February to April 2020 | 15 days from the due date |

| May 2020

June 2020 |

27/06/2020

20/07/2020 |

||

| Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana or Andhra Pradesh

Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands Lakshadweep |

Turnover is up to 5 Cr | February 2020

March 2020 April 2020 May 2020 June 2020 July 2020 August 2020 |

30th June 2020

3rd July 2020 6th July 2020 12th September 2020 23rd September 2020 27th September 2020 1st October 2020 |

| Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha or the Union territories of Jammu and Kashmir, Ladakh, Chandigarh, and Delhi | Turnover is up to 5 Cr |

February 2020 March 2020 April 2020 May 2020 June 2020 July 2020 August 2020 |

30th June 2020 5th July 2020 9th July 2020 15th September 2020 25th September 2020 29th September 2020 3rd October 2020 |

Notification no. 57/2020 curtailed the late fees at Rs. 500 per month per return. In the case of NIL return, the late fees are Zero.

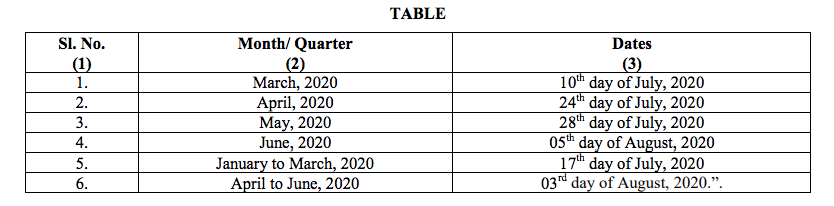

What are the various due dates for GSTR 1 for FY 2020?

Thus filing of GSTR 1 after these dates may land you in levy of late fees. Although there is no interest in this case. Because GSTR 1 is only a statement of Supply. The payment of tax is done via GSTR 3b.

Related Topic:

Quarterly Return Monthly Payment Scheme (QRMP) – New Facelift

What is the due date for Composition returns for 2020?

| Return | Period | Due date (Extended) | |

| CMP 08 | March Qtr | 7th July 2020 | 34/2020-Central Tax ,dt. 03-04-2020 |

| GSTR 4 | FY ending on 31st march | 15th July 2020 | 34/2020-Central Tax ,dt. 03-04-2020 |

Related Topic:

GST Audit Checklist

What is the due date for the Annual return in form GSTR 9 for FY 2018-19?

| 30th September 2020 | 41/2020- Central Tax ,dt. 05-05-2020 |

Related Topic:

Live Demo for Filing of GSTR-3B

These are the GST returns due dates for FY 2020. Pls, save this post for any future change. Thus a pandora’s box is here and you need to stay connected.

What will be the consequences of missing GST returns due dates:

- Full late fees from the original due date are leviable. These dates are for late filing without a late fee. Now you can file all the GSTR 3b by 30th Sept 2020. Late fees are maximum of Rs. 500 for returns with tax and NIL for returns without tax.

- Full interest is leviable @18% from the original due date.

Thus you should file all your returns before these due dates. Because delay may result in huge costs in terms of late fees and interest.

These provisions are also explained in this video.

Related Topic:

Critical Analysis of GST Constitutional Journey

Read the copy:

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.