Monthly End to End Indirect Taxes Updates

Table of Contents

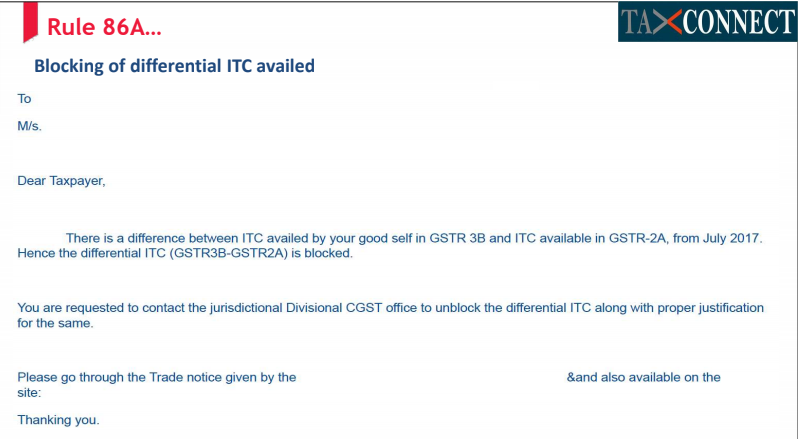

Facing Blocked ITC

CAL- MRS REALTY PRIVATE LTD & ANR. Vs UNION OF INDIA & ORS

GST – Petition challenging the constitutional validity of Rule 86A of the CGST Rules and reading down of Section 16(2)(c) of the CGST Act

HELD – Serve Notices to both Centre & State Govt.

In ‘Arise India Limited and other v. Commissioner Of Trade & Taxes, Delhi And others’ – SC held that the expression dealer or class of dealers occurring in Section 9 (2) (g) of the DVAT Act should be interpreted as not including a purchasing dealer who has bona fide entered into purchase transactions with validly registered selling dealers who have issued tax invoices and where there is no mismatch of the transactions in Annexures 2A and 2B. Unless the expression dealer or class of dealers in Section 9 (2) (g) is read down in the above manner, the entire provision would have to be held to be violative of Article 14 of the Constitution.

GUJ: M/s MILI ENTERPRISE Vs UNION OF INDIA

No notice served or the reasons for blocking the credit under Rule 86A provided

– HELD – Even if the powers are exercised under Rule 86(A) of the CGST Rules, 2017, then also, the concerned authority is required to give reasons for blocking the credits in the credit ledger of the petitioner – issue notice

KAR – M/s ARYAN TRADE LINK Vs THE UNION OF INDIA

Related Topic:

Interim restraining order against Sec 194N (TDS provision on cash withdrawal )

GST – Rule 86A(3) – Petitioner challenge the blocking of electronic credit ledger and its continuance beyond one year – expiry period of blocking of electronic credit ledger –

HELD – ..the action of the respondents in continuing the blocking of electronic credit ledger is set aside and orders and restoring credit to the electronic credit ledger to be made forthwith – writ petition is allowed

…Rule 86A

(1) The officer … not below the rank of an AC… having reasons to believe on the following grounds that credit of ITC is fraudulently availed or is ineligible may block ITC –

a) ITC has been availed on invoices, etc –

i. issued by a person who has been found non-existent or not .. conducting .. business registered place

ii. without receipt of goods or services or

b) ITC has been availed on the strength of any document, the tax charged on which has not been paid to the Govt; or

c) The recipient is found non-existent or

d) The recipient does not possess the document

Related Topic:

Indirect Tax Amendments by Finance Bill 2021

Read & Download the full copy in pdf: