GSTR 2A Reconciliation Tool

GSTR 2A Reconciliation Tool

The wrong availment of ITC is illegal and could attract both heavy interest and penalty. It is always suggested to reconcile your GSTR 2A with your books as often as possible.

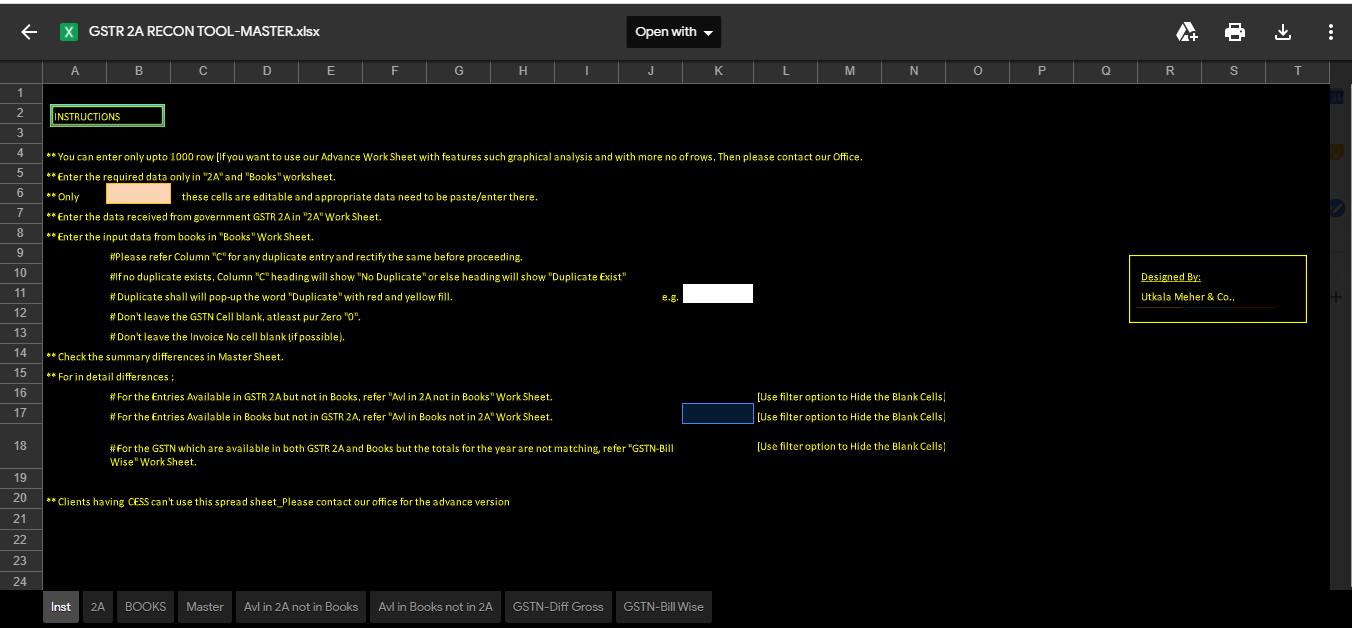

There is no Excel tool in the market to reconcile GSTR 2A with the ITC availed in the books which gives an accurate and detailed reconciliation statement. Hence, I decided to prepare the most accurate GSTR 2A reconciliation tool during this quarantine period with the help of MS Excel. This tool is very user friendly and saves a lot of time.

With the following simple steps, you can easily reconcile your GSTR 2A with your books with a fraction of seconds.

>>1. Download GSTR 2A from portal paste it in the Reconciliation spreadsheet.

>>2. Export \Extract input register or purchases register from the book and paste it in a Reconciliation spreadsheet.

Related Topic:

GSTR 2A Vs GSTR 2B – Detailed Comparison of GSTR-2A with GSTR-2B

And your reconciliation statement is ready.