IGST Set off : Do not fall prey to default set off in portal

New Functionality for IGST set off wef 11-06-2019

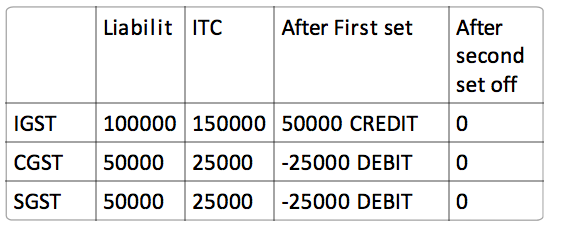

As per pronouncement made by GSTN, the manner of utilization of ITC as per Rule 88A which was suspended vide Circular No. 98 dated 23-04-2019 till the the new functionality is put into operation been operationalized wef 11-06-2019. Old System for Set off Every respective head of credit balance was being set off against its own liability , there by providing opportunity of utilization of ITC for all IGST, CGST and SGST.

Illustration:

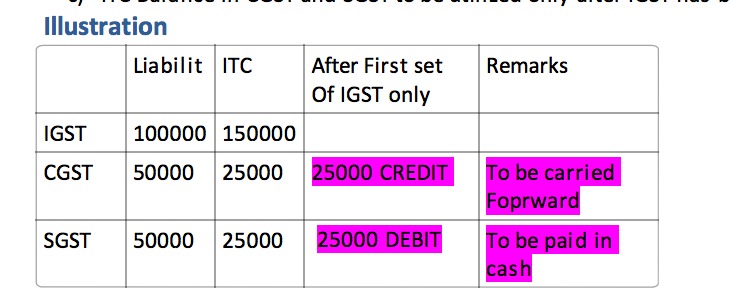

Default set off installed in the portal a) First Utilize IGST ITC against IGST liability Then utilize remaining IGST ITC against CGST or SGST in any order i.e. either of CGST or SGST can be set off b) c) ITC Balance in CGST and SGST to be utilized only after IGST has been fully utilization

The default set off installed as per new functionality considers the above proposition only.

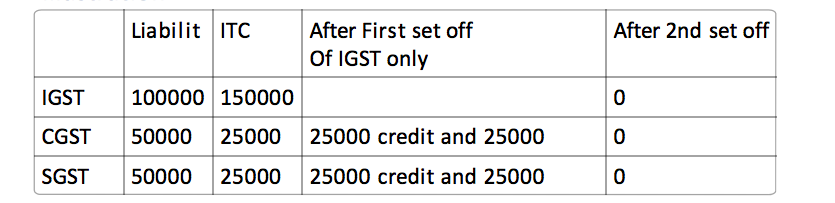

Set off as per Circular 98 dated 23-04-2019 As per Circular IGST credit can be set off in any order and also in any proportion. It means excess credit need to be set off 100% first against CGST / SGST and then proceed set off SGST/CGST, as fed in the portal. The portal allows manual alteration. This proportion can be of choice of the taxpayer. It can be 50:50, 60:40, 70:30 or any other of his choice.

Illustration

Here excess IGST credit Rs. 50000 has been set off in proportion of 50:50 towards CGST and SGST liability instead of setting off 100% of Rs. 50000 excess credit in IGST against CGST only. Thus old situation where no tax was payable gets restored. Conclusion: Hence one should not fall prey to the automatic set off provided in the portal which needs to be manually changed. It is the duty of every citizen to pay legitimate tax but at the same time it is his not to pay taxes which are not due.

Related Topic:

Facing Block Credit Under GST Rule 86A & Notices for GSTR 2A & 3B Mismatch

IGST set off need your review. It is advisable to make a proper set off.

CA Vinamar Gupta

CA Vinamar Gupta

Amritsar, India