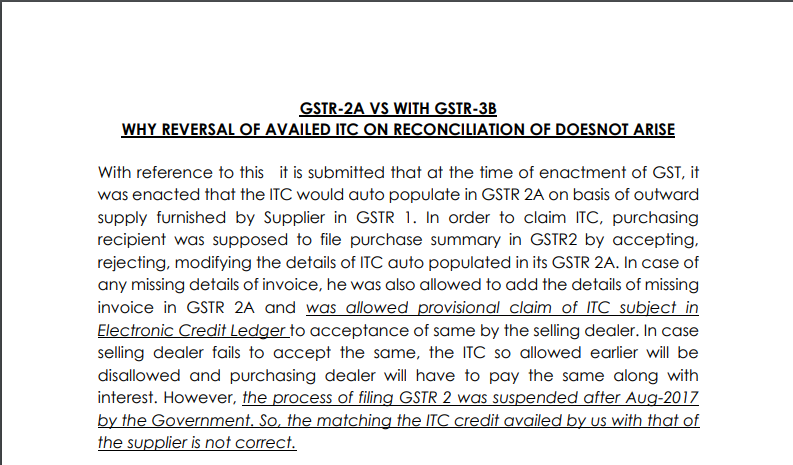

GSTR-2A VS With GSTR-3B why reversal of availed ITC on reconciliation of does not arise

GSTR-2A VS With GSTR-3B why the reversal of availed ITC on reconciliation of does not arise

With reference to this it is submitted that at the time of enactment of GST, it was enacted that the ITC would auto-populate in GSTR 2A on basis of outward supply furnished by Supplier in GSTR 1. In order to claim ITC, purchasing recipient was supposed to file a purchase summary in GSTR2 by accepting, rejecting, modifying the details of ITC auto-populated in its GSTR 2A. In case of any missing details of an invoice, he was also allowed to add the details of the missing invoice in GSTR 2A and was allowed the provisional claim of ITC subject in Electronic Credit Ledger to acceptance of same by the selling dealer. In case the selling dealer fails to accept the same, the ITC so allowed earlier will be disallowed and purchasing dealer will have to pay the same along with interest. However, the process of filing GSTR 2 was suspended after Aug-2017 by the Government. So, the matching the ITC credit availed by us with that of the supplier is not correct.

This apart, the GSTN has provided the details of uploading of the invoices by the supplier based on GSTR-1 in the GSTR-2A excel file and has not provided details about the filing status of GSTR-3B. Verification of the details provide by the GSTN in GSTR-2A revealed that the said supplier has uploaded the outward supply details. So, we are under the genuine belief that our availment of Input Tax Credit is as per the provisions of law. Had this information has provided we would not have paid the amount to the Registered person instead have paid to the Government as per the provisions of law.

Related Topic:

Late Fee Calculator For filing GSTR-3B free download

Further, the restrictions of ITC based on the GSTR-2A and GSTR-3B have been made applicable from October -2019 only as per the provisions of Rule 36(4) of GST Rules, 2017 introduced as per Notification No.49/2019-Central Tax dated 09.10.2019. The said amendment restricted the availment of Input Tax Credit (hereinafter referred to as ‘ITC’) by a registered person in respect of invoices or debit notes, the details of which have not been uploaded by the suppliers under sub-section (1) of Sections 37, shall not exceed 20% of the eligible credit available in respect of invoices or debit notes the details of which have been uploaded by the suppliers under sub-section (1) of Sections 37.

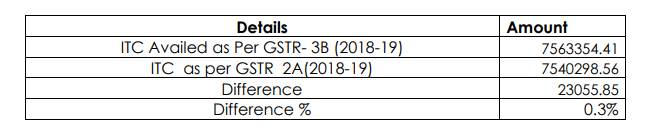

Later, through another Notification No.75/2019-Central Tax dated 26.12.2019, further amended the above-mentioned Rule, thereby restricting the cap to a maximum of 10%. In this connection, it is pertinent to note that this legal provision also does not contemplate that the ITC has to be availed based on the filing of GSTR-3B. When this restriction is applied in our case the difference is less than 20% as well as 10%. The details are as under:

Further, in GSTR-9 there is a provision at Sl. No 8, to declare details of invoices uploaded by the recipient and the actual availment as per 3B. With reference to the difference, between 2A and 3B, the Government vides Notification No: 56/2019 CT dated 14/11/2019, has informed that for the difference, the registered person has to upload the details of the invoices not available in GSTR-2A without auditors’ certificate and has not stated anything about denial of ITC. The relevant portion is as under:

(E.) against serial number 8A, –

(III) after the entry ending with the words “auto-populated in this table.”, the following entry shall be inserted, namely: –

“For FY 2018-19, It may be noted that the FORM GSTR-2Agenerated as of the 1st November 2019 shall be auto-populated in this table. For FY 2017-18 and 2018-19, the registered person shall have an option to upload the details for the entries in Table 8A to 8D duly signed, in PDF format in FORM GSTR-9C (without the CA certification).

This apart at the time of sanction of refund on account of export under bond /LUT, the department has verified the documents and sanctioned the refund after due verification. The instruction of the department wrt to invoice not reflected in 2A is as under as per Circular No: Circular No. 59/33/2018-GST dated 04/09/2018.

Related Topic:

Excess tax paid in Form GSTR-3B of F.Y.2017-18 and F.Y.2018-19 both years and given effect of the same in F.Y.2019-20 (Assuming).

2. Submission of invoices for processing of claims of refund:

2.1 It was clarified vide Circular No. 37/11/2018-GST dated 15th March 2018 that since the refund claims were being filed in a semi-electronic environment and the processing was completely based on the information provided by the claimants, it becomes necessary that invoices are scrutinized. Accordingly, it was clarified that the invoices relating to inputs, input services, and capital goods were to be submitted for processing of claims for refund of integrated tax where services are exported with payment of integrated tax; and invoices relating to inputs and input services were to be submitted for processing of claims for refund of input tax credit where goods or services are exported without payment of integrated tax.

2.2. In this regard, trade, and industry have represented that such requirement is cumbersome and increases their compliance cost, especially where the number of invoices is large.

Related Topic:

SC stay on Guj HC judgement on GSTR 3b, Should you be worried?

2.3. In view of the difficulties being faced by the claimants of refund, it has been decided that the refund claim shall be accompanied by a print-out of FORM GSTR-2A of the claimant for the relevant period for which the refund is claimed. The proper officer shall rely upon FORM GSTR-2A as evidence of the account of the supply by the corresponding supplier in relation to which the input tax credit has been availed by the claimant. It may be noted that there may be situations in which FORM GSTR-2A may not contain the details of all the invoices relating to the input tax credit availed, possibly because the supplier’s FORM GSTR-1 was delayed or not filed. In such situations, the proper officer may call for the hard copies of such invoices if he deems it necessary for the examination of the claim for refund. It is emphasized that the proper officer shall not insist on the submission of an invoice (either original or duplicate) the details of which are present in FORM GSTR-2A of the relevant period submitted by the claimant.

Related Topic:

New features- How to file GSTR 3b? Step by step process after all amendments

From the above, time again the Department has instructed to admit the tax liabilities by the suppliers and has not denied the ITC availed by the recipient if the recipient has complied with the provisions of GST Act and Rule, 2017.

In fact, the Madhya Pradesh High Court, in the case of Kabeer Reality Private Limited v/s The Union of India & Others held that the GSTR-1 is the declaration of tax liability and GSTR-3B is evidence of actual payment and further pronounced the tax recovery has to initiated aginst such registered person only. The Court also observed that the credit availed by the recipient on the basis of invoices issued by the said registered person also became invalid/ineligible despite no fault on their part.

Rama Krishnan Potty

Rama Krishnan Potty