The journey of ITC From July-2017 to Jan-2021…and onwards

Table of Contents

- The journey of ITC From July-2017 to Jan-2021…and onwards

- from July 2017 to Sept 2019…………..NO RESTRICTION ON ITC ( well almost)

- from Sept2019 to March 2021…..Putting restriction on ITC at 105% of Invoices in 2B

- from April 2021….. Putting Strict restrictions…Claim only equal to Invoices which Counter party uploads

- SECTION 16. Eligibility and conditions for taking the input tax credit

- Rule 36. Documentary requirements and conditions for claiming the input tax credit.

The journey of ITC From July-2017 to Jan-2021…and onwards

Analyzing ITC Restricting provisions i.e Rule 36(4), Section 16(2), Section 16(2)(aa) proposed and Implications on GSTR 3B & GSTR 9

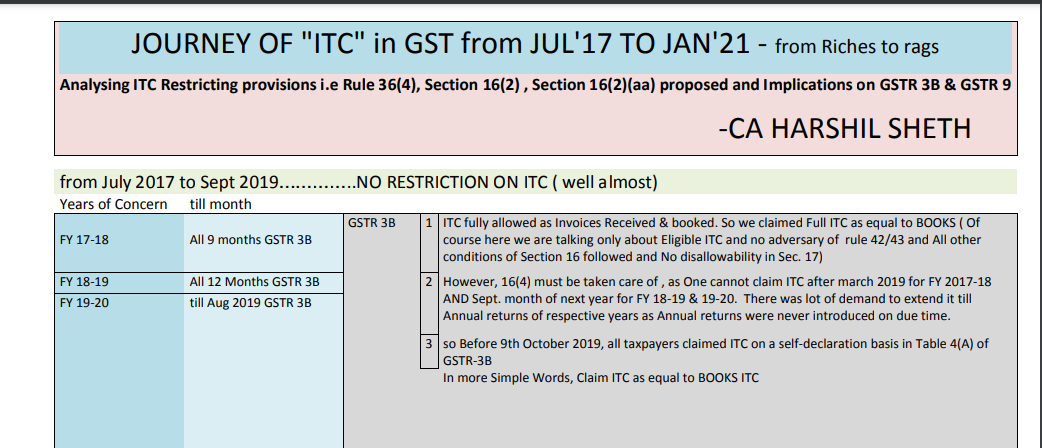

from July 2017 to Sept 2019…………..NO RESTRICTION ON ITC ( well almost)

| Years of Concern | till month | ||||||||||||

| GSTR 3B | 1 | ITC fully allowed as Invoices Received & booked. So we claimed Full ITC as equal to BOOKS ( Of course here we are talking only about Eligible ITC and no adversary of rule 42/43 and All other conditions of Section 16 followed and No disallowability in Sec. 17) | |||||||||||

| FY 17-18 | All 9 months GSTR 3B | ||||||||||||

| FY 18-19 | All 12 Months GSTR 3B | 2 | However, 16(4) must be taken care of , as One cannot claim ITC after march 2019 for FY 2017-18 AND Sept. month of next year for FY 18-19 & 19-20. There was lot of demand to extend it till Annual returns of respective years as Annual returns were never introduced on due time. | ||||||||||

| FY 19-20 | till Aug 2019 GSTR 3B | ||||||||||||

| 3 | so Before 9th October 2019, all taxpayers claimed ITC on a self-declaration basis in Table 4(A) of GSTR-3B | ||||||||||||

| In more Simple Words, Claim ITC as equal to BOOKS ITC

|

|||||||||||||

| GSTR 9 | We used to make Reconciliation about ITC reflected and Not reflected in 2A |

||||||||||||

| But There was no need for PAYMENT OF EXCESS CLAIMED ITC which was not reflected in GSTR 2A | |||||||||||||

from Sept2019 to March 2021…..Putting restriction on ITC at 105% of Invoices in 2B

| Years of Concern | till month | ||||||||||||

| FY 19-20 | from Sept 2019 GSTR 3B | GSTR 3B | 1 | on 9th October 2019, Rule 36(4) implemented.

|

|||||||||

| FY 20-21 | All 12 Months GSTR 3B | 2 | After the implementation of this rule, the ITC amount is restricted only to the extent of 105% of the eligible ITC value reflected in the GSTR-2B for that period ( Circular 123/2019) | ||||||||||

| 3 | Also, 16(4) must be taken care of, as One cannot claim ITC after Sept of next year.

