GSTR 9 & 9C with FEW SAMPLE DISCLOSURES

Table of Contents

- Data in various tables of GSTR 9:

- Data in various tables of GSTR 9C:

- GSTR 9C: PART – B- CERTIFICATION Changes Notified on 14tn November 2019

- Annexure to GST Audit Report GSTR-9C for FY 2017-18

- I. BASSIS OF AUDIT

- II. AUDIT DONE BY ANOTHER AUDITOR

- III. MAINTENANCE OF BOOKS OF ACCOUNTS

- IV. NON-AVAILABILITY OF TRAIL BALANCE IN CASE OF MULTI STATE ACTIVITY

- V. STOCK REGISTER

- VI. RECONCILIATION OF GROSS TURNOVER OF PERIOD APRIL 2017 TO MARCH 2018 (TABLE 5 A TO 5O)

- VII. REPORTING OF REVERSE CHARGE MECHANISM

- VIII. REPORT ON INPUT TAX CREDIT

- IX. RATEWISE TAX LIABLITY ON OUTWARD SUPPLY

- X. REPORT ON VALUATION OF SUPPLIES TO RELATED PARTIES

- XI. INTEREST AND PENALTY

- XII. TRANSITIONAL CREDIT

- XIII. MANAGEMNET REPRESENTATION LETTER

- XIV. RECOMMENDED ADDITIONAL LIABLITIY

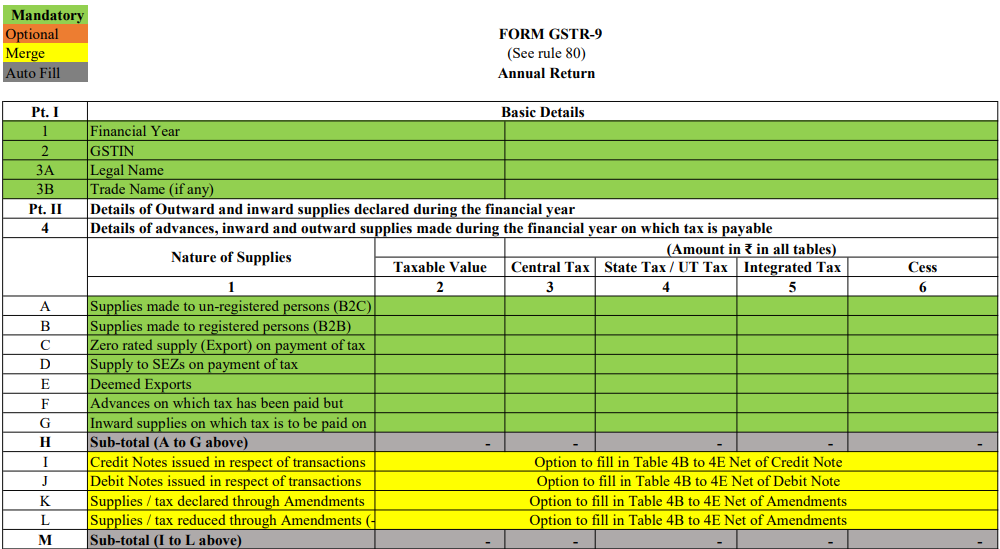

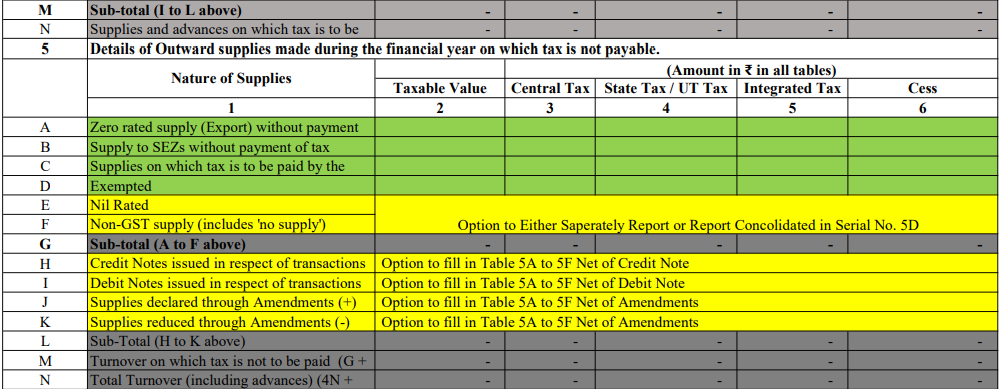

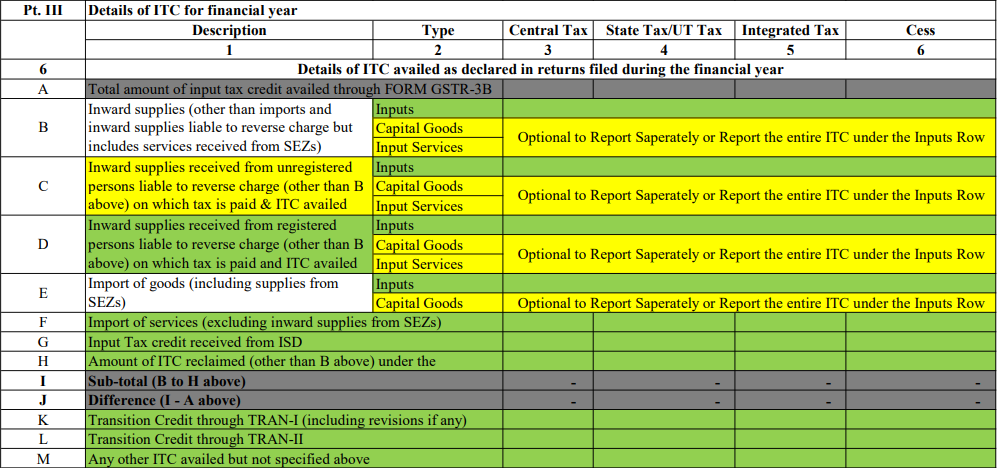

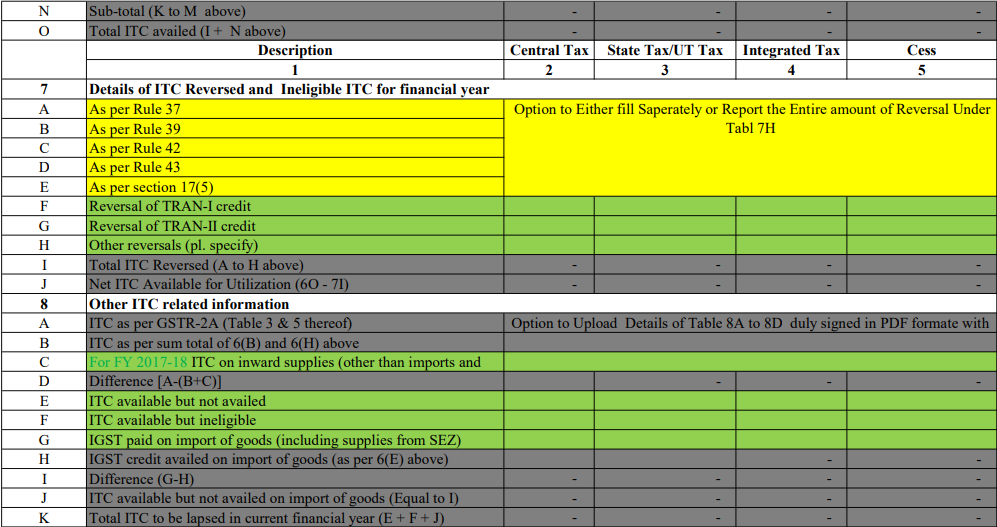

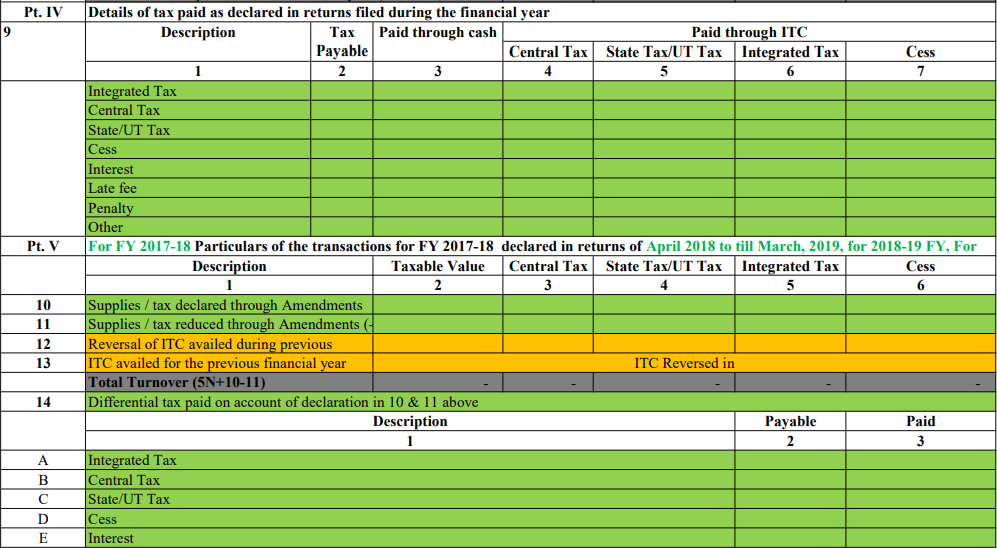

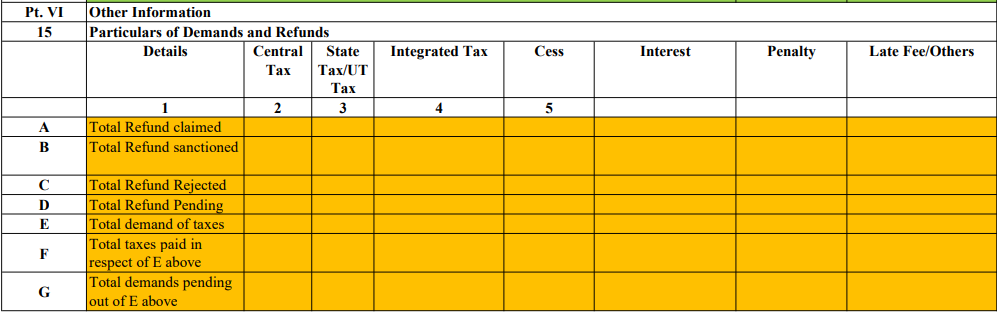

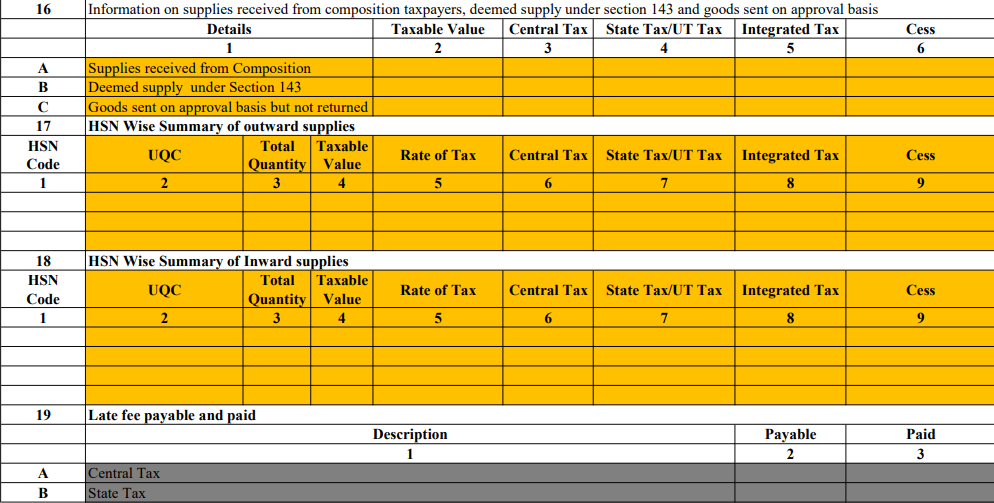

Data in various tables of GSTR 9:

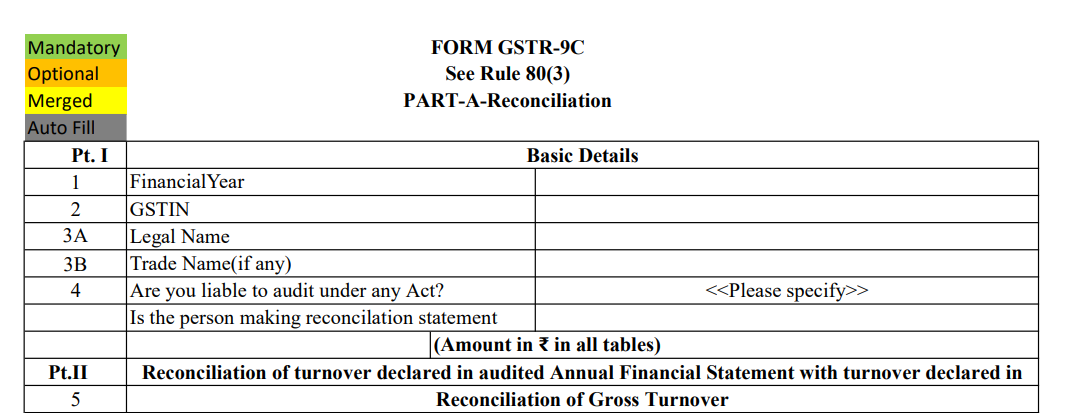

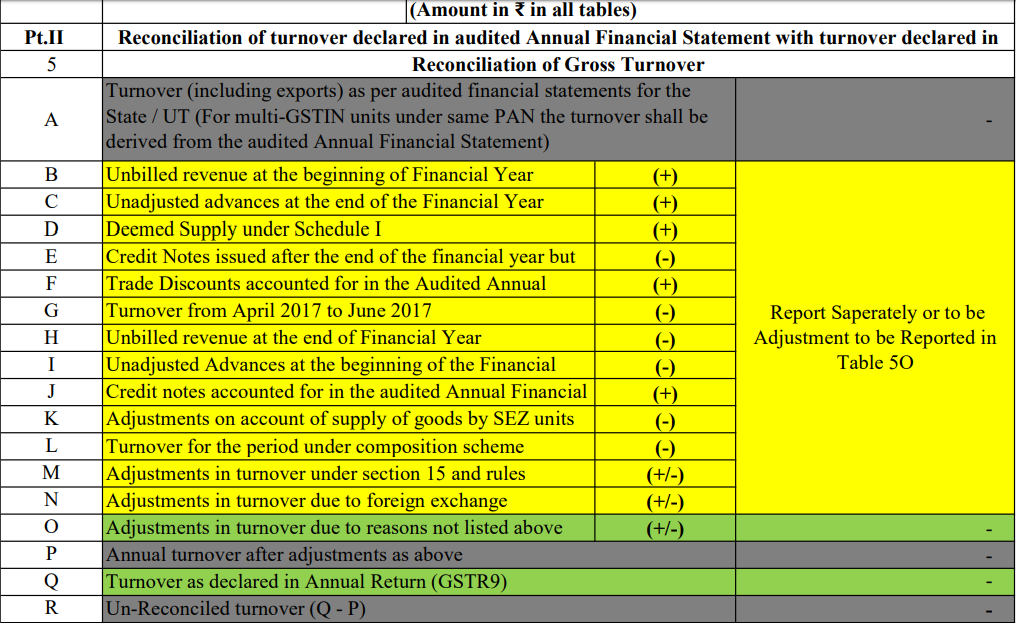

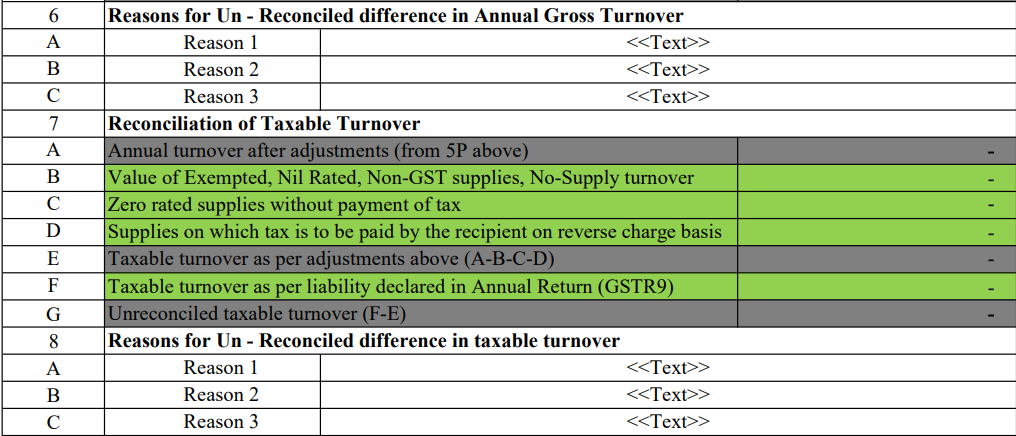

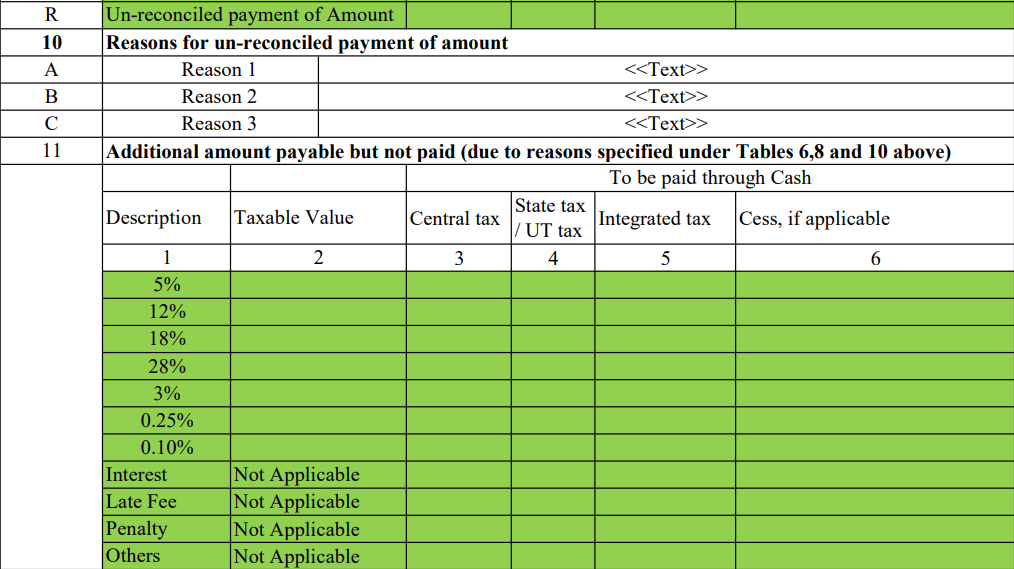

Data in various tables of GSTR 9C:

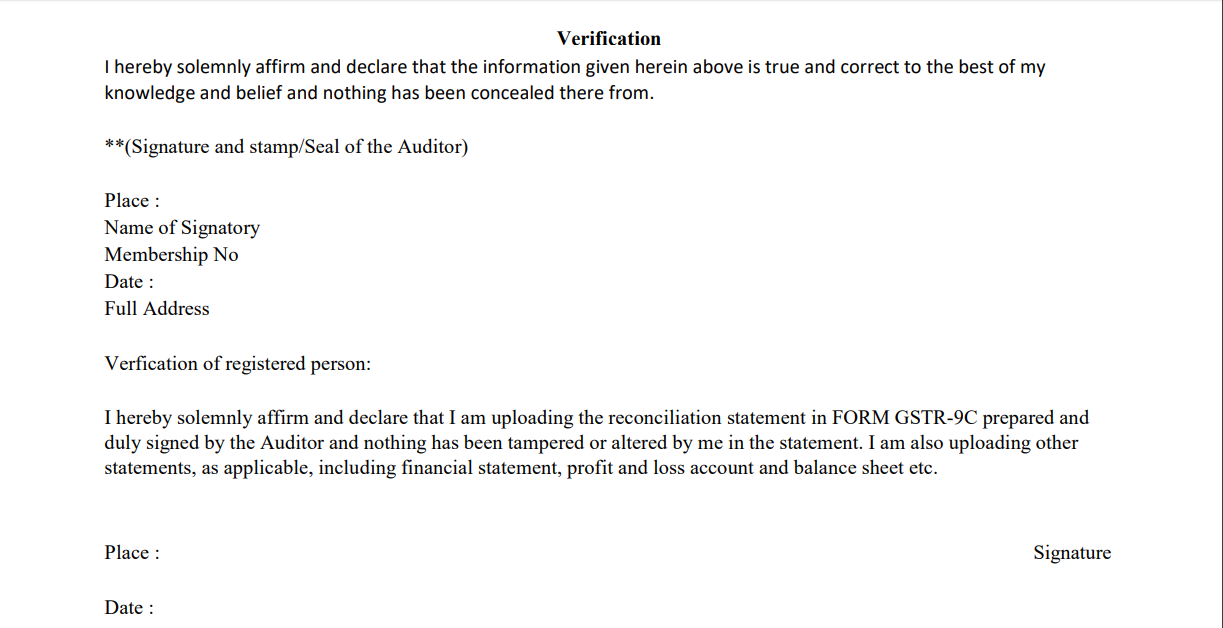

GSTR 9C: PART – B- CERTIFICATION Changes Notified on 14tn November 2019

- Certification in cases where the reconciliation statement (FORM GSTR-9C) is drawn up by the person who had conducted the audit:

I/we have examined the—

(a) the balance sheet as on ………

(b) the *profit and loss account/income and expenditure account for the period beginning from ………..…to ending on ……., and

(c) the cash flow statement (if available) for the period beginning from ……..…to ending on …………., —attached herewith, of M/s …………… (Name), …………………….………… (Address), ..…………………(GSTIN).

- Based on our audit I/we report that the said registered person—

*has maintained the books of accounts, records, and documents as required by the IGST/CGST/<<>>GST Act, 2017 and the rules/notifications made/issued thereunder

*has not maintained the following accounts/records/documents as required by the IGST/CGST/<<>>GST Act, 2017 and the rules/notifications made/issued thereunder:

1.

2.

3.

- (a) *I/we report the following observations/ comments / discrepancies / inconsistencies; if any:

……………………………………. …………………………………….

…………………………………………………………………………….

- (b) *I/we further report that, –

(A) *I/we have obtained all the information and explanations which, to the best of *my/our knowledge and belief, were necessary for the purpose of the audit/ information and explanations which, to the best of *my/our knowledge and belief, were necessary for the purpose of the audit were not provided/partially provided to us.

(B) In *my/our opinion, proper books of account *have/have not been kept by the registered person so far as appears from*my/ our examination of the books.

(C) I/we certify that the balance sheet, the *profit, and loss/income and expenditure account and the cash flow Statement (if available) are *in agreement/not in agreement with the books of account maintained at the Principal place of business at ……………………and ** ……………………additional place of business within the State.

4. The documents required to be furnished under section 35 (5) of the CGST Act / SGST Act and Reconciliation Statement required to be furnished under section 44(2) of the CGST Act / SGST Act is annexed herewith in Form No. GSTR-9C.

5. In *my/our opinion and to the best of *my/our information and according to explanations given to *me/us, the particulars are given in the said Form No.GSTR-9C are true and correct fair subject to following observations/qualifications, if any:\

II. Certification in cases where the reconciliation statement (FORM GSTR-9C) is drawn up by a person other than the person who had conducted the audit of the accounts:

- *I/we report that the audit of the books of accounts and the financial statements of M/s. ………………..…………………. (Name and address of the assessee with GSTIN) was conducted by M/s. …………………………………………..………. (full name and address of auditor along with status), bearing membership number in pursuance of the provisions of the …………………………….Act, and

*I/we annex hereto a copy of their audit report dated ……………………………. along with a copy of each of :-

(a) balance sheet as on ………

(b) the *profit and loss account/income and expenditure account for the period beginning from ………..…to ending on …….,

(c) the cash flow statement (if available) for the period beginning from ……..…to ending on ………, and

(d) documents declared by the said Act to be part of, or annexed to, the *profit and loss account/income and expenditure account and balance sheet.

2. I/we report that the said registered person—

*has maintained the books of accounts, records and documents as required by the IGST/CGST/<<>>GST Act, 2017 and the rules/notifications made/issued thereunder

*has not maintained the following accounts/records/documents as required by the IGST/CGST/<<>>GST Act, 2017 and the rules/notifications made/issued thereunder:

1.

2.

3.

3. The documents required to be furnished under section 35 (5) of the CGST Act / SGST Act and Reconciliation Statement required to be furnished under section 44(2) of the CGST Act / SGST Act is annexed herewith in Form No.GSTR-9C.

4. In *my/our opinion and to the best of *my/our information and according to examination of books of account including other relevant documents and explanations given to *me/us, the particulars given in the said Form No.9C are true and correct fair subject to the following observations/qualifications, if any:

(a)…………..

(b)…………..

(c)…………..

Auditor is required to give certification in Part B of GSTR 9C. Following are few sample observation which can be given by the auditor. These are sample observations & user should modify, delete or add as may be required in each individual audit case.These observations are only for academic purpose & author will not be responsible for any consequence of these observation.

Related Topic:

Detailed format of a management representation letter

Name of Company:

Address of Company:

GST Number:

Annexure-I

Annexure to GST Audit Report GSTR-9C for FY 2017-18

I. BASSIS OF AUDIT

Maintenance of books of accounts, GST related records, preparation of financial statements and preparation of GSTR-9 are the responsibilities of the entity’s management. Our responsibility is to express an opinion on their GST related records based on our audit.

We have done reconciliation as explained in para h of the of press release dated 3rd July 2019. For reference para of the said press release has been reproduced below:

There are apprehensions that the chartered accountant or cost accountant may go beyond the books of account in their recommendations under FORM GSTR-9C. The GST Act is clear in this regard. With respect to the reconciliation statement, their role is limited to reconciling the values declared in annual return (FORM GSTR-9) with the audited annual accounts of the taxpayer.

We have conducted Tax Audit or Statutory Audit of the assessee. We have conducted our audit in accordance with the standard auditing principles generally accepted in India .These standards require that we plan and perform the audit to obtain reasonable assurance about whether the related records and financial statements are free from material mis-statement(s).

The audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates by management as well as evaluating the overall financial statements presentation. We believe that our audit provides a reasonable basis for our opinion on Reconciliation Statements in Form 9C

II. AUDIT DONE BY ANOTHER AUDITOR

Statutory Audit for the FY 2017-18 of the Company is done by M/s XYZ Y Co. We have relied on the report of statutory audit conducted under Companies Act, 2013 or Tax Audit under Income Tax Act, 1961.

III. MAINTENANCE OF BOOKS OF ACCOUNTS

As per the information and explanation given to us and on the basis of our examination of records of the taxpayer, the taxpayer has maintained proper records of books and documents listed in Sec 35 read with Rule 56 to 58 of CGST Act, except the following;

(a) Stock Register

(b) ITC Register

(c) …….

IV. NON-AVAILABILITY OF TRAIL BALANCE IN CASE OF MULTI STATE ACTIVITY

As per the information and explanation given to us and on the basis of our examination of records of the taxpayer, further taxpayer do not have an accounting system or software for preparing State wise trial balance. However taxpayer maintains accounts in TALLY/SAP/ERP software on all India bases and have common data base.

Separate Sales and purchase register is maintained by the taxpayer for the transactions of Maharashtra State, on the basis of which the taxpayer regularly files GST returns and the same is considered for GST Audit in the State

V. STOCK REGISTER

The taxpayer has not maintained Stock register/not available/maintained but all information not available, as per information and explanation given by the taxpayer, due to the peculiar nature of retail business there are numerous items and maintenance of stock register on day to day basis not possible.

The same has been reported in Tax Audit Report under Income Tax Act, 1961/CARO report.

VI. RECONCILIATION OF GROSS TURNOVER OF PERIOD APRIL 2017 TO MARCH 2018 (TABLE 5 A TO 5O)

As per the information and explanation given to us and on the basis of our examination of records of the taxpayer.

In absence of State wise trial balances, we have relied on the reconciliation statement provided by the management of statewise turnover and of the returns filed under Sales Tax/ Service Tax/ Excise/GST as the case may be Turnover as declared in table 5A includes other income for the period from April 2017 to March 2018.

- The exempt turnover of the taxpayer comprises of interest from bank and non-financial income etc. Value of exempted, nil rated, non-GST and no supply turnover has been declared in Table 7B. The turnover reported is net of credit notes, debit notes and amendments. Exempted Supplies for FY 2017-18 had not been declared in GSTR 3B filed till March 2019.

- Assessee has issued total credit notes of Rs …..in FY 2017-18. Out of Rs……Credit note of Rs ……are without impact of GST and Credit Note of Rs…..are with impact of GST. We have not got confirmation whether recipient of credit note has reduced corresponding ITC or not.

- Out of the total turnover for F.Y 2017-18, turnover of Rs.XXXX for the period April, 2017 to June, 2017 is deducted, which include other income also.Credit Notes pertaining of April 2017 to June 2017 issued from July 2017 to March 18 has been adjusted with turnover of April 2017 to June 2017 and Net figure has been reduced from table 5A.

- Unbilled revenue has not been recognized at branch level and total unbilled revenue has been considered at HO level. It does not impact GST liability as unbilled revenue has been recognized as per accounting policy of the company as mentioned in para…..of the notes of Accounts and Time of Supply has not occurred for these transactions in FY 2017-18.

- All other adjustment including unbilled revenue, Unadjusted Advances, Deemed Supply, trade discount and any other adjustment to reconcile the turnover is shown separately wherever possible or reported in table 5O as consolidated.

- Total turnover includes Reimbursements of Rs……….. This amount is not included in GSTR 3B and GSTR 9, however same is part of turnover of financials. As per confirmation from the management such reimbursements are in conformity with Rule 33 of the CGST/SGST rules and accordingly taxable value of such transactions is nil.

VII. REPORTING OF REVERSE CHARGE MECHANISM

As per the information and explanation given to us and on the basis of our examination of records of the taxpayer and on the basis of test-check of the Books of Accounts, we report as below;

- Liability of RCM u/sec 9(4)/ 9(3) is Rs. ____ and out of it Rs. ___ has been paid in the year 2018-19. The amount paid in 2018-19 is not shown in GSTR-9C based on the clarification issued by CBIC vide circular dated 3rd July 2019. Accordingly, ITC has been claimed on payment basis in the year of payment by the taxpayer

- We have relied on management representation for unregistered status of the taxpayers.

- The taxpayer has not maintained complete record of inward supplies on which RCM is applicable u/sec 9(3) / 9(4). Thus, we are unable to comment on the liability of the taxpayer under reverse charge for the year 2017-18.

- Subject to above, on the basis of information provided and test-check basis, we have reported liability of inward supplies on which RCM is applicable u/sec 9(3) / 9(4).

