Input Tax Credit on Medical Insurance

Table of Contents

INPUT TAX CREDIT ON MEDICAL INSURANCE

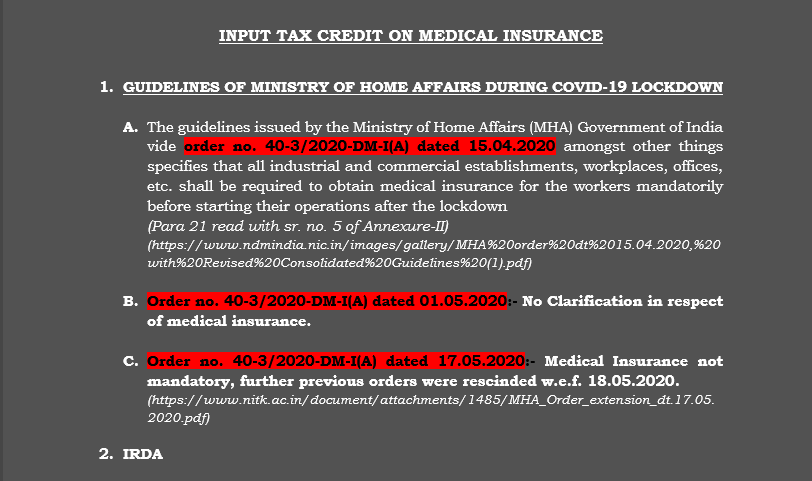

1. GUIDELINES OF MINISTRY OF HOME AFFAIRS DURING COVID-19 LOCKDOWN

A. The guidelines issued by the Ministry of Home Affairs (MHA) Government of India vide order no. 40-3/2020-DM-I(A) dated 15.04.2020 amongst other things specifies that all industrial and commercial establishments, workplaces, offices, etc. shall be required to obtain medical insurance for the workers mandatorily before starting their operations after the lockdown (Para 21 read with sr. no. 5 of Annexure-II)

B. Order no. 40-3/2020-DM-I(A) dated 01.05.2020:- No Clarification in respect of medical insurance.

C. Order no. 40-3/2020-DM-I(A) dated 17.05.2020:- Medical Insurance not mandatory, further previous orders were rescinded w.e.f. 18.05.2020.

2. IRDA

Inline, IRDAI has issued instructions to all health insurance companies vide their letter no. Ref: IRDAI/HLT/CIR/MISC/093/04/2020 dated April 16, 2020 (“Letter”) whereby it has been said that all General and Health Insurance companies may offer comprehensive health insurance policies either to individuals or groups in order to enable the listed organizations/employers/establishments comply with the above-referred directions. It is further instructed to the insurance companies that all General and Health Insurance companies may offer comprehensive health insurance policies either to individuals or groups in order to enable the listed organizations/employers/establishments to comply with the above-referred directions.

3. GST LAW

As per Section 17(5)(b)(i) of CGST Act 2017 read with the proviso, which provides that:-

• ITC for health insurance shall not be eligible unless the same is obligatory for an employer to provide the same to its employees under any law for the time being in force.

• The term “health insurance” has not been defined in the GST laws.

• Such term “health insurance business” has been defined in Section 2(6C) of the Insurance Act, 1938 as,

“Health insurance business” means the effecting of contracts which provide for sickness benefits or medical, surgical or hospital expense benefits, whether inpatient or out-patient travel cover and personal accident cover;’ Therefore it would imply that medical insurance would be part of the health insurance and hence ITC would be permitted only if obtaining such medical insurance is mandatory.

4. AUTHORITY OF LAW; DISASTER MANAGEMENT ACT 2005 IS HAVING OVERRIDING EFFECT

A. In the given situation the guidelines of MHA issued under the powers conferred under Section 10(2)(l) of the Disaster Management Act, 2005 would be considered as law.

B. As per Section 72 in the Disaster Management Act, 2005:-

72. Act to have overriding effect.—The provisions of this Act shall have the effect, notwithstanding anything inconsistent therewith contained in any other law for the time being in force or in any instrument having effect by virtue of any law other than this Act. —The provisions of this Act shall have the effect, notwithstanding anything inconsistent therewith contained in any other law for the time being in force or in any instrument having effect by virtue of any law other than this Act.”

VIEW

1. Though many clarifications are yet to be given by the government on various issues but on a bare perusal of the above-said provisions, in my view, Input tax credit in respect of Medical Insurance shall be available if it is taken between 15.04.2020 and 18.05.2020.

2. Also, ITC for the individual policy taken for the family members of the employees would not be available as obtaining such coverage of family members is not mandatory under law.

Read the copy: