Ineligible ITC in GST for works contract supply

Ineligible ITC in GST for works contract supply

It is very important to reverse the ITC not eligible for a taxpayer. Construction contracts are treated as a composite supply. In this article we will discuss all the provisions related to the reversal of ITC in GST. Specific provisions related to Reversal of ITC on unsold inventory after completion will also be discussed.

Reversal of ITC on goods/services or both used for other than business purpose:

Section 17(1) where the goods or services or both are used by the registered person partly for the purpose of any business and partly for other purposes, the amount of credit shall be restricted to so much of the input tax as is attributable to the purposes of his business

Reversal on ITC on goods /services/ both used for both taxable/exempt supplies:

Section 17(2) Where the goods or services or both are used by the registered person partly for effecting taxable supplies including zero-rated supplies under this Act or under the Integrated Goods and Services Tax Act and partly for effecting exempt supplies under the said Acts, the amount of credit shall be restricted to so much of the input tax as is attributable to the said taxable supplies including zero-rated supplies.

Related Topic:

GST SAC Code For Real Estate Services

Value of exempt supply for above :

The value of exempt supply under sub-section (2) shall be such as may be prescribed, and shall include supplies on which the recipient is liable to pay tax on reverse charge basis, transactions in securities, sale of land and, subject to clause (b) of paragraph 5 of Schedule II, sale of building.

Related Topic:

SAC Code & GST Rate for Accounting and Professional Services

ITC eligibility for works contract services but not for sale of immovable property:

(c) works contract services when supplied for construction of an immovable property (other than plant and machinery) except where it is an input service for further supply of works contract service; (d) goods or services or both received by a taxable person for construction of an immovable property (other than plant or machinery) on his own account including when such goods or services or both are used in the course or furtherance of business.

Related Topic:

Analysis of landmark HC decision for ITC of construction ( Safari retreats)

When construction will be deemed as works contract is well defined in para 5(b) of schedule II.

Para 5(b) construction of a complex, building, civil structure or a part thereof, including a complex or building intended for sale to a buyer, wholly or partly, except where the entire consideration has been received after issuance of completion certificate, where required, by the competent authority or after its first occupation, whichever is earlier.

Related Topic:

Construction Services Under GST – A Detailed Information

Works contract in turn is deemed as service:

Para 6a of schedule II of CGST Act provide that a) works contract as defined in clause (119) of section 2; will be considered as service.Even when the value of goods is more than the value of services it will be assumed as a service. This will result in levy of tax rates of services. This may result in absurd situation because input goods may taxable at a less rate but output will be chargeable at services standard rate. For construction industry tax rate of 18% in SAC 9954 in notification No. 11/2017 CT.

Related Topic:

What is GST input tax credit, ITC in GST

SAC code 9954 is reproduced below:-

| SlNo. | Chapter,Section orHeading |

Description of Service |

Rate(per cent.) |

Condition |

| (1) | (2) | (3) | (4) | (5) |

| 1 | Chapter 99 | All Services | ||

| 2 | Section 5 | Construction Services | ||

| (ii) Composite supply of works contractas defined in clause 119 of section 2 ofCentral Goods and Services Tax Act, 2017.

|

9 | – |

Calculation of amount of reversal of ITC for unsold flats:

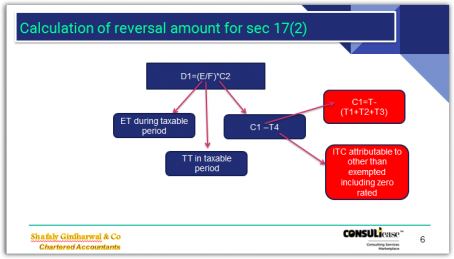

Rule 42 of CGST rules provide for the mechanism for the reversal of ITC in GST. Following is the summarise formula for such calculation:

Conclusion:

Now here is a big dispute related to availability of ITC related to the inventory of flats remain with a developer after receiving completion certificate. As per the provisions of schedule II it will not be a works contract services if it is unsold after its completion certificate. Now the reversal of the ITC will be retrospective from the date of starting the project or it will be only for input of goods/services taken after the completion certificate.

It is advisable to account for the ITC relevant to those flats directly and calculate the common credit proportionately. Section 17(2) prohibits the ITC when inward supply is used for both taxable and exempted services. For the purpose of this section the exempted supply will include the sale of building. It is clear that the ITC taken for exempted supply including the sale of bundling which is not falling in para 5(b) will be disallowed in GST.

Although some expert are of opinion that ITC related to the period after the completion certificate will only be liable for reversal.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.