|

||||||||||||

| 4 | With Rule 36(4), If there only Time differences then Interest will be levied.. ( For e.g. You claim in Oct-20 GSTR 3B for an invoice from a Quarterly dealer. Counterparty Uploaded in DEC GSTR 1, So Department will ask Interest for 2 months. (of course, From January-2021, the GSTN portal has brought IFF for Quarterly dealer, So this kind of problems will not arise much) | ||||||||||||

| 5 | And If the Counterparty has not uploaded at all, Then I fear that above 105 %, One should reverse ITC with Interest in GSTR 3B only | ||||||||||||

| In more Simple Words, Claim ITC is equal to 105% of GSTR 2B … If excess claimed then reverse with Interest | |||||||||||||

| GSTR 9 | We STILL make Reconciliation about ITC reflected and Not reflected in 2A

|

||||||||||||

| Ideally, If one has followed R.36(4) from Sept-19 GSTR 3B, then The Difference in Table 8 will not be there more than 5% | |||||||||||||

| If it is still there, Pay at the time of the Annual return with Interest. This is an interpretation of Law prevailing at that time

|

|||||||||||||

from April 2021….. Putting Strict restrictions…Claim only equal to Invoices which Counter party uploads

| FY 21-22 | From April 2021 Onwards | GSTR 3B | 1 | In addition to Rule 36(4) existing, in budget 2021, Govt. has added Section 16(2)(aa) in Budget 2021. “CLAIM ITC ONLY IF COUNTERPARTY HAS UPLOADED” (one should dissect this only when Notified) Putting end to 36(4) now you can’t even claim 5% higher |

|||||||||

| 2 | So if you have claimed ITC which is not reflected in your GSTR 2A/2B, You must reverse with Interest in 3B | ||||||||||||

| 3 | This Puts end to 36(4), now you can’t even claim 5% higher. ” ACT” itself amended which is over & above Rule | ||||||||||||

| 4 | Also, 16(4) must be taken care of, as One cannot claim ITC after Sept of next year | ||||||||||||

| In more Simple Words, Claim ITC as equal to Appear in 2B … If excess claimed then reverse with Interest | |||||||||||||

| GSTR 9 | We STILL make Reconciliation about ITC reflected and Not reflected in 2A

|

||||||||||||

| Now, Table 8 difference in GSTR 9 will be payable at the time of filing GSTR 9. Because it will convey that You have excess claimed than ITC appearing in 2A.

|

|||||||||||||

| So if you have not reversed at the time of GSTR 3B, Then reverse at time of Annual return with Interest | |||||||||||||

SECTION 16. Eligibility and conditions for taking the input tax credit

16(1) Every registered person shall, subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49, be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business and the said amount shall be credited to the electronic credit ledger of such person.

16(2) Notwithstanding anything contained in this section, no registered person shall be entitled to the credit of any input tax in respect of any supply of goods or services or both to him unless, –

16(2)(a) he is in possession of a tax invoice or debit note issued by a supplier registered under this Act, or such other tax paying documents as may be prescribed;

16(2) (aa) A new clause (aa) to sub-section (2) of section 16 of the CGST Act is sought to be inserted to provide that input tax credit on invoice or debit note may be availed only when the details of such invoice or debit note have been furnished by the supplier in the statement of outward supplies and such details have been communicated to the recipient of such invoice or debit note.

Brief remarks – The conditions for determining the eligibility of input tax credit u/s 16(2) of the CGST Act, 2017 does not include the requirement of furnishing the details of the invoice by the vendors and the consequent communication to the recipient. Now it has been proposed to add a new clause providing for such requirement to determine the eligibility of input tax credits.

16(2) (b) he has received the goods or services or both

[Explanation—For the purposes of this clause, it shall be deemed that the registered person has received the goods or, as the case may be, services––

(i) where the goods are delivered by the supplier to a recipient or any other person on the direction of such registered person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to goods or otherwise;

(ii) where the services are provided by the supplier to any person on the direction of and on account of such registered person]

16(2) (c) subject to the provisions of 2[section 41 or section 43A], the tax charged in respect of such supply has been actually paid to the Government, either in cash or through the utilization of input tax credit admissible in respect of the said supply; and

16(2) (d) he has furnished the return under section 39:

Provided that where the goods against an invoice are received in lots or installments, the registered person shall be entitled to take credit upon receipt of the last lot or installment:

Provided further that where a recipient fails to pay to the supplier of goods or services or both, other than the supplies on which tax is payable on a reverse charge basis, the amount towards the value of supply along with tax payable thereon within a period of one hundred and eighty days from the date of issue of invoice by the supplier, an amount equal to the input tax credit availed by the recipient shall be added to his output tax liability, along with interest thereon, in such manner as may be prescribed: Provided also that the recipient shall be entitled to avail of the credit of input tax on payment made by him of the amount towards the value of supply of goods or services or both along with tax payable thereon.

Related Topic:

Input Tax Credit under Section 16 (2) – The Etymology of Double/Triple Jeopardy (???)

16(3) Where the registered person has claimed depreciation on the tax component of the cost of capital goods and plant and machinery under the provisions of the Income Tax Act, 1961, the input tax credit on the said tax component shall not be allowed.

16(4) A registered person shall not be entitled to take the input tax credit in respect of any invoice or debit note for the supply of goods or services or both after the due date of furnishing of the return under section 39 for the month of September following the end of the financial year to which such invoice or 3[invoice relating to such] debit note pertains or furnishing of the relevant annual return, whichever is earlier.

[Provided that the registered person shall be entitled to take input tax credit after the due date of furnishing of the return under section 39 for the month of September 2018 till the due date of furnishing of the return under the said section for the month of March 2019 in respect of any invoice or invoice relating to such debit note for the supply of goods or services or both made during the financial year 2017-18, the details of which have been uploaded by the supplier under sub-section (1) of section 37 till the due date for furnishing the details under sub-section (1) of said section for the month of March 2019]

Rule 36. Documentary requirements and conditions for claiming the input tax credit.

(1) The input tax credit shall be availed by a registered person, including the Input Service Distributor, on the basis of any of the following documents, namely,-

(a) an invoice issued by the supplier of goods or services or both in accordance with the provisions of section 31;

(b) an invoice issued in accordance with the provisions of clause (f) of sub-section (3) of section 31, subject to the payment of tax;

(c) a debit note issued by a supplier in accordance with the provisions of section 34;

(d) a bill of entry or any similar document prescribed under the Customs Act, 1962 or rules made thereunder for the assessment of integrated tax on imports;

(e) an Input Service Distributor invoice or Input Service Distributor credit note or any document issued by an Input Service Distributor in accordance with the provisions of sub-rule (1) of rule 54.

(2) Input tax credit shall be availed by a registered person only if all the applicable particulars as specified in the provisions of Chapter VI are contained in the said document, and the relevant information, as contained in the said document, is furnished in FORM GSTR-2 by such person:

[Provided that if the said document does not contain all the specified particulars but contains the details of the amount of tax charged, description of goods or services, the total value of supply of goods or services or both, GSTIN of the supplier and recipient and place of supply in case of inter-State supply, the input tax credit may be availed by such registered person]

(3) No input tax credit shall be availed by a registered person in respect of any tax that has been paid in pursuance of any order where any demand has been confirmed on account of any fraud, willful misstatement, or suppression of facts.

(4) [Input tax credit to be availed by a registered person in respect of invoices or debit notes, the details of which have not been uploaded by the suppliers under subsection (1) of section 37, shall not exceed 5 percent]. of the eligible credit available in respect of invoices or debit notes the details of which have been uploaded by the suppliers under sub-section (1) of section 37]

To summarise – Initially, in the Return filling system, It was GSTR 1/1A for Outward GSTR 2/2A was for Inward..GSTR 2 was never a practical solution. Because it required a huge time to accept reject edit… Also technically GSTN failed to deliver the GSTR 2 module… It was a flop mechanism Then more emphasis on GSTR 2A. GSTR 2A is only a viewable document, showing inward supplies… It’s daily-updated… As and when Suppliers upload his GSTR 1…Again No much contribution to the Monthly return filling system… At year-end, It helps to do Reconcile your BOOKS ITC. Then came Rule 36(4) with a view to restricting ITC from Oct 9th, 2019. R. 36(4) came with restrictions to take only 5% excess ITC of what is visible as on the 11th date in GSTR 2A… Another impossible & impractical idea… Because It doesn’t address the basic question that What abt those who filed the return late.?? Or What abt ITC of Quarterly dealers?. Also, to make things more confusing, GSTR 2B was brought. Again a Readable Form showing all ITC up to 11th. It is 2A only. But a static one. It will show ITC from those recipients who uploaded GSTR 1 from 1 to 11th. It won’t change. Those who file after the 11th date, Those ITC will reflect in next month .. Again It doesn’t address the basic question that What about the ITC of Quarterly dealers? So They brought IFF for quarterly dealers Now, It is proposed in Budget-2021 By the addition of Section 16(2)(aa). “Claim only ITC what is visible in GSTR 2B”. The main question still remains unanswered. “What about seamless ITC?” “ Why depend on counterparty upload ( that too before due date) for an eligible claim of my ITC when I have paid amount with Tax to counterparty”

This is an interpretation of Law prevailing at that time. Any suggestion/query feel free to convey on my number 9879831157 or email id ca.harshilsheth@gmail.com. If any mistake in this article then also, please let me know.