Notification No. 61/2018 – Central Tax

Notification No. 61/2018 – Central Tax

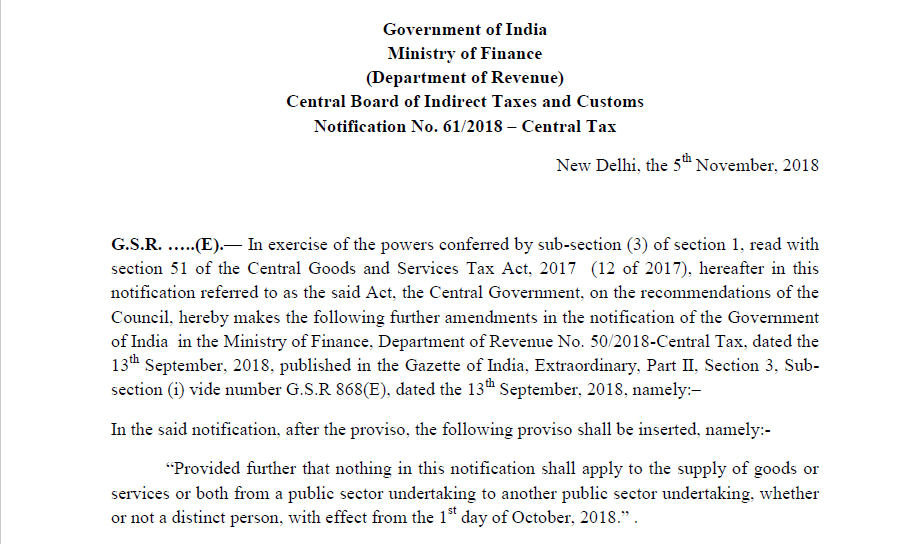

Government of India

Ministry of Finance

(Department of Revenue)

Central Board of Indirect Taxes and Customs

Notification No. 61/2018 – Central Tax

New Delhi, the 5th November 2018

G.S.R. …..(E).— In exercise of the powers conferred by sub-section (3) of section 1, read with section 51 of the Central Goods and Services Tax Act, 2017 (12 of 2017), hereafter in this notification referred to as the said Act, the Central Government, on the recommendations of the Council, hereby makes the following further amendments in the notification of the Government of India in the Ministry of Finance, Department of Revenue No. 50/2018-Central Tax, dated the 13th September 2018, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R 868(E), dated the 13th September 2018, namely:–

In the said notification, after the proviso, the following proviso shall be inserted, namely:-

Download the Notification No. 61/2018 – Central Tax by clicking the below image:

“Provided further that nothing in this notification shall apply to the supply of goods or services or both from a public sector undertaking to another public sector undertaking, whether or not a distinct person, with effect from the 1st day of October 2018.”

[F. No. CBEC/20/06/16/2018-GST]

(Dr. Sreeparvathy S.L.)

Under Secretary to the Government of India

Note:- The principal notification was published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R 868 (E), dated the 13th September 018 and subsequently amended vide notification No. 57/2018-Central Tax, dated the 23rd October 2018, published vide number G.S.R 1057(E), dated the 23rd October 2018.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.