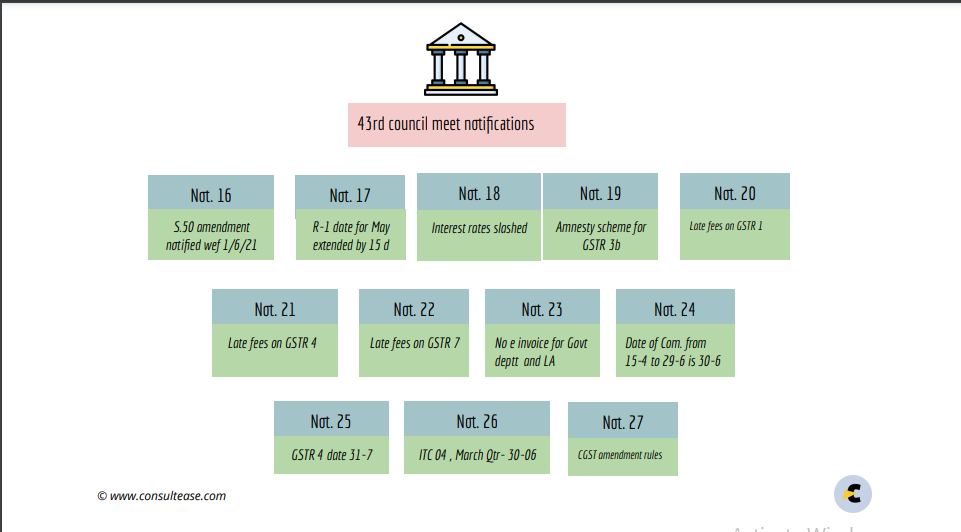

Important changes in GST Return, Interest and Rules

Not. 16/2021

Provisions of Section 112 of FA 2021 is notified applicable from 1st July 2017

112. In section 50 of the Central Goods and Services Tax Act, in sub-section (1), for the proviso, the following proviso shall be substituted and shall be deemed to have been substituted with effect from the 1st day of July 2017, namely:––

“Provided that the interest on tax payable in respect of supplies made during a tax period and declared in the return for the said period furnished after the due date in accordance with the provisions of section 39, except where such return is furnished after commencement of any proceedings under section 73 or section 74 in respect of the said period, shall be payable on that portion of the tax which is paid by debiting the electronic cash ledger.”.

Impact- There was ambiguity in the language in the proviso. Now it is replaced with the new one. Interest is applicable on the net amount of tax payable via cash ledger. In the original section, it was applicable on gross. It is amended retrospectively from 1st July 2017.

Not. 17/2021

The due date for GSTR 1 of May 21 by 15 days

Not. 18/2021

Monthly return filers

| Taxpayers having an aggregate turnover of more than rupees 5 crores in the preceding financial year | 9 percent for the first 15 days from the due date and 18 percent thereafter | March 2021, April 2021, and May 2021 |

| Taxpayers having an aggregate turnover of up to rupees 5 crores in the preceding financial year who are liable to furnish the return as specified under subsection (1) of section 39 | Nil for the first 15 days from the due date, 9 percent for the next 45 days, and 18 percent thereafter | March 2021 |

| Nil for the first 15 days from the due date, 9 percent for the next 30 days, and 18 percent thereafter | April 2021 | |

| Nil for the first 15 days from the due date, 9 percent for the next 15 days, and 18 percent thereafter | May 2021 |

Quarterly return filers

| Taxpayers having an aggregate turnover of up to rupees 5 crores in the preceding financial year who are liable to furnish the return as specified under Proviso to subsection (1) of section 39 | Nil for the first 15 days from the due date, 9 percent for the next 45 days, and 18 percent thereafter | March 2021 |

| Nil for the first 15 days from the due date, 9 percent for the next 30 days, and 18 percent thereafter | April 2021 | |

| Nil for the first 15 days from the due date, 9 percent for the next 15 days, and 18 percent thereafter | May 2021 |

Interest for delay in Composition return

| Nil for the first 15 days from the due date, 9 per cent for the next 45 days, and 18 per cent thereafter | Quarter ending March, 2021”. |

Read & Download the full Copy in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.