What is ITC 2A and how to file it?

Table of Contents

New form ITC 2A:

ITC 2A is the form to transfer the ITC in GST. IN case of transfer of business from one entity to another entity. The ITC of the transferor can be transferred to the transferee.

Example-

M/s Tata Sons acquired the Sontel India. In this case, the ITC of Sontel can be transferred to Tata Sons.

M/s Vodafone and Idea are merged to make the Vodaidea. In this case, the ITC of both Vodafone and Idea can be transferred to Vodaidea.

The new form is updated on the GST portal. The name of this form is ITC 2A. It is a form to shift ITC from one registration to another in the same state. Section 25(2) of the CGST Act provides this facility. Now a person can take separate registrations for the various places of business in one state.

“Provided that a person having multiple places of business in a State or Union territory may be granted a separate registration for each such place of business, subject to such conditions as may be prescribed.”

This transfer can be only for registrations within the same state. You cant shift the ITC of one state to the entity registered in other states. Rule 41A in CGST rules in inserted to enable this transfer. Also, only the unutilized portion of ITC can be transferred under this option.

Related Topic:

The journey of ITC From July-2017 to Jan-2021…and onwards

Is it mandatory for all?

No, It is not a mandatory form. It is a specific purpose form. As per GST provisions, a person can take the registration of various places of business in one state. Now when I am taking the registration of a new place of business I need to shift ITC there. The return for that place is separate. The supply from that place is separate. Thus the ITC relevant for the supply from that place is transferred to that registration.

What amount can be transferred as ITC via ITC 2A?

The amount of ITC that can be transferred via ITC 2A shall be in the proportion of assets. The assets held by the newly registered entity. Here the assets mean, not only the one bearing ITC but all assets. The proviso to rule 41A provide for this.

Provided that the input tax credit shall be transferred to the newly registered entities in the ratio of the value of assets held by them at the time of registration.

Explanation.- For the purposes of this sub-rule, it is hereby clarified that the “value of assets‘ means the value of the entire assets of the business whether or not input tax credit has been availed thereon.

Related Topic:

Allowability of ITC on GST paid on group medical insurance, health or medical insurance cover for all categories of employees

How to file ITC 2A on the GSTN portal?

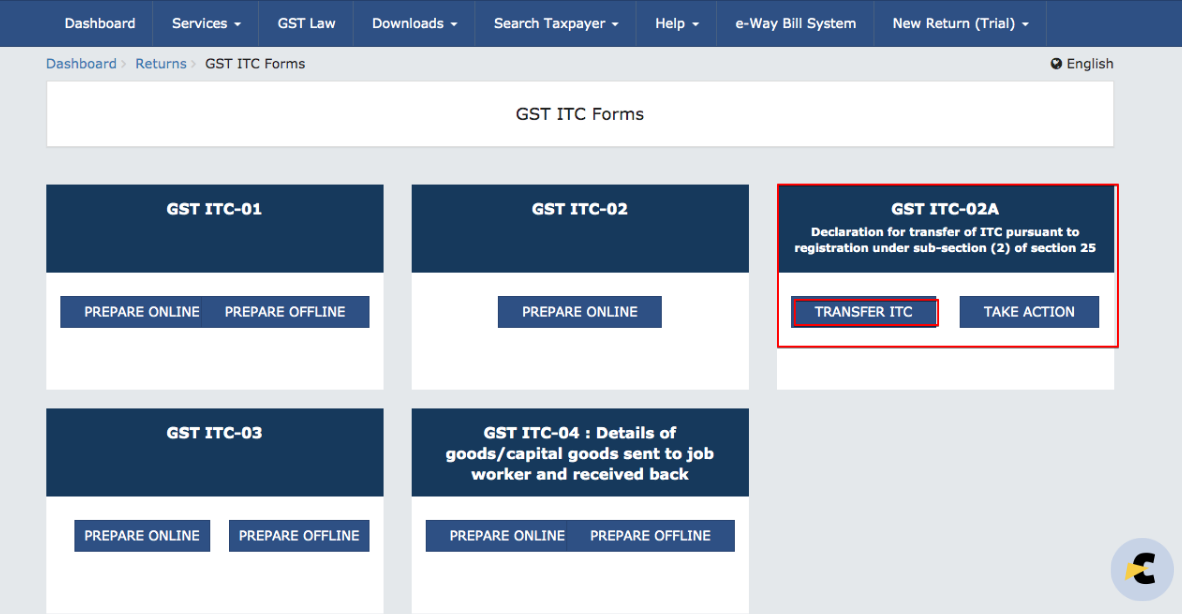

Login at your GSTN dashboard and click on ITC forms in USer services. You will see the following window.

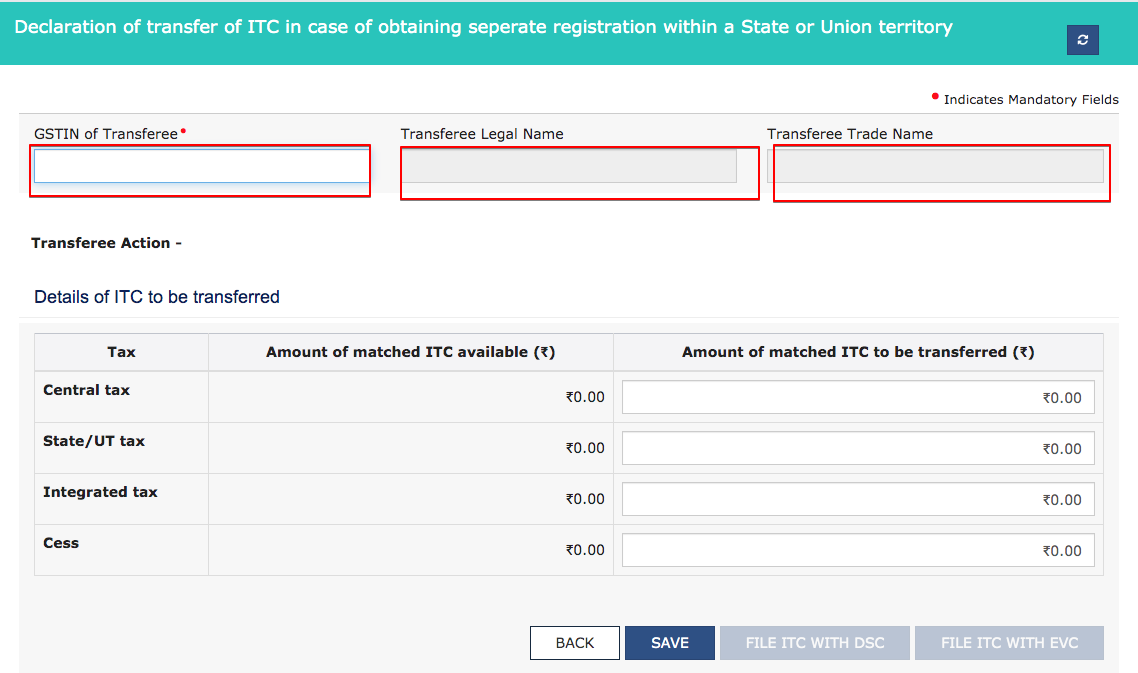

Now you need to click on transfer ITC. A new window will open.

Here you can select the transferee and move the ITC to the transferee. Here the transferee is the registration of the place of business in the same state.

Related Topic:

Can the buyer be denied the ITC on account of the fraud or malpractices committed by the supplier?

The time limit for the transfer of ITC:

The time limit for the transfer of ITC is 30 days from the date of registration. Here we will check the 30 days from registration of a new place of business. Where the ITC is transferred.

e.g. Xeon limited registered with the Head office in GST. They obtained the registration of 4 additional places of business within the same state. The registration is granted on 28th March 2020. Here they can shift the ITC till 26th April 2020.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.