RULE 36(4) LEGAL VALIDITY & COMPLIANCE

Table of Contents

RULE 36(4) LEGAL VALIDITY & COMPLIANCE

Minutes of 28th council meeting while discussion on new returns

The first time the term ‘uploaded’ has been used. The officer explained that today i.e before new returns are implemented paper invoice is sufficient to avail credit.

RULE 36(4)

• 4) Input tax credit to be availed by a registered person

• in respect of invoices or debit notes, the details of which have not been uploaded by the suppliers under sub-section (1) of section 37,

• shall not exceed 20 percent. of the eligible credit available in respect of invoices or debit notes the details of which have been uploaded by the suppliers under sub-section (1) of section 37.

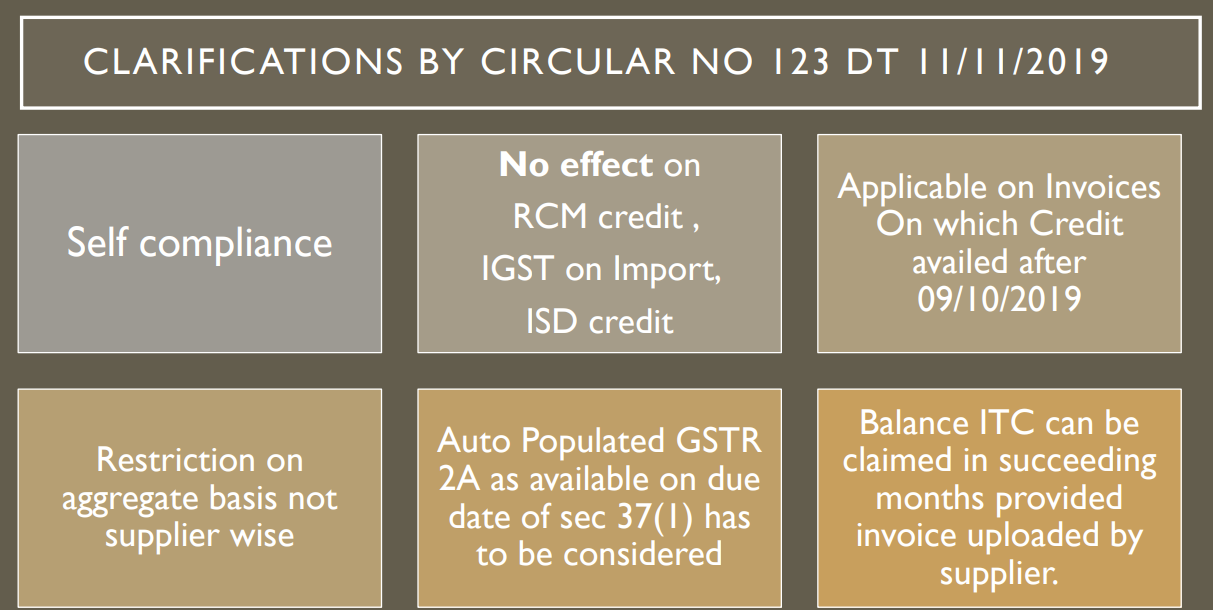

CLARIFICATIONS BY CIRCULAR NO 123 DT 11/11/2019

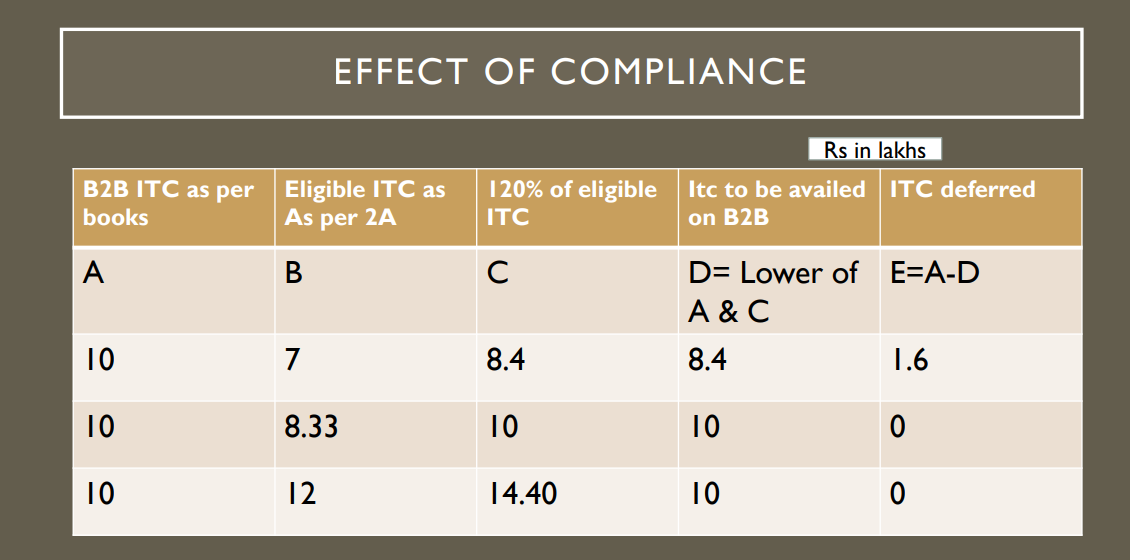

EFFECT OF COMPLIANCE

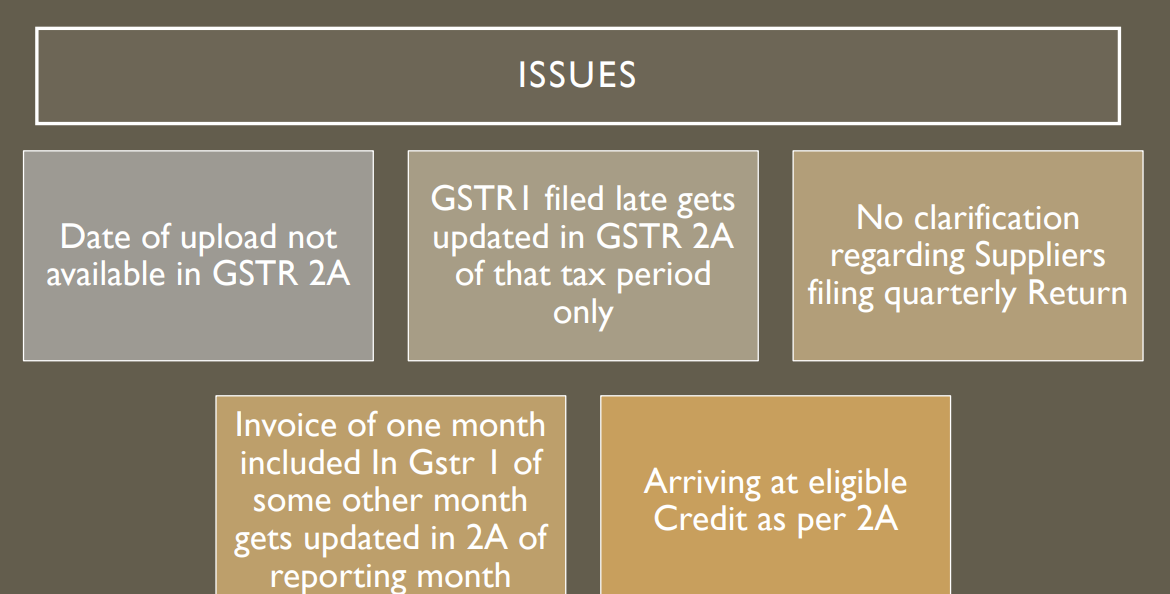

ISSUES

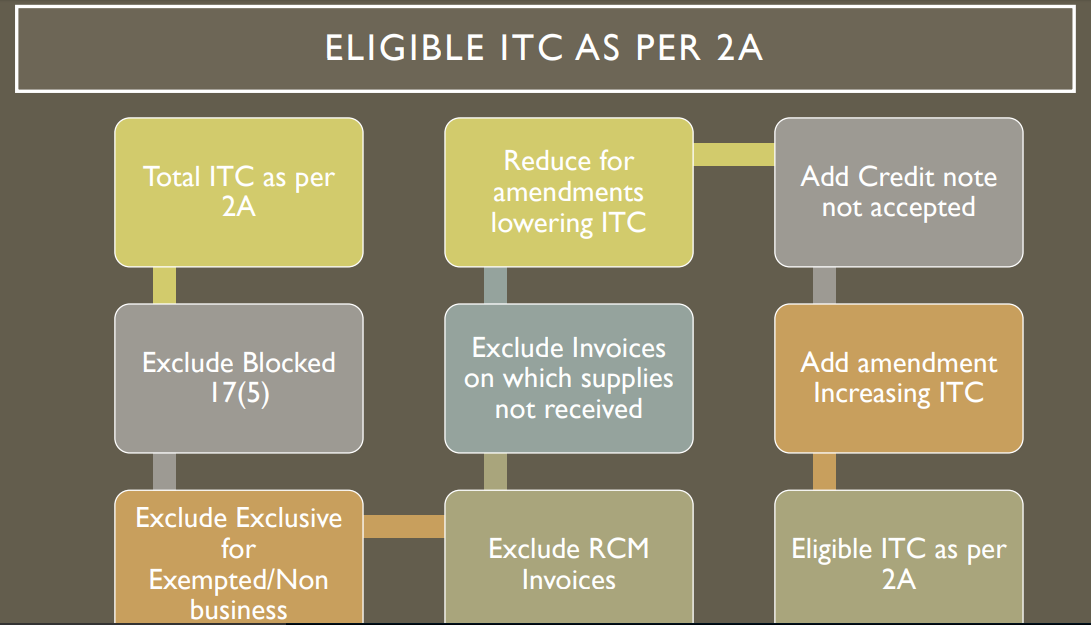

ELIGIBLE ITC AS PER 2A

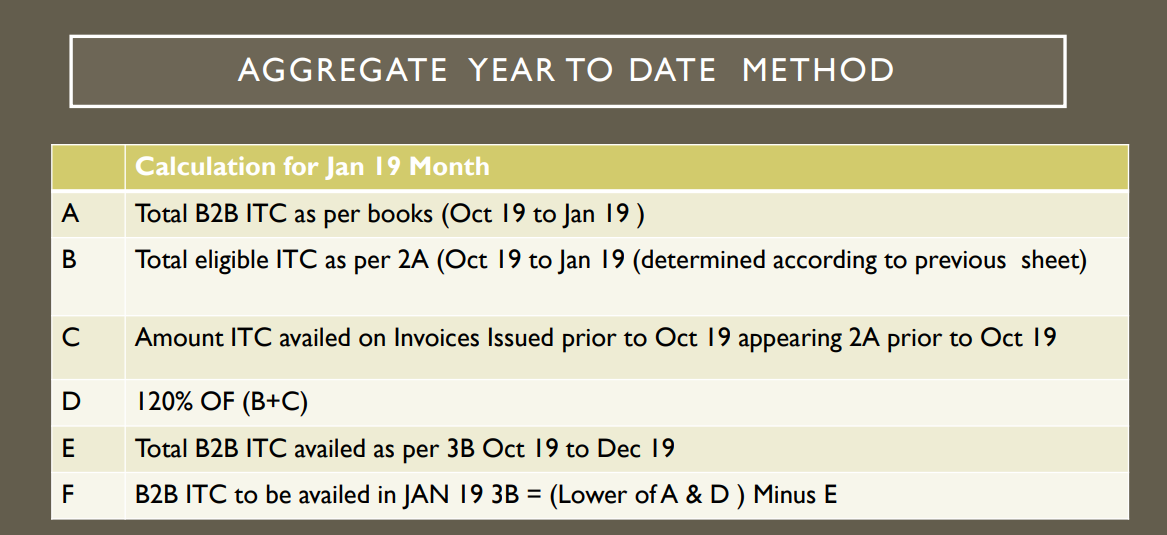

AGGREGATE YEAR TO DATE METHOD

ULTRA VIRES?

POWER TO MAKE RULES (SEC 164)

• The govt may on the recommendation of Council by notification make rules for carrying out the provisions of the Act.

• Without prejudice to the generality of the provisions of sub-section (1), the Government may make rules for

• all or any of the matters which by this Act are required to be or may be, prescribed

• or in respect of which provisions are to be or may be made by rules

SEC 16(1)

• Every registered person shall,

• subject to such conditions and restrictions as may be prescribed and

• in the manner specified in section 49,

• be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business

• and the said amount shall be credited to the electronic credit ledger of such person.

SEC 16(2)

• Notwithstanding anything contained in this section, no registered person shall be entitled to the credit of any input tax in respect of any supply of goods or services or both to him unless,—

• he is in possession of a tax invoice or debit note issued by a supplier registered under this Act, or such other tax paying documents as may be prescribed

• he has received the goods or services or both

• subject to the provisions of section 41 or section 43A the tax charged in respect of such supply has been actually paid to the Government,

• he has furnished the return under section 39

Download the copy: