Profit sharing based agreement with tenant will also fall in renting

Profit sharing based agreement with tenant will also fall in renting: CESTAT Mumbai

On 9th August 2018, CESTAT Mumbai has pronounced an order. Regarding the Profit sharing based agreement with tenant will also fall in renting. The applicant has an agreement with the m/s Pantaloons and m/s Trent Ltd.

Following is the text of order:

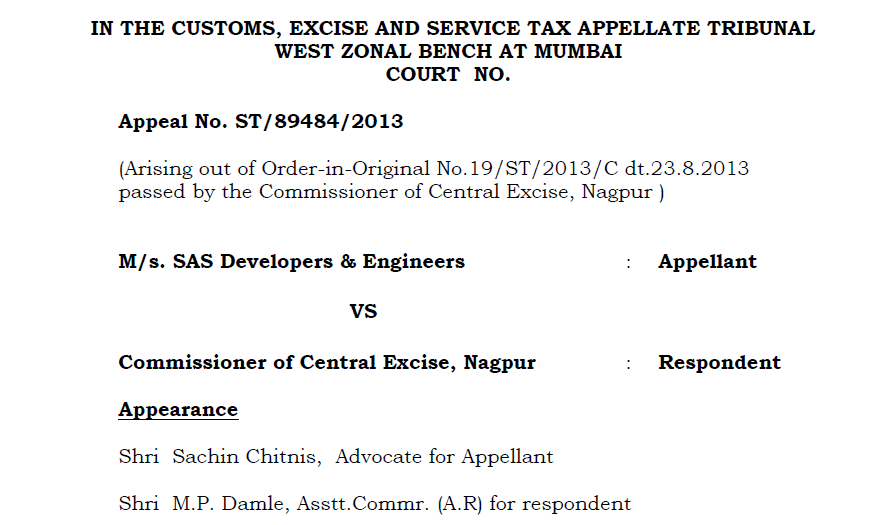

Appeal is directed against Order-in-Original No.19/ST/2013/C dt.23.8.2013 passed by the Commissioner of Central Excise, Nagpur, confirming demand of Service Tax of Rs.2,56,65,366/- under Section 73 of Finance Act, 1994 read with interest under Section 75 and penalties under Section 76, 77 and 78 of the Finance Act, 1994 and appropriated amounts already paid.

2. The facts relating to the present appeal are as enumerated below:

(i) The appellants are a Partnership firm and owners of a building named “Landmark”. They entered into Business Agreement dated 2.8.2003 with Pantaloons. As per the said agreement, the appellants provided necessary space for a departmental store-cum-coffee shop in part of that premises. For providing the same Pantaloons agreed to pay the appellant firm an amount calculated as the percentage on the basis of net sales during the year.

(ii) Another agreement was entered into between the appellant and M/s. Trent Ltd. for creating another store for the retail sale of readymade garments and other household items, accessories in the same premises. In terms of this agreement also the appellants were to be given a percentage of net sales depending upon the total sales turnover.

Download the Full order regarding Profit sharing based agreement with tenant will also fall in renting. By clicking the below image:

(iii) After considering the said two agreements department was of the view that the consideration received in terms of the said agreement was nothing but rent for the provision of the space for setting up the said stores and hence taxable under the category of “Renting of Immovable Property” w.e.f. 1.6.2007.

(iv) Accordingly, notice dt.18/22.10.2012 was issued demanding service tax to the tune of Rs.2,56,65,366/- along with interest and for the imposition of penalty under Sections 76,77 and 78.

(v) The show cause notice was adjudicated by the Commissioner confirming the demand of the service tax along with interest and imposition of penalties.

(vi) Against the said order of Commissioner present appeal has been filed.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.