Quarterly Return Monthly Payment Scheme (QRMP) – New Facelift

Table of Contents

Quarterly Return Monthly Payment Scheme (QRMP) – New Facelift

Volume: 2

A. Exordium

The Central Board of Indirect Taxes & Customs (CBIC) vide Circular No. 143/13/2020-GST dated 10th November 2020 introduced Quarterly Return Filing and Monthly Payment of Taxes (QRMP) scheme under Goods and Services Tax (GST) to help small taxpayers whose turnover is less than Rs.5 crores. This is a welcome step towards the goal of increasing “Ease of Doing Business” The QRMP scheme allows the taxpayers to file GSTR-3B every quarter and pay tax every month. This will make 8 returns in total for a small taxpayer. Various notifications were issued to implement the QRMP Scheme. (Notification No. 81/2020, 82/2020, 84/2020, 85/2020 – Central Tax, dated 10.11.2020.).

The effective date for this scheme is commencing from 01.01.2021.

B. Eligibility for the Scheme:

– A registered person who is required to furnish a return in FORM GSTR-3B, and who has an aggregate turnover of up to 5 crore rupees in the preceding financial year, is eligible for the QRMP Scheme.

– The aggregate annual turnover for the preceding financial year shall be calculated in the common portal taking into account the details furnished in the returns by the taxpayer for the tax periods in the preceding financial year.

– Further, in case the aggregate turnover exceeds 5 crore rupees during any quarter in the current financial year, the registered person shall not be eligible for the Scheme from the next quarter.

Related Topic:

Payment of Tax By Fixed Sum Method Under QRMP Scheme

Exercising option for QRMP Scheme

– A registered person can opt-in for any quarter from the first day of the second month of the preceding quarter to the last day of the first month of the quarter.

– Facility to avail of the Scheme on the common portal would be available throughout the year to facilitate the taxpayer for easy opt-in.

– It is important to note that to exercise this option, the registered person must have furnished the last return, as due on the date of exercising such an option.

For example, A registered person intending to avail of the Scheme for the quarter ‘July to September’ can exercise his option from the 1st of May to 31st of July. If he is exercising his option on 27th July for the quarter (July to September), in such case, he must have furnished the return for June which was due on 22/24th July.

Similarly, the persons who have obtained registration during any quarter or the registered persons opting out from paying tax under composition scheme during any quarter shall be able to opt any time between 1st May to 31st July for July to Sep Quarter (first day of the second month of preceding quarter to the last day of the first month of the quarter).

Registered persons are not required to exercise the option every quarter. Where such option has been exercised once, they shall continue to furnish the return as per the selected option for future tax periods, unless they revise the said option.

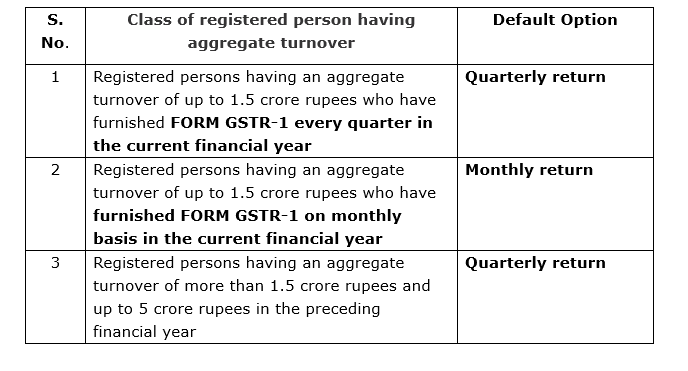

C. Default Migration for the first quarter of the Scheme:

It has been decided that for the first quarter i.e., January 2021 to March 2021, the registered persons having turnover up to Rs 5 cr and who has furnished the return in FORM GSTR-3B for October 2020 by 30th November 2020, shall be migrated on the common portal as indicated below:

The taxpayers who have not filed their return for October 2020 on or before 30th November 2020 will not be migrated to the Scheme. They will be able to opt for the Scheme once the FORM GSTR-3B as due on the date of exercising option has been filed.

The registered persons opting for the Scheme would be required to furnish the details of an outward supply in FORM GSTR-1 quarterly as per rule 59 of the CGST Rule.

For each of the first and second months of a quarter, such a registered person will have the facility (Invoice Furnishing Facility- IFF) to furnish the details of such outward supplies to a registered person, as he may consider necessary, between the 1st day of the succeeding month till the 13th day of the succeeding month. The said details of outward supplies shall, however, not exceed the value of fifty lakh rupees in each month. It may be noted that after the 13th of the month, this facility for furnishing IFF for the previous month would not be available. The facility of furnishing details of invoices in IFF has been provided to allow details of such supplies to be duly reflected in the FORM GSTR-2A and FORM GSTR-2B of the concerned recipient. This facility will help the taxpayer to show partial supplies for the recipient who desires to avail ITC in that month itself. (same clarified in the Circular No. 143/13/2020- GST dated 10th November 2020, Example for Para 5.2).

Further, this facility is not mandatory and is only an optional facility made available to the registered persons under the QRMP Scheme. The details of invoices furnished using the said facility in the first two months are not required to be furnished again in FORM GSTR-1. At the same time, a registered person may choose to furnish the details of outward supplies made during a quarter in FORM GSTR-1 only, without using the IFF.

Read & Download the full copy in pdf:

TaxTru Business Advisors

TaxTru Business Advisors

Consultants