Penalty & Seizure Under GST-Critical Appraisal

Table of Contents

- Introduction:

- Section 125 of CGST Act – Statutory Provisions

- Analysis and Interpretation

- Section 126 General disciplines related to penalty- Statutory Provisions

- Section 129 Detention, Seizure and Release of goods and conveyances in transit – Statutory Provision

- Analysis and Interpretation

- CONTINUING OFFENCE:

- LEVY OF PENALTY IN CASE OF CHARGING EXTRA AMOUNT AND NOT PASSING ON THE ITC TO THE BUYER.

- MENS REA DEFINED

- MENS-REA IS NOT REQUIRED

- PROPORTIONALITY OF PENALTY/FINE MUST BE KEPT IN MIND

- DISCRETION MUST BE JUDICIALLY APPLIED.

Introduction:

In this Article detailed analysis has been made of:

- Section 125: General Penalty

- Section 126: General disciplines related to penalty

- Section 129: Detention, seizure, and release of goods and conveyances in transit.

2: The Article critically analyzes step by step each of the above Sections supported by latest judicial precedents.

Section 125 of CGST Act – Statutory Provisions

Any person, who contravenes any of the provisions of this Act or any rules made there-under, for which, no penalty is separately provided for in this Act, shall be liable to a penalty which, may extend to twenty-five thousand rupees.

Analysis and Interpretation

The duty of the State is not only to recover all lawful dues from a defaulter, but to do complete justice towards law abiding assessee while imposing penalty. Any offence, that does not have a specific penalty prescribed, cannot be let off without penal consequences. Section 125 is a general/residuary penalty provision under the GST law for cases where no separate penalty is prescribed under the Act or rules.

4 Section 125 articulates that, penalty upto 25,000 is imposable where any person contravenes

- Any provision of this act, or

- Rules made there-under

for which, no penalty is separately prescribed under the Act.

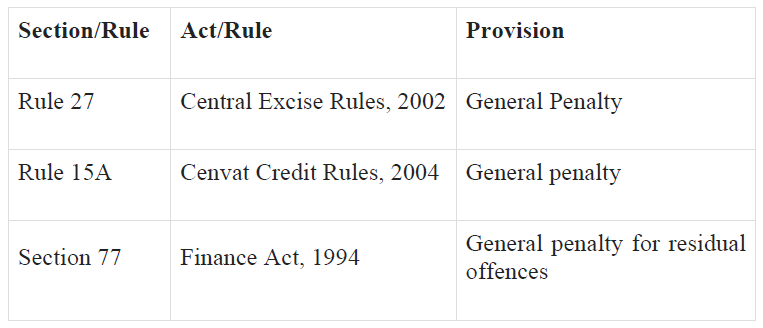

5 It must be noted that general penalty provisions are more or less in line with the following provisions of subsumed Central laws in addition to the provisions of VAT laws of various States:

Section 126 General disciplines related to penalty- Statutory Provisions

(1) No officer, under this Act, shall impose any penalty for minor breaches of tax regulations or procedural requirements and in particular, any omission or mistake in documentation, which is easily rectifiable and made without fraudulent intent or gross negligence.

Explanation.––For the purpose of this sub-section,––

(a) a breach shall be considered a ‘minor breach’ if the amount of tax involved is less than five thousand rupees;

(b) an omission or mistake in documentation shall be considered to be easily rectifiable if the same is an error apparent on the face of record.

(2) The penalty imposed under this Act shall depend on the facts and circumstances of each case and shall be commensurate with the degree and severity of the breach.

(3) No penalty shall be imposed on any person without giving him an opportunity of being heard.

(4) The officer, under this Act, shall, while imposing penalty in an order for a breach of any law, regulation or procedural requirement, specify the nature of the breach and the applicable law, regulation or procedure under which the amount of penalty for the breach has been specified.

(5) When a person voluntarily discloses to an officer, under this Act, the circumstances of a breach of the tax law, regulation or procedural requirement prior to the discovery of the breach by the officer under this Act, the proper officer may consider this fact as a mitigating factor when quantifying a penalty for that person.

(6) The provisions of this section shall not apply in such cases where the penalty specified under this Act is either a fixed sum or expressed as a fixed percentage.

Analysis and Interpretation

6.. The Section 126 provides guidance on ‘how’ and ‘when’ – to impose or refrain from imposing penalty.

7. The following guiding disciplines, in certain circumstances, apply to substantial penalties: Analysis and Interpretation

8: No penalty can be imposed where the tax involved is less than ` Rs.5,000/- (minor breach) or in case of documentation where “errors apparent on the face of record” made without fraudulent intent or gross negligence. It may be kept in mind that the limit of Rs.5,000/- shall include the amount of tax and not amount of interest and penalty. The words, ‘error apparent on the face of record’, have not been defined in the Act and, therefore, the same need to be understood in the light of judicial pronouncements.

9: Then Hon’ble Supreme Court in Satyanarayan Laxminarayan Hegde v. Malikarjun Bhavanappa Tirumule MANU/SC/0169/1959 has explained in the following words:- “An error which has to be established by a long-drawn process of reasoning on points where there may conceivably be two opinions can hardly be said to be “an error apparent on the face of the record”. Where an alleged error can be established by lengthy and complicated arguments, such an error cannot be cured by a writ of certiorari according to the rule governing the powers of the superior Court to issue such a writ.”

10: The Hon’ble Kerala High Court in CIT Vs. Younus Kunju MANU/KE/0053/2018 has observed as under:- “An error apparent on the face of record, on the other hand, an error that strikes one “on mere looking at the record and would not require any long-drawn process of reasoning on points where there may conceivably be two opinions.”

11: The Apex Court in P. Devi Vs. Sumitri Devi MANU/SC/1360/1997 held that “an error which is not self evident and has to be detected by a process of reasoning can hardly be said to be an error apparent on the face of the record.

12: Section 126, inter-alia, provides that no penalty shall be leviable in case of an error apparent on the face of record is not coupled with fraudulent intent or gross negligence. In order to claim exemption from levy of penalty under Section 126(1), there must be want of mens-rea. Another factor to consider is that whether in cases other than error apparent on the face of record, mens rea is an essential factor for imposition of penalty or not? This issue has been extensively dealt with in later part of Article. MEANING OF WORD “FALSE”

13: The word false appears in many statutes and it calls for imposition of penalty. Therefore, it is necessary to understand the meaning of the word “False”. According to the Black’s Law Dictionary (6th Edition), the word “false” has two distinct and well-recognized meanings: (1) intentionally or knowingly or negligently untrue; (2) untrue by mistake or accident, or honestly after the exercise of reasonable care. A thing is called “false” when it is done, or made, with knowledge, actual or constructive, that it is untrue or illegal, or is said to be done falsely when the meaning is that the party is in fault for its error.

14: Likewise, P. Ramanatha Aiyar in Advance Law Lexicon (3rd Edition, 2005) explains the word “false” as: In the more important uses in jurisprudence the word implies something more than a mere untruth; it is an untruth coupled with a lying intent….or an intent to deceive or to perpetrate some treachery or fraud. The true meaning of the term must, as in other instances, often be determined by the context’.

15: In Cement Marketing Co. of India Ltd. v. Assistant Commissioner of Sales Tax, Indore and Ors. MANU/SC/0436/1979 : (1980) 1 SCC 71, a similar question fell for consideration. In that case, a penalty under Section 43 of the MP General Sales Tax Act, 1958 and Section 9(2) of the Act was imposed on the dealer on the ground that he had furnished false returns by not including the amount of freight in the taxable turnover disclosed in the returns. Allowing the appeal of the dealer, this Court had observed as under: What Section 43 of MP General Sales Tax Act, 1958 requires is that the assessee should have filed a ‘false’ return and a return cannot be said to be ‘false’ unless there is an element of deliberateness in it. It is possible that even where the incorrectness of the return is claimed to be due to want of care on the part of the assessee and there is no reasonable explanation forthcoming from the assessee for such want of care, the Court may, in a given case, infer deliberations and the return may be liable to be branded as a false return. But where the assessee does not include a particular item in the taxable turnover under a bona fide belief that he is not liable so to include it, it would not be right to condemn the return as a ‘false’ return inviting imposition of penalty.

16: The Madras High Court in the case of Joy Alukkas Traders (India) Private Limited vs. The State of Tamil Nadu : MANU/TN/0261/2019 has defined the word “false” in the following words:- From the above definition, it is clear that the word ‘false’ includes intentionally or knowingly or negligently untrue and a thing is called “false” when it is done, or made, with knowledge, actual or constructive, that it is untrue or illegal. In the instant case, the assessee was initially registered with Triplicane Assessment circle and it is stated that at the relevant point of time, these items were mentioned in the Registration Certificate.

17: The Supreme Court in the case of J.K. Synthetics v. CTO MANU/SC/0493/1994:(1994) 94 STC 422 (SC) has held that if a dealer has furnished particulars without willfully omitting or withholding any particular information which has bearing on the assessment of tax, which he honestly believes to be correct and complete, it would be difficult to hold that the dealer has not acted bona fide in depositing of tax due on that information. When penalty is still liable to be imposed, the next safety as provided down is to inquire into the degree and severity of the breach to proceed with imposition of penalty. In these cases, if the facts do not demand imposition of penalty, restraint is advised. OPPORTUNITY OF PERSONAL HEARING BEFORE IMPOSITION OF PENALTY BY A SPEAKING ORDER

18: A person liable to penalty must be given an opportunity of being heard. Further, a speaking order should be passed for imposing such penalty. The officer must provide explanation for levy of penalty and the basis on which penalty is quantified. It is well settled principle of law that every order must be a speaking and reasoned order i.e. in line with the principles of natural justice. The following judgments support the above proposition of law:

Ghanshyan Indravadan Pandya v. University Engineer 2018 MANU/GJ/0854/2018

Cadila Pharmaceuticals Ltd. V. Asstt CIT MANU/IB/0520/2012

Bhor Industries Ltd. V. CCE 1999 MANU/CM/0601/1999

Shrilekha Vidyarthi v. State of U.P. and Ors. MANU/SC/0504/1991

Mohinder Singh Gill v. Chief Election Commissioner MANU/SC/0209/1977

19: The voluntary disclosure by a person to an officer (not merely in his own books and records) about the circumstances of the breach prior to the discovery of the breach by the officer may be considered as a mitigating factor for quantifying of penalty.

20: However, it may be kept in mind that cases involving fixed sum or fixed percentage of penalty are excluded. The Section further stipulates that it shall be applicable only in cases where the act provides for maximum penalty or a band of penalty. Simply stated guidelines for imposing penalty, as discussed above, shall not be applicable in case penalty is a fixed sum or fixed percentage.

Section 127 Power to Impose Penalty in certain cases

21: Where the proper officer is of the view that a person is liable to a penalty and the same is not covered under any proceedings under section 62 or section 63 or section 64 or section 73 or section 74 or section 129 or section 130, he may issue an order levying such penalty after giving a reasonable opportunity of being heard to such person

Section 128 Power to waive penalty or fee or both

22: The Government may, by notification, waive in part or full, any penalty referred to in section 122 or section 123 or section 125 or any Section 127 Power to Impose Penalty in certain cases Section 128 Power to waive penalty or fee or both late fee referred to in section 47 for such class of taxpayers and under such mitigating circumstances, as may be specified therein, on the recommendations of the Council.

23: In exercise of the above power, the Central Government, vide Notification No. 73/2017 dated 29.12.2017, waived the amount of late fee payable under Section 47 of the said Act, by any registered person for failure to furnish the return in FORM GSTR-4 by the due date, which is in excess of an amount of twenty five rupees for every day during which such failure continues provided that where the total amount payable in lieu of central tax in the said return is nil, the amount of late fee payable under section 47 of the said Act, by any registered person for failure to furnish the said return by the due date, shall stand waived to the extent which is in excess of an amount of ten rupees for every day during which such failure continues.

Section 129 Detention, Seizure and Release of goods and conveyances in transit – Statutory Provision

(1) Notwithstanding anything contained in this Act, where any person transports any goods or stores any goods while they are in transit in contravention of the provisions of this Act or the rules made there-under, all such goods and conveyance used as a means of transport for carrying the said goods and documents relating to such goods and conveyance shall be liable to detention or seizure and after detention or seizure, shall be released,––

(a) on payment of the applicable tax and penalty equal to one hundred per cent of the tax payable on such goods and, in case of exempted goods, on payment of an amount equal to two per cent of the value of Section 129 Detention, Seizure and Release of goods and conveyances in transit – Statutory Provision goods or twenty-five thousand rupees, whichever is less, where the owner of the goods comes forward for payment of such tax and penalty;

(b) on payment of the applicable tax and penalty equal to the fifty per cent of the value of the goods reduced by the tax amount paid thereon and, in case of exempted goods, on payment of an amount equal to five per cent of the value of goods or twenty-five thousand rupees, whichever is less, where the owner of the goods does not come forward for payment of such tax and penalty;

(c) upon furnishing a security equivalent to the amount payable under clause (a) or clause (b) in such form and manner as may be prescribed: Provided that no such goods or conveyance shall be detained or seized without serving an order of detention or seizure on the person transporting the goods.

(2) The provisions of sub-section (6) of section 67 shall, mutatis mutandis, apply for detention and seizure of goods and conveyances.

(3) The proper officer detaining or seizing goods or conveyances shall issue a notice specifying the tax and penalty payable and thereafter, pass an order for payment of tax and penalty under clause (a) or clause (b) or clause (c).

(4) No tax, interest or penalty shall be determined under sub-section (3) without giving the person concerned an opportunity of being heard.

(5) On payment of amount referred in sub-section (1), all proceedings in respect of the notice specified in sub-section (3) shall be deemed to be concluded.

(6) Where the person transporting any goods or the owner of the goods fails to pay the amount of tax and penalty as provided in sub-section (1) within seven days of such detention or seizure, further proceedings shall be initiated in accordance with the provisions of section 130:

Provided that where the detained or seized goods are perishable or hazardous in nature or are likely to depreciate in value with passage of time, the said period of seven days may be reduced by the proper officer.

Analysis and Interpretation

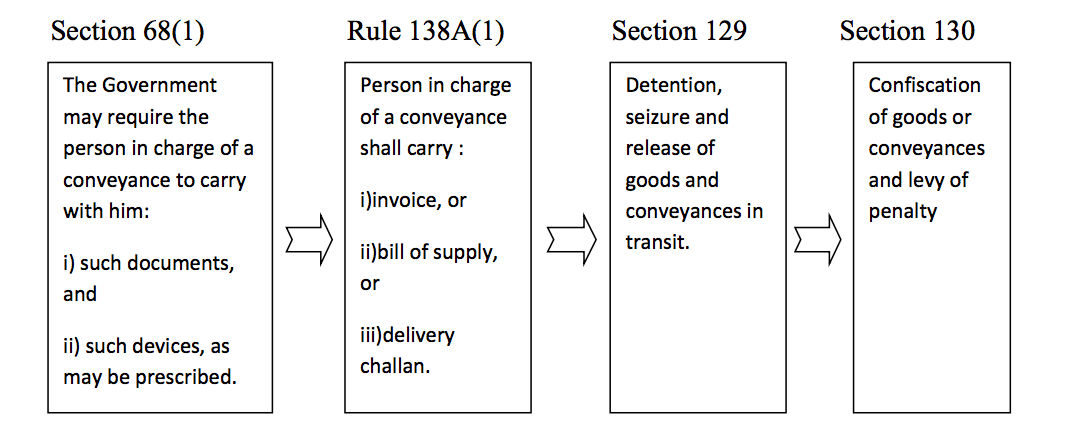

24: Section 129 of CGST Act, which begins with a non-obstante clause, empowers the officers to detain and seize the goods, documents and the conveyance, if the goods are transported or stored during the transit in contravention of the provisions of this Act or the rules made there-under. The officers are authorized to release the taxable goods etc. if the owner pays the applicable tax and penalty equal to the amount of tax payable, in case the owner does not come forward, the amount of penalty will be equivalent (50% CGST + 50% SGST) to the value of taxable goods. In case of exempted case, the maximum quantum of penalty is Rs. 50,000/- (CGST 25000 + SGST 25000).

25: Another interesting point of discussion is that whether due to nonobstante clause contained under section 129, Section 130 (dealing with confiscation of goods and conveyances) shall be read in isolation?

26: This question was answered by Hon’ble Kerala High Court in case of Indus Towers Ltd. vs. Asstt STO MANU/KE/0803/2018 held that Section 129 cannot be read ignoring the provisions of section 130. A combined reading of Sections 129 and 130, specially, the provision contained in sub-section (6) of Section 129 indicates that the detention of the goods is contemplated under statutes only when it is suspected Analysis and Interpretation that the goods are liable to confiscation. Section 130 dealing with the confiscation of goods indicates beyond doubt that the confiscation of goods is contemplated under the statutes only when a taxable supply is made otherwise than in accordance with the provisions contained in the statutes and the Rules made there-under with the intent to evade payment of tax. If that be so, mere infraction of the procedural Rules like Rules 55 and 138 of the State GST Rules cannot result in detention of goods, though they may result in imposition of penalty. In other words, detention of goods merely for violation of the procedural Rules in transactions which do not amount to taxable supply, is without jurisdiction. The above mentioned judgment was retreated in Age Industries (P) Ltd.Vs. Asstt STO, GST, MANU/KE/0063/2018

27: Further, CBIC vide Circular No. 41/15/2018 – GST dated 13th April, 2018 has laid down procedures in relation to inception, inspection, detention, release, confiscation of goods and the conveyances. The conjoint reading of the above judgments and circular reveals the following procedure:

CONTINUING OFFENCE:

28: In word ‘Continuing Offence’, has been defined to say that as long as the default continues, the offence is deemed to repeat and, therefore, it is taken as a continuing offence.

29: In view of the language used in Section 271(1)(a) of Income Tax Act, the position is beyond dispute that the legislature intended to deem the non-filing of the return to be a continuing default, the wrong for which penalty is to be visited, commences from the date of default and continues month after month until compliance is made and the default comes to an end.

30: The Hon’ble Supreme Court in the case of Maya Rani Punj vs. CIT: MANU/SC/0082/1985, while explaining the concept of “continuing default”, has observed as under:- The imposition of penalty not confined to the first default but with reference to the continued default is obviously on the footing that non-compliance with the obligation of making a return is an infraction as long as the default continued. PENALTY WHERE EXTENDED PERIOD OF LIMITATION INVOKED. 31. In Union of India and Ors. v. Dharamendra Textile Processors and Ors. MANU/SC/4448/2008 : (2008) 13 SCC 369, while examining the scope of Section 11AC (under which extended period of limitation is invoked) of Central Excise Act, 1944, the Supreme Court, observed that: A penalty imposed for a tax delinquency is a civil obligation, remedial and coercive in its nature, and is far different from the penalty for a crime or a fine or forfeiture provided as punishment for the violation of criminal or penal laws.

32: However, in Union of India v. Rajasthan Spinning and Weaving Mills MANU/SC/0786/2009 : (2009) 13 SCC 448, this Court observed that: We fail to see how the decision in Dharamendra Textile can be said to hold that Section 11AC would apply to every case of nonpayment or short-payment of duty regardless of the conditions expressly mentioned in the section for its application… 33: The decision in Dharamendra Textile must, therefore, be understood to mean that though the application of Section 11AC would depend upon the existence or otherwise of the conditions expressly stated in the Section for invocation of extended period of limitation.

LEVY OF PENALTY IN CASE OF CHARGING EXTRA AMOUNT AND NOT PASSING ON THE ITC TO THE BUYER.

34: The National Anti-Profiteering Authority has in the case of Pallavi Gulati and Ors. vs. Puri Constructions Pvt. Ltd. (08.05.2019 – NAA) : MANU/NT/0029/2019, has held as under:- It is also evident from the above narration of facts that the Respondent has denied benefit of ITC to the buyers of the flats being constructed by him in his Anand Vilas Project in contravention of the provisions of Section 171(1) of the CGST Act, 2017 and has thus realized more price from them than what he was entitled to collect and has also compelled them to pay more GST on the additional realization than what they were required to pay by issuing incorrect tax invoices and hence he has committed an offence under section 122(1)(i) of the CGST Act, 2017 and therefore, he is liable for imposition of penalty under the provisions of the above Section. The above act of the Respondent appears to be deliberate, contumacious and conscious violation of the provisions of the CGST Act, 2017.

MENS REA DEFINED

35. To put it succinctly, in examining whether mens rea is an essential element of an offence created under a taxing statute, regard must be had to the following factors: (i) the object and scheme of the statute; (ii) the language of the section and; (iii) the nature of penalty.

36: In Gujarat Travancore Agency, Cochin v. Commissioner of Income Tax, Kerala, Ernakulam MANU/SC/0332/1989 : (1989) 3 SCC 52, the question that arose for consideration was whether Section 271(1)(a) of the Income Tax Act, 1961 required the existence of mens rea. While holding that the said Section dealt merely with a failure to file return, and hence no mens rea was required, this Court observed thus: It is sufficient for us to refer to Section 271(1)(a), which provides that a penalty may be imposed if the Income Tax Officer is satisfied that any person has without reasonable cause failed to furnish the return of total income, and to Section 276C which provides that if a person willfully fails to furnish in due time the return of income required under Section 139(1), he shall be punishable with rigorous imprisonment for a term which may extend to one year or with fine. It is clear that in the former case what is intended is a civil obligation while in the latter what is imposed is a criminal sentence. There can be no dispute that having regard to the provisions of Section 276C, which speaks of willful failure on the part of the defaulter and taking into consideration the nature of the penalty, which is punitive, no sentence can be imposed under that provision unless the element of mens rea is established.

37: The Supreme Court in the case of Hindustan Steel Ltd Vs. State of Orissa (supra), held that the liability to pay penalty under the Orissa Sales Tax Act, 1947, does not arise merely upon proof of default in registering as a dealer. An order imposing penalty for failure to carry out a statutory obligation is the result of a quasi criminal proceeding and penalty will not ordinarily be imposed unless the party either acted deliberately in defiance of the law or was guilty of conduct contumacious or dishonest or acted in conscious disregard of its obligation. The Court also pointed out that penalty will not also be imposed merely because it is lawful to do so.

MENS-REA IS NOT REQUIRED

38: The SC in the case of SEBI Vs. Shriram Mutual Funds MANU/SC/8185/2006 while, holdings that in respect of violation of civil obligations, has observed as under:- It was further held that unless the language of the provision intends the need to establish mens rea, it is generally sufficient to prove the default/contravention in complying with the statute. In the present case also the statute provides for a hearing. However, that hearing is only to find out whether the assessee has contravened Section 78(2) and not to find out evasion of tax which function is assigned not to the officer at the check-post but to the A.O. in assessment proceedings. In the circumstances, we are of the view that mens rea is not an essential element in the matter of imposition of penalty under Section 78(5).

39: The Punjab & Haryana High Court in the case of CIT v. State Bank of Patiala MANU/PH/0311/2004 has observed as under:-

Moreover, failure to furnish the form XXXI in time is a mistake of technical in nature for which no penalty can be imposed.

40: The Full Bench of Rajasthan High Court in a Sales Tax Revision Petition ACTIO Vs. Indian Oil Corporation Ltd. MANU/RH/0327/2015 has observed as under:-

“(i) The requirement of mens rea is not relevant for the purpose of determining the liability for penalty, in terms of section 78(5) of the RST Act, 1994. (ii) The mens rea is not required to be proved as necessary ingredient for imposition of penalty under sub-section (5) of section 78, on proving violation of sub-section (2) of section 78 of the RST Act, 1994.

41: The following judgments have been relied upon in the case of Hindustan Unilever Limited vs. State of Andhra Pradesh (08.06.2018 – HYHC) : MANU/HY/0607/2018

42: The Supreme Court in Hindustan Steel Ltd. v. State of Orissa MANU/SC/0418/1969 : [1970] 25 STC 211 (SC); AIR 1970 SC 253, observed that an order imposing penalty for failure to carry out a statutory obligation is the result of a quasi-criminal proceeding and penalty would not ordinarily be imposed unless the party obliged either acted deliberately in defiance of law or was guilty of conduct, contumacious or dishonest, or acted in conscious disregard of its obligation. It was further observed that penalty should not be imposed merely because it is lawful to do so and it would be a matter of discretion to be exercised judicially, upon consideration of all relevant circumstances.

43: The Division Bench of A P High Court in A.N. Cigarette Trading Company v. State of A. P. MANU/AP/0629/2000 : [2000] 5 ALD 726 was dealing with levy of penalty under section 14(8) of the Act. It was observed that authorities are given discretion even in a case where there is a failure to disclose total or part of the turnover to levy penalty from an amount equal to the tax due as a result of the suppressed turnover and may extend to five times. The Division Bench further observed that while levying penalty, the discretion conferred on the authorities has to be exercised properly and judiciously in order to determine the quantum of penalty to be levied as it is the gravity of the omission that would determine the same

44: The Supreme Court in E.I.D. Parry (I) Ltd. Vs. Comm. Sales Tax MANU/SC/0794/1999 held that when the correct position of law was not free from doubt as to the status of transport subsidy in relation to taxable turnover and when the assessee had a bona fide belief that such a subsidy was not includible in the turnover, the same could not be the basis for levy of penalty as they had not acted deliberately in defiance of law and that their conduct was neither dishonest nor in conscious disregard of their statutory obligation.

45: The Hon’ble Supreme Court in Excel Crop Care Ltd. Vs. Competition Commission of India, MANU/SC/0588/2017 had the occasion to consider the parameters for imposition of penalty under the Competition Act, 2002 and the manner in which discretion must be exercised according to the settled principles of proportionality by the regulatory authorities while imposing penalty and accordingly held as under:- “109. At this point, I would like to emphasize on the usage of the phrase “as it may deem fit” as occurring under Section 27 of the Act. At the outset this phrase is indicative of the discretionary power provided for the fining authority under the Act. As the law abhors absolute power and arbitrary discretion, this discretion provided under Section 27 needs to be regulated and guided so that there is uniformity and stability with respect to imposition of penalty. This discretion should be governed by rule of law and not by arbitrary, vague or fanciful considerations.

46: In Dilip N. Shroff v. CIT MANU/SC/3182/2007, this Court, while dealing with the imposition of the penalty, has observed that: Imposition of penalty is not automatic. Levy of penalty is not only discretionary in nature but such discretion is required to be exercised on the part of the assessing officer keeping the relevant factors in mind. Some of those factors apart from being inherent in the nature of penalty proceedings as has been noticed in some of the decisions of this Court, inhere on the face of the statutory provisions. Penalty proceedings are not to be initiated, as has been noticed by the Wanchoo Committee, only to harass the assessee. The approach of the assessing officer, in this behalf, must be fair and objective.” It should be noted that any penal law, imposing punishment, is made for general good of the society. As a part of equitable consideration, we should strive to only punish those who deserve it and to the extent of their guilt. Further, it is well-established by this Court that the principle of proportionality requires the fine imposed must not exceed what is appropriate and necessary for attaining the object pursued.

PROPORTIONALITY OF PENALTY/FINE MUST BE KEPT IN MIND

47: The Supreme Court in the case of Coimbatore District Central Coop. Bank v. Employees Assn. MANU/SC/2117/2007 has explained the concept of “proportionality” in the following words. (SCC p. 678, paras 18-19): 18. “Proportionality” is a principle where the court is concerned with the process, method or manner in which the decision-maker has ordered his priorities, reached a conclusion or arrived at a decision. The very essence of decision-making consists in the attribution of relative importance to the factors and considerations in the case. The doctrine of proportionality thus steps in focus true nature of exercise the elaboration of a rule of permissible priorities. 19. De Smith states that “proportionality” involves “balancing test” and “necessity test”. Whereas the former (“balancing test”) permits scrutiny of excessive onerous penalties or infringement of rights or interests and a manifest imbalance of relevant considerations, the latter (“necessity test”) requires infringement of human rights to the least restrictive alternative.”

49: In consonance with the established jurisprudence, the principle of proportionality needs to be carefully examined before any penalty is imposed under Section 27 of the Act. Otherwise excessively high fines may over-deter, by discouraging potential investors, which is not the intention of the Act…”

DISCRETION MUST BE JUDICIALLY APPLIED.

50: The Appellate Tribunal, FEMA, in the case of Jaipur IPL Cricket Pvt. Ltd. and Ors. Vs. Sp. Director Directorate of Enforcement, MANU/AE/0024/2019, after dealing with various judgments of Hon’ble Supreme Court and that of various High Courts, on the issue of quantum of penalty to be imposed under the provisions of FEMA , has observed as under:- In case, all the decisions, including the latest judgment of Supreme Court, if read in meaningful manner, it is clear that the imposition of penalty is discretionary in nature and exercise of such discretion while imposing penalty must be guided by fair, objective and relevant considerations. Exercise of such discretion, while imposing penalty, must not be based on arbitrary, vague or fanciful considerations. There is no justification provided in the Impugned Order for the exercise of discretion by the Respondent in imposing the maximum permissible penalty (i.e., three time the amount involved) for alleged contraventions of FEMA and Regulations made there-under, which contraventions can, at best, only be categorized as technical and venial in nature. It is submitted that the exercise of discretion by the Respondent, while imposing penalty in the instant case, is ex facie arbitrary, capricious, without application of mind and unsustainable. 51: However, the Supreme Court in the case of SEBI v. Shriram Mutual Fund, MANU/SC/8185/2006 : (2006) 5 SCC 361 has observed that mens rea is not an essential ingredient required to be established for imposition of penalty in cases of contravention of civil legislations.

Advocate Pradeep Kumar

Advocate Pradeep Kumar

PK Mittal BCom Delhi university 1975 LLB Delhi University 1978 FCS Fellow Member of ICSI 1992 1982 to 1992 as CS in Corporate Head Legal Apollo Tyres Ltd 1986 to 1992 1993 onwards Advocate in Delhi High Court CESTAT NCLT = Practcising Indirect Tax and Corporate laws 1993 to till date. Written more than 100 Article on Company Law and Corporate laws Indirect Tax Speaker on Indirect Tax Co Law and IBC in various Seminars Workshop organised by ICAI ICSI and ICMA and other organisations Convenor Core Group on GST of ICSI