Late Fee Calculator For filing GSTR-3B free download

Late Fee Calculator For filing GSTR-3B free download

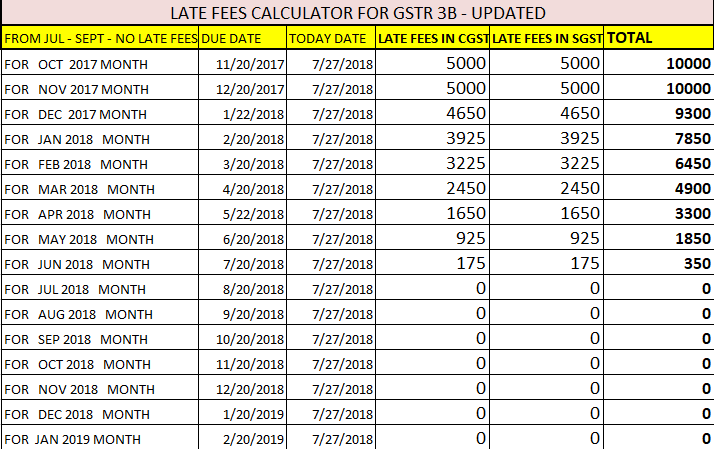

The problem arises when the taxpayer forgets to file the GST returns on time. In the beginning, the Government has given a lot of extension in the due dates for filing the returns. But, From May 2018 and forward the due date for filing the return have returned in its normal state without many extensions. The problem is how much should be the late fees on the return. How much Money we have to submit at the time of filing the return. CA Harshil Seth has brought you the cure for such a problem for calculating the late fees on the returns. The cure is Late Fee Calculator For filing GSTR-3B.

The excel sheet is created so that the taxpayer can calculate the late fees to be submitted by the taxpayer and how much liability he has. There are two major factors, which can affect the calculation so much. One is whether the return is to be filed nill or is there any transaction. The second one is the date of filing.

The maximum limit of the late fee is 10,000(CGST-5,000 and SGST-5,000).

Click the image to download the Late Fee Calculator For filing GSTR-3B: