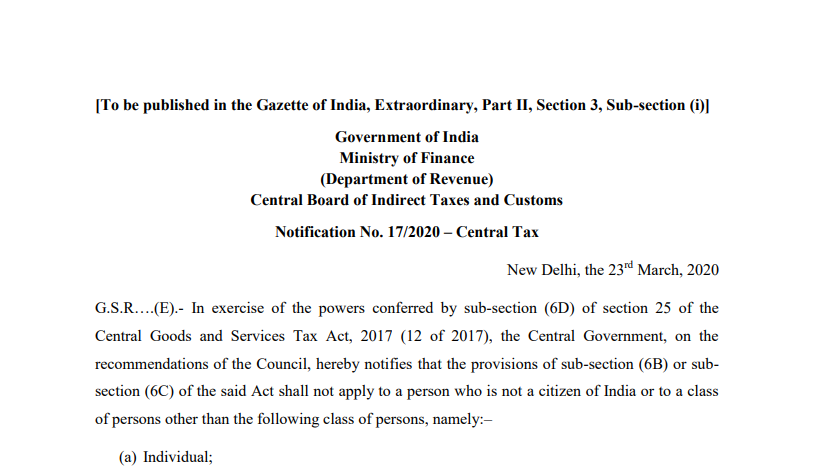

Notification No. 17/2020 – Central Tax

G.S.R….(E).- In exercise of the powers conferred by sub-section (6D) of section 25 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on the recommendations of the Council, hereby notifies that the provisions of sub-section (6B) or subsection (6C) of the said Act shall not apply to a person who is not a citizen of India or to a class of persons other than the following class of persons, namely:–

(a) Individual;

(b) authorized signatory of all types;

(c) Managing and Authorised partner; and

(d) Karta of a Hindu undivided family.

2. This notification shall come into effect from the 1 st day of April 2020.

Download the copy: