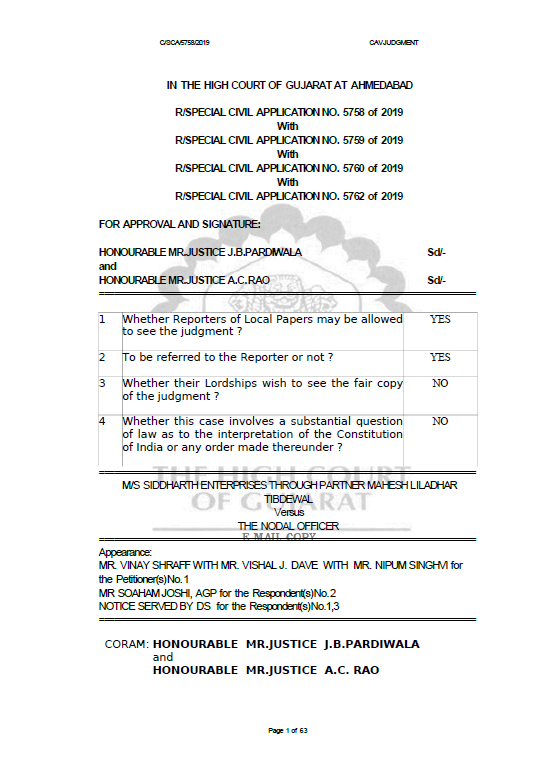

Original order of M/S SIDDHARTH ENTERPRISES Ve. Nodal officer: Gujarat HC

1. Since the issues raised in all the captioned writapplications are the same, those were heard analogously and are being disposed of by this common judgment and order.

2. RULE returnable forthwith in all the captioned writapplications. Mr.Soaham Joshi, the learned AGP waives service of notice of rule for and on behalf of the respondents nos.1 and 2 respectively.

3. For the sake of convenience, the Special Civil Application No.5758 of 2019 is treated as the lead matter. By this writapplication under Article 226 of the Constitution of India, the writ-applicant, a partnership firm, has prayed for the following reliefs :

“(a) Your Lordships may be pleased to issue writ of mandamus and/or any other appropriate writ(s) to allow filing of declaration in form GST Tran-1 and GST Tran-2, to enable it to claim transitional credit of eligible duties in respect of inputs held in stock on the appointed day in terms of Section 140(3) of the Central Goods and Services Tax Act, 2017;

(b) Your Lordships may be pleased to issue writ of declaration and/or any other appropriate writ(s) for declaration of the due date contemplated under Rule 117 of the CGST Rules to claim the transitional credit as being procedural in nature and thus merely directory and not a mandatory provision;

(c) Your Lordships may be pleased to grant ad-interim relief with respect to prayer under Para (a) and Para (b) above;

(d) Your Lordships may be pleased to award costs of and incidental to this application be paid by the respondents;

(e) Your Lordships may be pleased to issue order(s), direction(s), writ(s) or any other relief(s) as this Hon’ble Court deems fit and proper in the facts and circumstances of the case and in the interest of justice;”

4. The writ-applicant is a partnership firm having its= registered office at Bharuch, State of Gujarat. The writ-applicant is in the business of import-export and distributor of branded housewares registered under the CGST Act vide registration bearing No.GSTIN24ABJFS7809M1ZL

5. It appears from the materials on record that the writapplication has been filed seeking appropriate writ, order or direction to the respondents for being permitted to file declaration in the form GST TRAN-1 and GST TRAN-2 respectively to enable the writ-applicants to claim transitional credit of the eligible duties in respect of the inputs held in the stock on the appointed day in terms of Section 140(3) of the Central Goods and Services Tax Act, 2017 (hereinafter referred to as, ‘the Act’) read with Rule 117 of the Central Goods and Services Tax Rules, 2017 (hereinafter referred to as, ‘the Rules’).

6. It is the case of the writ-applicants that the declaration in the form GST TRAN-1 could not be filed on account of the technical glitches in terms of poor net connectivity and other technical difficulties on the common portal. The writ-applicants, in the alternative, have prayed for a declaration that the due date contemplated under Rule 117 of the Rules to claim transitional credit is procedural in nature, and thus, merely directory and not a mandatory provision.

SUBMISSIONS ON BEHALF OF THE WRIT-APPLICANTS :

7. Mr.Shraff, the learned counsel appearing with Mr.Dave for the writ-applicants, vehemently submitted that when the Indirect Tax regime transitioned from the Central Excise regime to the Goods and Services Tax regime, the CGST Act, 2017, allowed the carry forward of the CENVAT credit on the duty paid stock on the appointed day, i.e. 1st July 2017.

8. It is submitted that the CGST was payable on such duty paid stock and, therefore, the credit was allowed because the intention of the Government was not to collect tax twice on the same goods. It is pointed out that in such cases, it was provided that the credit of the duty/tax paid earlier would be admissible as credit.

9. The learned counsel submitted that as his clients were not able to file the form GST TRAN-1 within the date specified, i.e. 27th December 2017, on account of the technical difficulties, they had to physically lodge their claim of transitional credit on stock in the form GST TRAN-1 and GST TRAN-2 respectively

with their Jurisdictional Officer.

10. The learned counsel submitted that his clients also met the Jurisdictional Officer time to time and also addressed various letters to the Nodal Officer and the Jurisdictional Officer for being allowed to file on-line form GST TRAN-1 and GST TRAN-2 respectively in terms of the decision of the Goods and Services Council and the Circular No.39/13/2018-GST dated 3rd April 2018.

Download the Full Copy of Judgement in case of M/S SIDDHARTH ENTERPRISES THROUGH PARTNER MAHESH LILADHAR TIBDEWAL, below:

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.