Notification No. 38/2018 – Central Tax

Notification No. 38/2018 – Central Tax

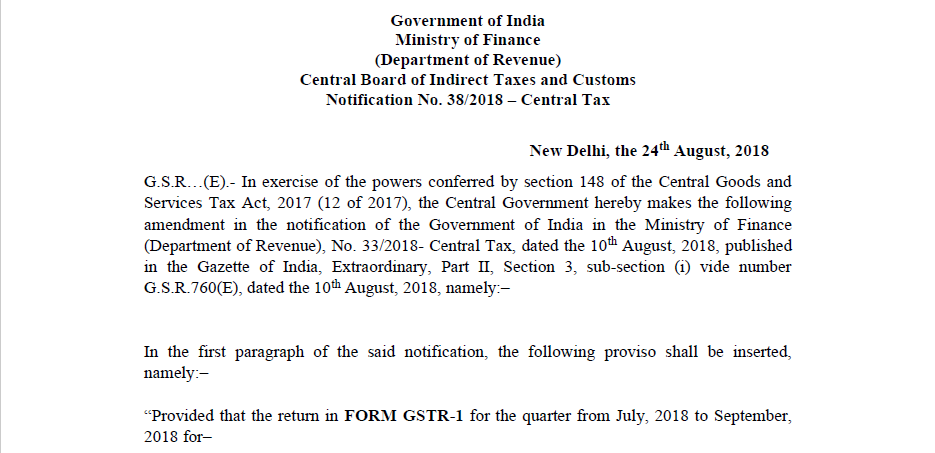

Government of India

Ministry of Finance

(Department of Revenue)

Central Board of Indirect Taxes and Customs

Notification No. 38/2018 – Central Tax

New Delhi, the 24th August 2018

G.S.R…(E).- In exercise of the powers conferred by section 148 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government hereby makes the following amendment in the notification of the Government of India in the Ministry of Finance (Department of Revenue), No. 33/2018- Central Tax, dated the 10th August 2018, published in the Gazette of India, Extraordinary, Part II, Section 3, sub-section (i) vide number G.S.R.760(E), dated the 10th August 2018, namely:–

In the first paragraph of the said notification, the following proviso shall be inserted, namely:–

Download the Notification No. 38/2018 – Central Tax by clicking the below image:

“Provided that the return in FORM GSTR-1 for the quarter from July 2018 to September 2018 for–

(i) registered persons in the State of Kerala;

(ii) registered persons whose principal place of business is in Kodagu district in the State of Karnataka; and

(iii) registered persons whose principal place of business is in Mahe in the Union territory of Puducherry

shall be furnished electronically through the common portal, on or before the 15 November 2018.”.

[F. No. 349/58/2017-GST (Pt.)]

(Dr. Sreeparvathy S.L.)

Under Secretary to the Government of India

Note:- The principal notification was published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R 760 (E), dated the 10th August 2018.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.