Important FAQ’s on new return of GST RET 01

Table of Contents

- FAQ’s on the new return of GST:

- 1. Where to show the Imports in the new return of GST, RET-01?

- 2. How to enter export in new GST return RET-01?

- 3. How to enter advances in the new return of GST?

- 4. How to enter exempt/nil rated /non-GST Supply in RET 01:

- 5. Where to enter debit and credit notes in new GST return RET 01:

FAQ’s on the new return of GST:

GST new return will be mandatory soon. RET 01 will be the new return. Sahaj and Sugam are abridged versions for small users have limited type of supply. Let us have a look at how we can enter the various types of supplies into it.

1. Where to show the Imports in the new return of GST, RET-01?

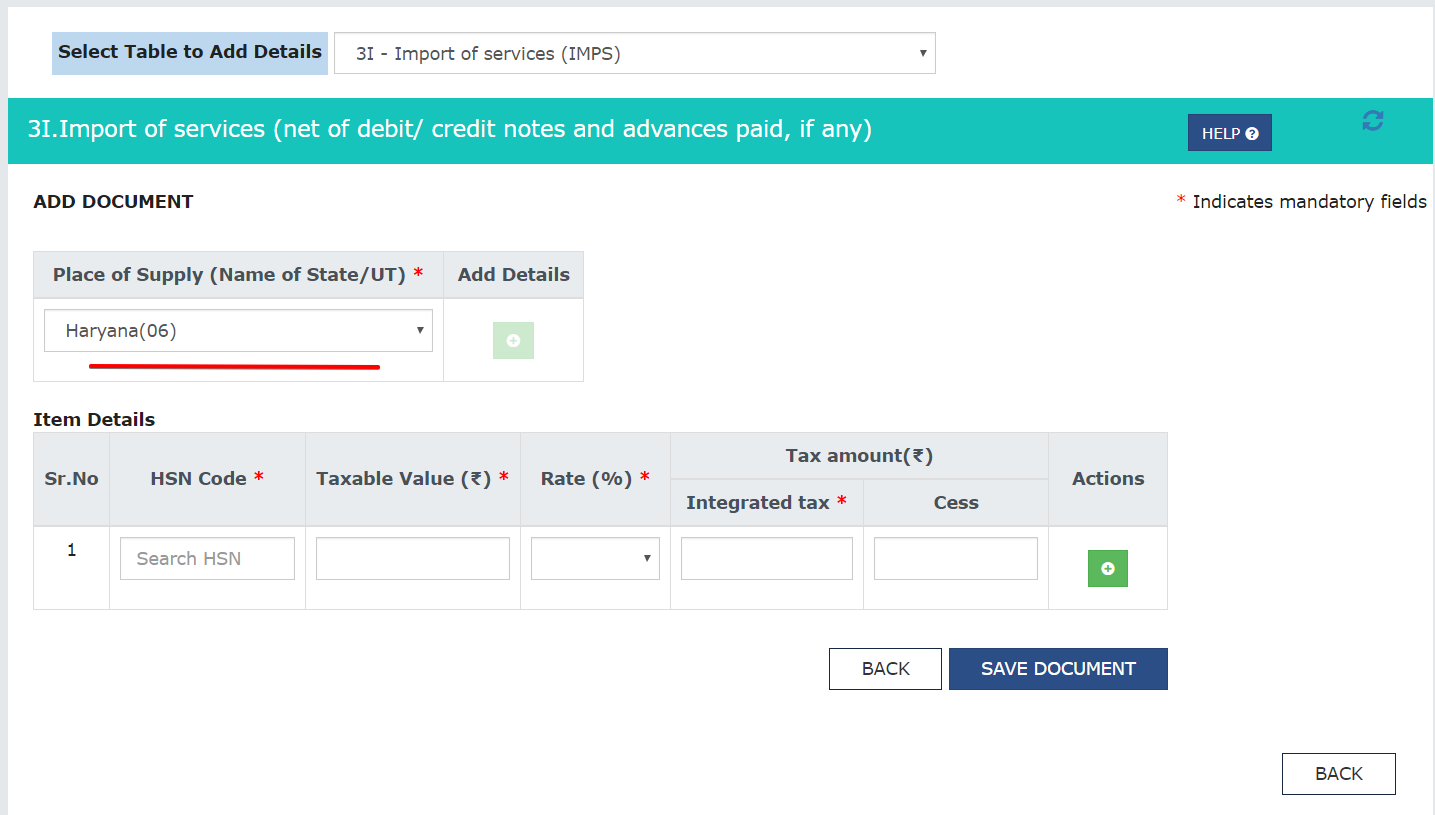

Imports will be covered in annexure 1. Table 3I and table 3J will cover the import of services and goods respectively. Services will be entered in Table 3I of annex 1.

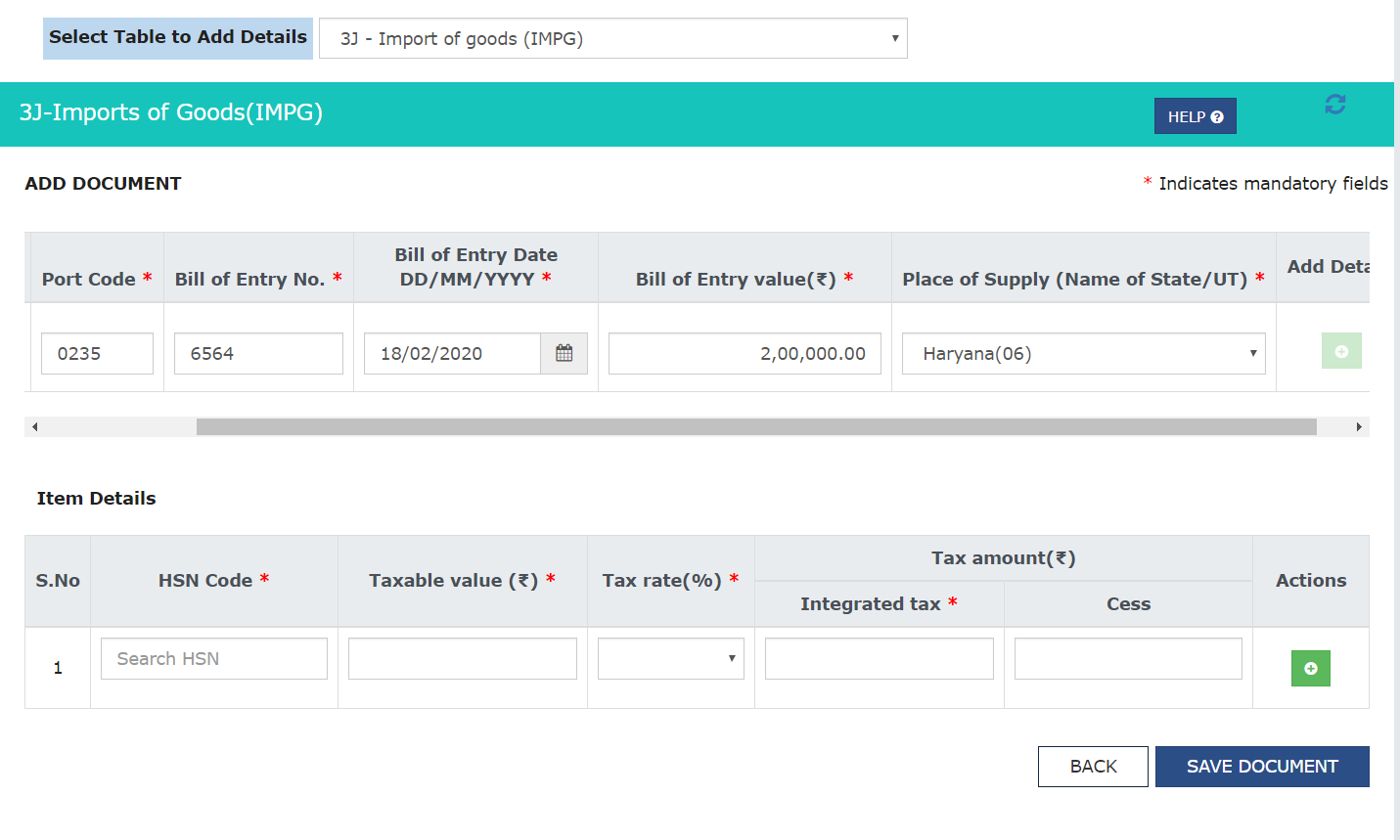

The import of goods will be entered in table 3J of Annex 1.

2. How to enter export in new GST return RET-01?

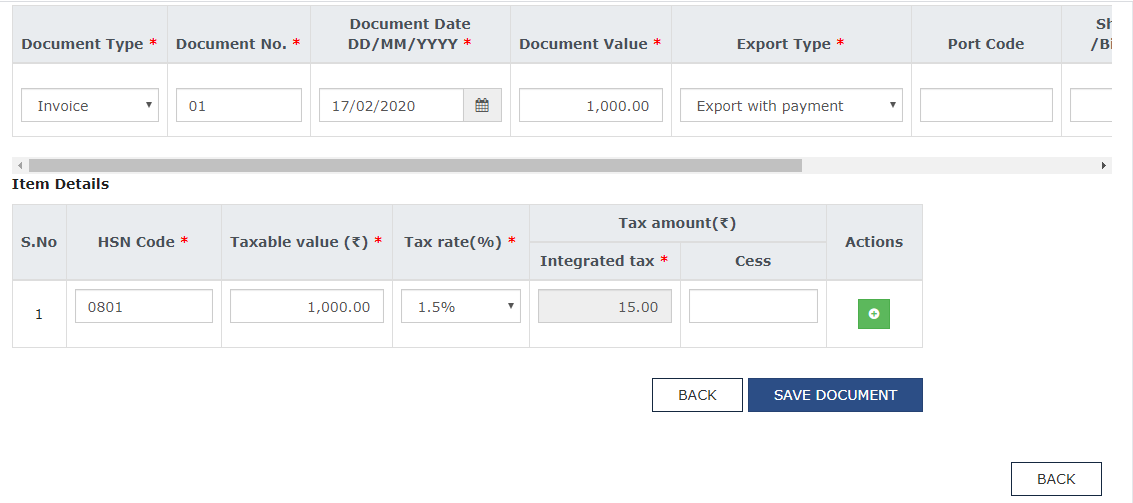

Export supplies may be entered in ANX-01 in Table- 3C & 3D. In the case of export of goods port code and shipping bill details are also mandatory. Also, taxpayers having export and import transactions are required to mention HSN code even is there turnover is less than 5 Cr.

3. How to enter advances in the new return of GST?

3. How to enter advances in the new return of GST?

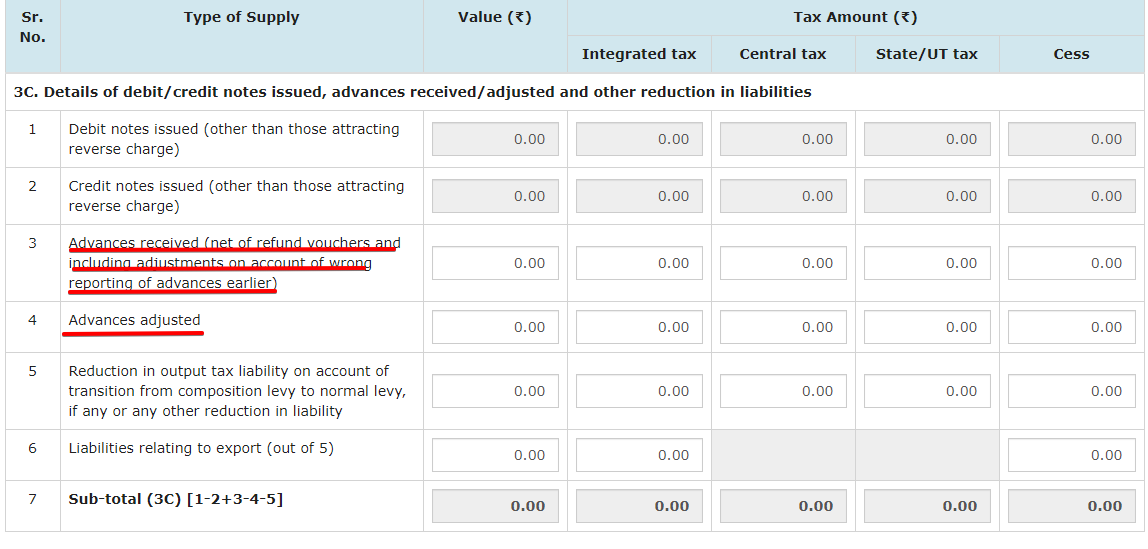

Advances will be entered in table-3C in RET-01. Advances against the supply of goods are not taxable thus advances received against the supply of services will only be liable to tax. In 3C(3) we need to enter the details of advance considered for payment of tax. In the future when this amount will be adjusted with an invoice, it will be entered in Table 3C(4).

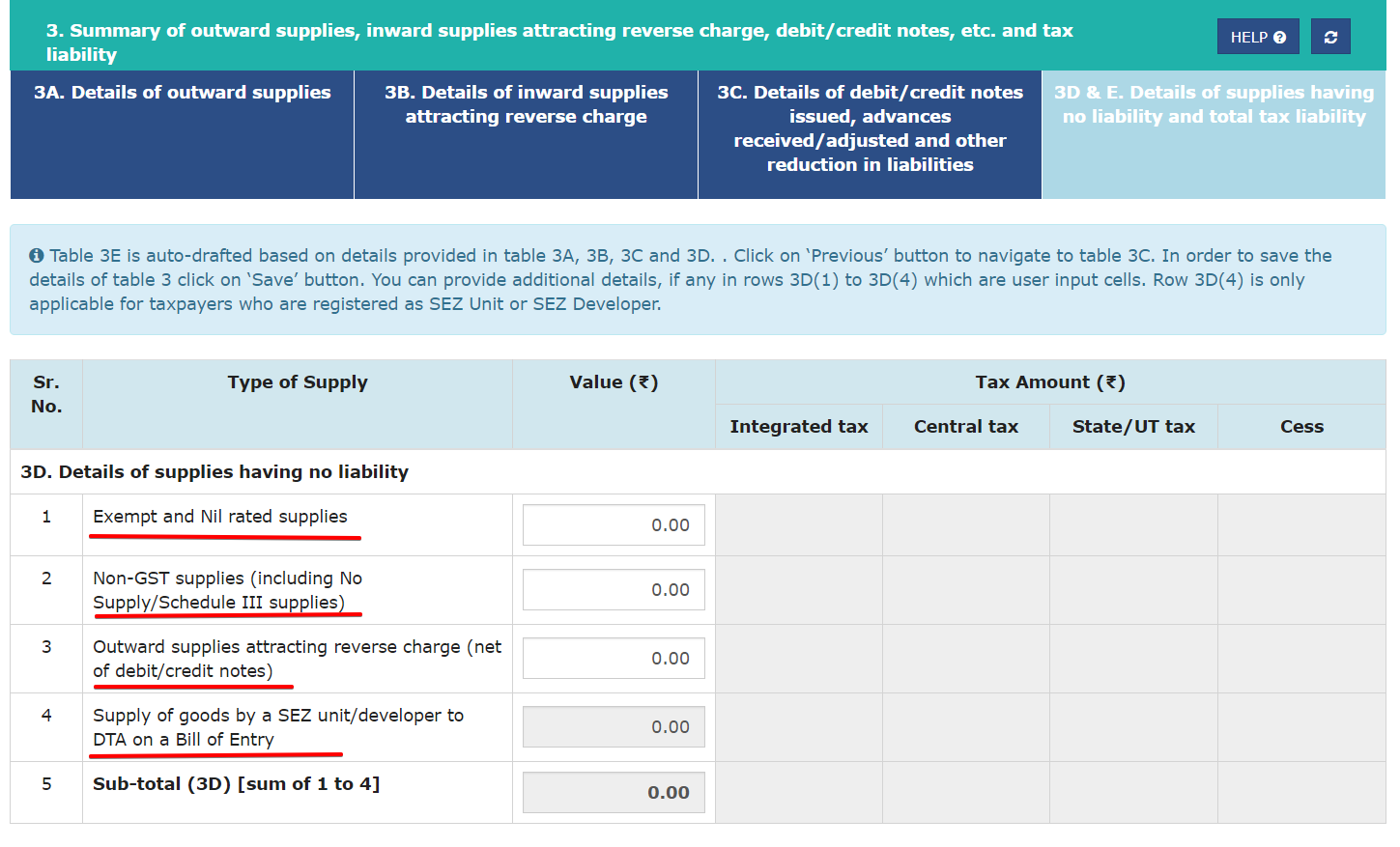

4. How to enter exempt/nil rated /non-GST Supply in RET 01:

The following supplies will be entered in table 3C.

Exempt supply

Nil rated supply

No supply including Schedule III supply

Supply of goods by SEZ unit/developer to DTA on a bill of entry

We will keep adding more questions to this post. You can also send your issues in a comment or can post on QA section of our website.

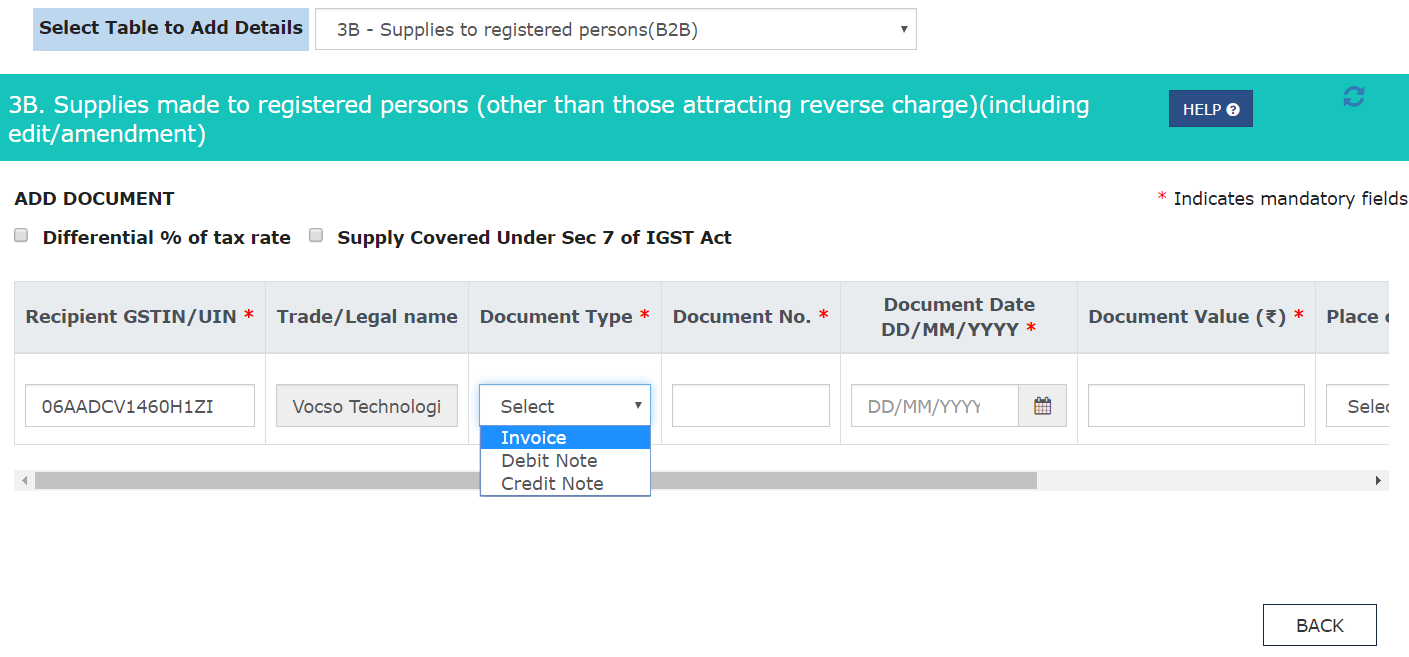

5. Where to enter debit and credit notes in new GST return RET 01:

Debit and credit notes can be entered into the new GST return in Annex 1. How it will be entered. There are two type of supplies we need to enter. B2C supply in table 3A and B2C supply in table 3B. Let us discuss both of them.

Debit/credit notes in case of B2C supply:

B2C supply is required to be entered net of debit and credit notes. Thus we can adjust the figure of debit /credit note in the coming months. In case the supply is in one state and in next month there is no supply but you want to enter the credit note. You can enter minus figure also.

Debit/credit notes in case of B2C supply:

In this case, you can choose while entering the details. See the image below it will be more clear.

You can select an invoice, debit note or credit note. But one anomaly I can see here is that there is no linking of credit note with the invoice. Maybe it is removed in a new return. Then it is great news. Let us explore more into the new returns. Send your questions and queries to me in comments.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.