10 common mistakes while filing GST returns

Table of Contents

- How the mistakes while filing GST returns can impact your business?

- The most common mistake while filing GST returns: Wrong GSTN or invoice number

- Showing Zero-rated turnover in exempted or domestic turnover

- Interstate supply entered in intrastate supply

- Not showing exempted receipts in exempted supply

- Entering No supply into the exempted supply

- Reversal of ITC for exempted supplies

- Wrong adjustment of input tax credit

- Entering the B2B supply in B2C supply

How the mistakes while filing GST returns can impact your business?

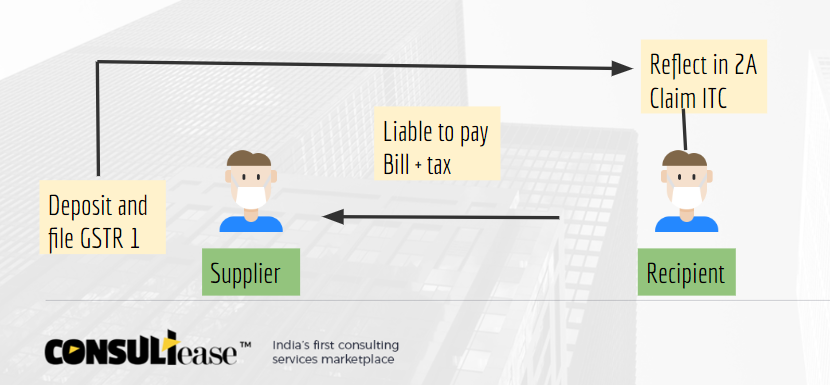

Yes, they can definitely harm your business. How? a very small example: You started a business but skipped to file GSTR 1. ITC is not visible in the 2A of your buyer. They will stop buying from you. Also if it is a part of the agreement. They can sue you to recover the tax amount they paid with interest. These types of mistakes while filing GST returns can result in cash loss and in some cases closure of the business.

A list of these types of mistakes will save your business from huge consequences.

This is the normal correlation between the filing of return and the claim of ITC by the buyer.

The most common mistake while filing GST returns: Wrong GSTN or invoice number

There is a matching mechanism on the GST portal. Data entered in GSTR 1 is auto-populated in GSTR 2A of the recipient. He can take the input tax credit of the bills only if it is reflected in GSTR 2A. But if you quote the wrong invoice or GSTIN. It will not be properly reflected. Even if it reflects, it won’t match with the invoice number. This can cause problems for the buyer. Take care to fill the details of the invoice properly. Special care in entering the GSTN number of recipients.

Showing Zero-rated turnover in exempted or domestic turnover

Exporters file their returns to get a refund. They have two types of refunds. First is a refund of tax paid at the time of export. The second one is a refund of the input tax credit on purchases. A formula to calculate it is given in rule 89 of CGST Rules. But if you fill it at the wrong place your refunds will never proceed.

The reason is that data is pushed to ICEGATE from GST returns. In case of wrong entry of data into the return, it is not pushed by the portal. The worst part is there is no manual process to inform the department. Also, the return under the form GSTR 3b cant is amended.

The export or zero-rated supply should be entered in Table 3.1.b of GSTR 3b. In GSTR 1 also it should be entered in a relevant table. Export invoices are required to be entered in a separate table in GSTR 1.

Related Topic:

Last opportunity to rectify the GST errors of FY 2017-18

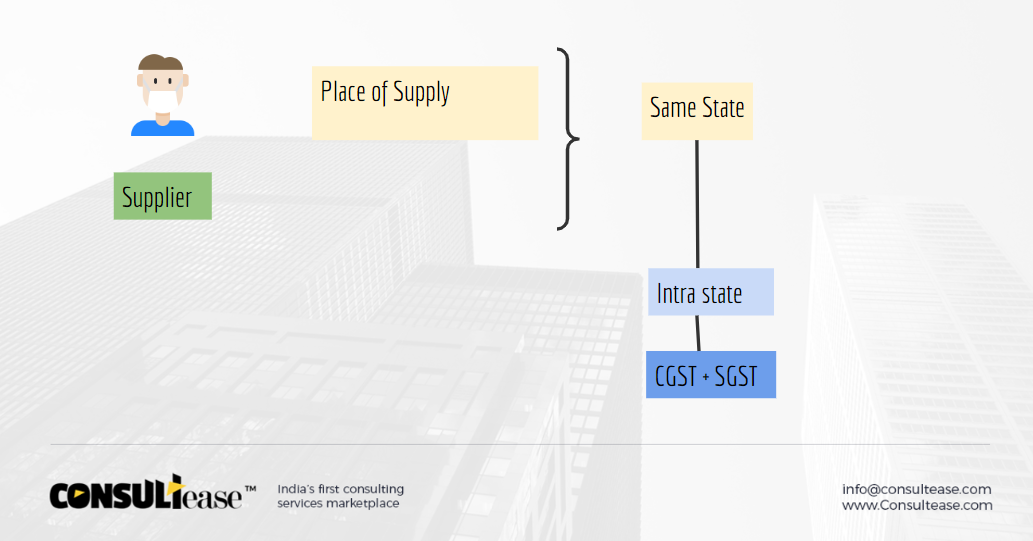

Interstate supply entered in intrastate supply

We levy CGST SGST on intrastate supply and IGST on the interstate. What are the criteria to decide the nature of supply?

When both suppliers and places of supply are in the same state. This is an intrastate supply. You can see the place of supply provisions in the IGST Act.

Intrastate supply is just the opposite of inter-state supply.

Once this amount is entered in return. It is very difficult to amend it. You need to adjust your incoming returns. But if you don’t have other kinds of supply. It is almost impossible to adjust it.

Not showing exempted receipts in exempted supply

GST law provides for the reversal of input tax credit for exempted supply. Here are some examples of common exempted supplies.

- Interest on FDR and savings

- Rent from Residential property

Entering No supply into the exempted supply

We need to understand the difference between a no supply and an exempted supply. Everything other than no supply is either a taxable supply or an exempted supply. What is no supply? A transaction not covered by the definition of supply is a no supply. Also, items covered by schedule III of the CGST Act are also no supply.

We don’t need to report this any supply anywhere. We need to report the exempted supply. e.g. Amount received as a pure agent is no supply. But some people fill it in exempted supply. Anything filled in exempted supply may also fall for reversal u/s 17(2).

Reversal of ITC for exempted supplies

ITC related to exempted supply is disallowed in GST. It may be directly correlated to exempted supply or a common ITC. In the case of directly correlated ITC, you shouldn’t take this. How we take ITC? By writing it in GSTR 3b. We should not avail ITC related to exempted supply.

Then if it is a common credit we need to allocate it to taxable and exempted. Then we need to disallow the exempted by reversing it from availed ITC. Following is the formula as per rule 42.

Common input tax credit* Exempted turnover/ Total turnover

This amount shall be reduced from availed ITC. This calculation is monthly. It is only for ITC on Inputs & Input services. In case of capital goods, the formula is slightly different.

This is one of the common mistakes while filing GST returns. Later on, it may be demanded by the department with interest.

Related Topic:

GST Returns Due Dates for GTSR 1 and GSTR 3b

Wrong adjustment of input tax credit

This is one of the common mistakes while filing GST returns. There is a mechanism to adjust the input tax credit.

First of all, IGST shall be exhausted. Then CGST & SGST shall be utilized. Although IGST can be adjusted from any of these three. But CGST & SGST can be adjusted with their own payable only.

E.g.1

Mr. A Has IGST of 10 lac, CGST of 5 lac & SGST of 5 Lac.

First of all, IGST will be exhausted only then CGST or SGST can be utilized.

E.g. 2:

CGST ITC : Rs. 2 Lac

SGST ITC : Rs.1 lac

Liability:

Payable of CGST: Rs. 1.5 Lac

Payable of SGST : Rs. 1.5 lac.

Now the balance of CGST of Rs. 50000 after adjustment of CGST payable cant be adjusted with SGST liability. SGST will be paid by cash ledger. After the adjustment of ITC balance, only balance will be paid via cash.

Entering the B2B supply in B2C supply

In GSTR 1 B2B supply is reported invoice wise. Whereas B2C supply is entered consolidated. If by mistake B2B supply is added into B2C supply. There is no layout. You will have to enter the invoice of B2B in the next period. The supply in B2C supply cant is edited except once. But then ITC will not be reflecting in GSTR 2A. The buyer will not be able to take ITC of that supply. Unless you edit GSTR 1, the buyer cant take the ITC. This is the most prominent mistake amongst the mistakes while filing GST returns.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.