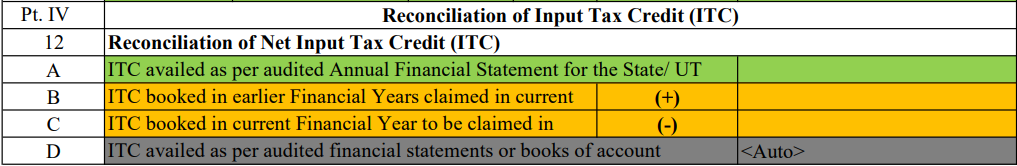

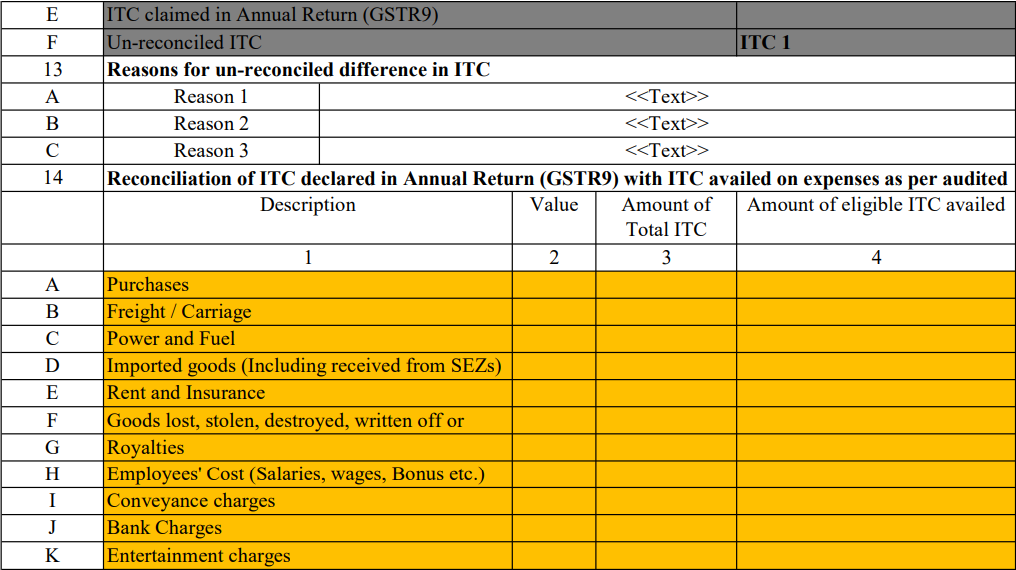

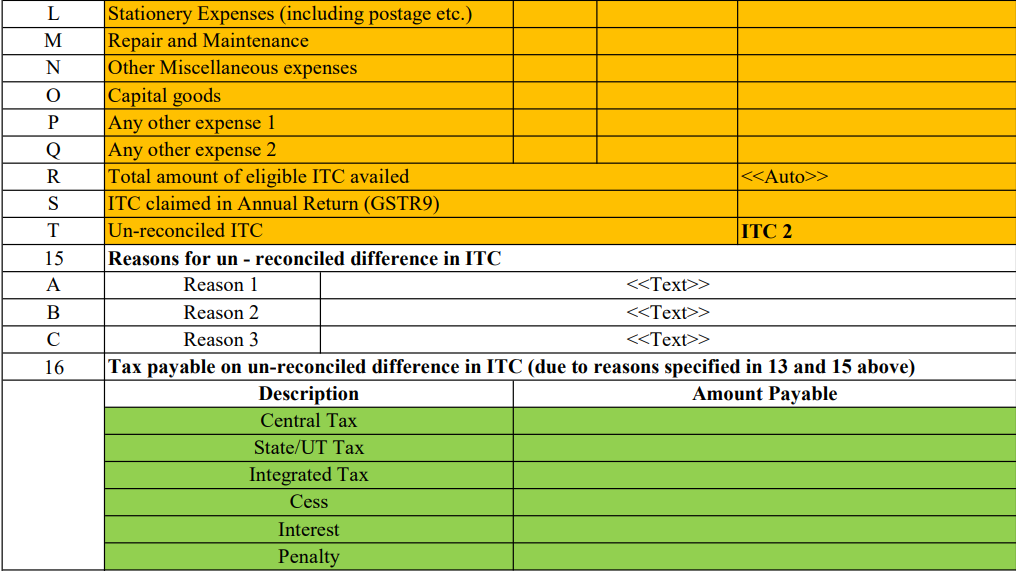

VIII. REPORT ON INPUT TAX CREDIT

As per the information and explanation given to us and on the basis of our examination of records of the taxpayer, our audit report is subject to the below disclosure in respect of ITC provisions by the taxpayer.

- we have not received expense wise breakup of ITC claimed

- For Accounting purchases other than capital goods, the taxpayer has followed Para 6 and 7 of AS-2 “ Valuation on Inventories” where “ Cost of Purchases” includes only those taxes, which are not subsequently recoverable by the enterprise form the taxing authorities.” Accordingly a separate ledger for ITC has been mentioned.

- The data available from the Books of Accounts i.e. ledgers of ITC/ ITC registers has been verified for the period to arrive at the gross ITC as per books and also reversals has been reported.

- Reconciliation has been maintained by the management to ensure that the ITC availed as per GSTR 9C reconciles and tallies with ITC of the state. Separate ITC registers are maintained state-wise and the cognizance of the same taken while reconciliation of ITC of the GSTN in the state.

- The taxpayer has followed AS-10 “Accounting of Fixed Assets”, which provides that “The Cost of an item of fixed assets comprises its purchase price, including import duties and other non- refundable taxes or levies and directly attributable cost of bringing the assets to its working condition for its intended use; any trade discounts and rebates are deducted in arriving at the purchase price

- ITC booked in FY 2017-18 in the books but was disallowed in the returns for FY 2017-18 on account of Reversal of Rule 37, but the same was availed in the returns filed during the FY 2018-19 upto March 2019, these reversals have also been reduced in clause 12C.

- ITC of goods in transit as on 31st March 2018, of Rs. XXXXX was not availed in books of account as basic condition for claiming ITC was not met.

Further, the management is of the opinion that no liability of ITC reversal/ excess claim arises due to difference in information of ITC as per GSTR-2A and GSTR-9C.

IX. RATEWISE TAX LIABLITY ON OUTWARD SUPPLY

GST rate wise details of taxable value for outward supply are disclosed in Table 9. The auditor has relied on information as provided by management /the basis of books of Account. Auditor has reconciled only rate as per books of account and rates declared in GST returns. We have not verified the accuracy and correctness of classification in books of account as same has also been suggested vide para h of the press release dated 3rd July 2019.

X. REPORT ON VALUATION OF SUPPLIES TO RELATED PARTIES

Section 7(1)(c) of the CGST Act provides that the activities specified in Schedule I is to be treated as a supply, even if, it is made without consideration. We have been represented by the management that the said transactions viz, supplies to related parties or supplies between distinct entities / distinct persons are valued as per valuation rules.

Transactions with respect to CXO and other services had not been identified by the entity in FY 2017-18. These transactions have been identified and recognized in Year 2018-19 and accordingly tax has been paid on these transactions in FY 2018-19.

XI. INTEREST AND PENALTY

The details of total tax payable for the period July, 2017 to March, 2018 as declared in GSTR 9 i.e. under the Annual Return is disclosed. Also, the disclosure of interest is made based on the working provided by the management which is calculated on net liability basis. It is subject to interpretation as per Sec 50 of CGST Act.

We have relied on the same and interest on gross basis is not quantified by the management. As per the opinion of management interest is paid according to net liability is prudent interpretation of Sec 50 of CGST Act based on amendment proposed in Sec 50 in Union Budget,2019

As per the information available and based on the management representation, no penalty notices are received from the Tax Authorities.

XII. TRANSITIONAL CREDIT

As per the information and explanation given to us and on the basis of our examination of records of the taxpayer, we have verified the claims made in trans 1 and trans 2 from the books of accounts visa-vis the conditions laid down under law for the claim of the same.

Also the same has been verified online from the system to ascertain that the claim made in the books have been registered on the site for its availment.

Credit against education Cess/KKC/SBC has been initially taken but later on reversed in GSTR 3B for the month of …….

XIII. MANAGEMNET REPRESENTATION LETTER

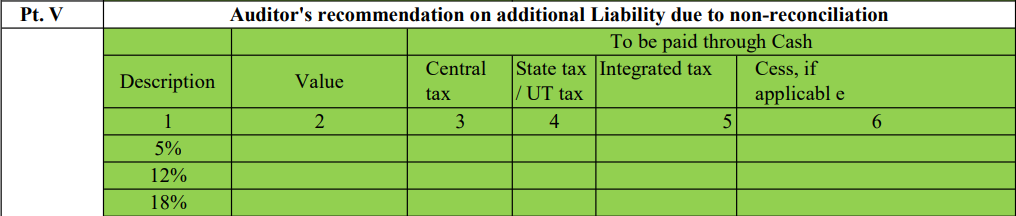

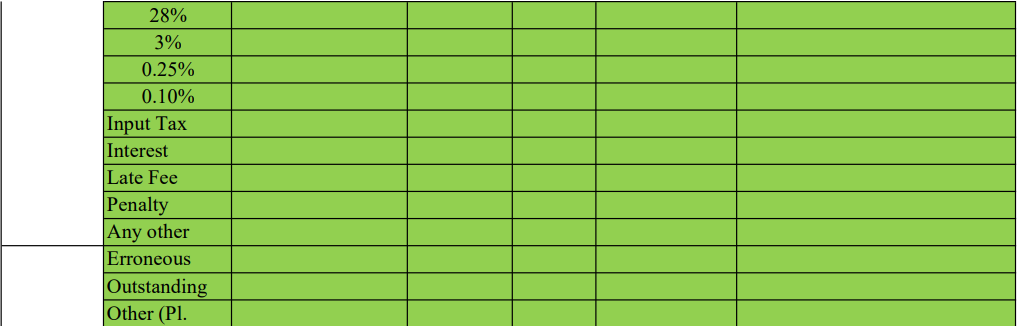

XIV. RECOMMENDED ADDITIONAL LIABLITIY

We have recommended in Part V of the GSTR 9C, the additional tax Liability to be paid by the Registered Person due to the reasons mentioned therein. Rs. ____ tax/interest is paid on ___ via DRC-03.

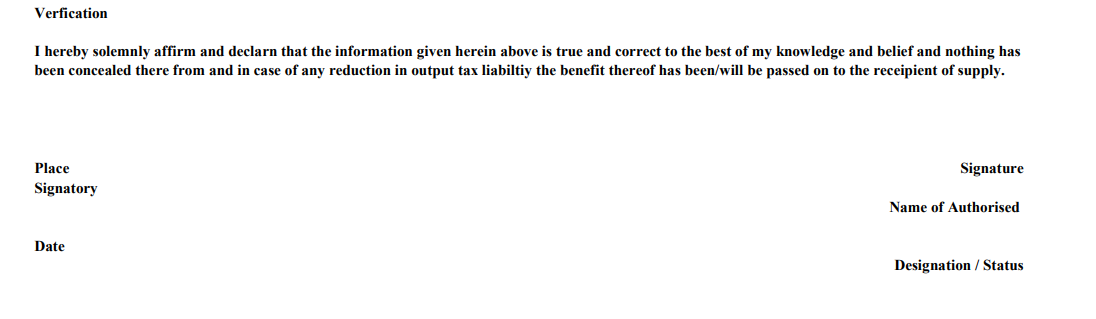

For, XYZ & Co.

Chartered Accountants

(Name of Partner)

FRN No.

UDIN No.

Date

Place:

Download the full pdf on GSTR 9 & 9C with FEW SAMPLE DISCLOSURES, below:

Ashu Dalmia

Ashu Dalmia

New Delhi, India

Ashu Dalmia is Managing Partner of the firm AAP and Co., having office in Connaught Place Delhi. He is rank holder in CA Inter and also at graduation level from Lucknow university. He is has been working extensively in GST training, Consultancy and litigation in India and also handled VAT implementation projects for mid and large corporates in Saudi Arabia. He was special Invitee to Indirect Tax Committee of ICAI for year 2018-19. He is faculty in ICAI to train professionals for GST in India and VAT for UAE. He has authored books on GST: “GST A Practical Approach” published by Taxman, “Audit and Annual Return in GST” published by Wolters Kluwer-CCH GST Referencer and Manual published by LMP. He has taken more than 300 workshops and trainings on various forums: like ICAI, ASSOCHAM, CII, PHD Chamber of commerce, trade associations in India, UAE and KSA.