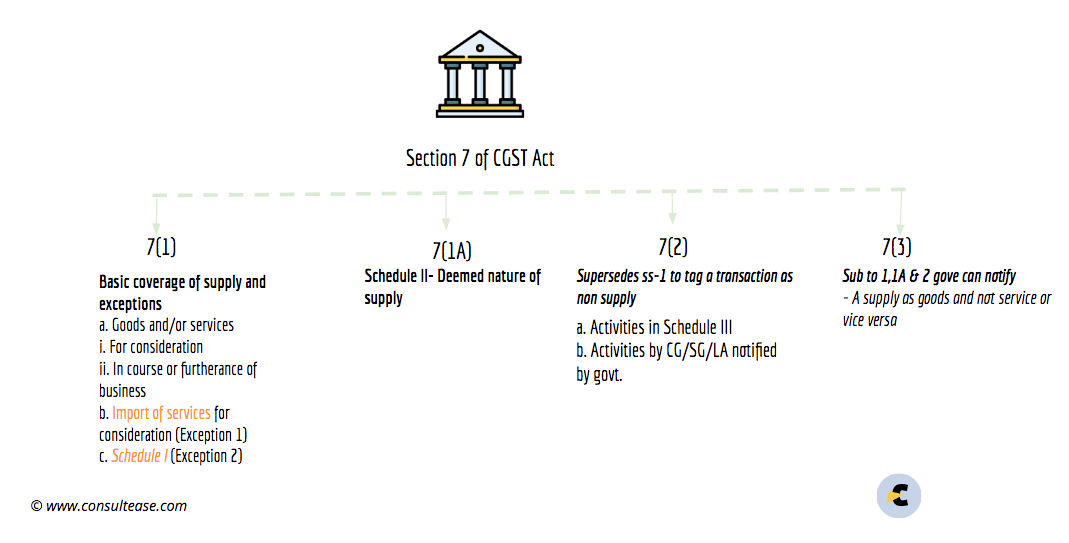

Scope of supply : section 7 of the CGST Act (updated till on July 2024)

Scope of supply: section 7 of the CGST Act as amended by the Finance Act 2023

Note: The Scope of supply: section 7 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended portion is depicted with a different color.

- (1) For the purposes of this Act, the expression “supply” includes––

(a) all forms of supply of goods or services or both such as sale, transfer, barter, exchange, licence, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business;

(aa) the activities or transactions, by a person, other than an individual, to its members or constituents or vice-versa, for cash, deferred payment, or other valuable consideration.

Explanation.- For the purposes of this clause, it is hereby clarified that, notwithstanding anything contained in any other law for the time being in force or any judgment, decree or order of any Court, tribunal or authority, the person and its members or constituents shall be deemed to be two separate persons and the supply of activities or transactions inter se shall be deemed to take place from one such person to another

(b) import of services for a consideration whether or not in the course or furtherance of business; and

(c) the activities specified in Schedule I, made or agreed to be made without consideration; and

(d) the activities to be treated as supply of goods or supply of services as referred to in Schedule II.

Related Topic:

TAXABILITY OF TDR ON OR AFTER 01.04.2019

(1A) where certain activities or transactions constitute a supply in accordance with the provisions of sub-section (1), they shall be treated either as supply of goods or supply of services as referred to in Schedule II.”

(2) Notwithstanding anything contained in sub-section (1),––

(a) activities or transactions specified in Schedule III; or

(b) such activities or transactions are undertaken by the Central Government, a State Government or any local authority in which they are engaged as public authorities, as may be notified by the Government on the recommendations of the Council, shall be treated neither as a supply of goods nor a supply of services.

Related Topic:

Principle Governing Attachment of Property Under Section 83 CGST Act, 2017

(3) Subject to the provisions of sub-sections (1) (1A) and (2), the Government may, on the recommendations of the Council, specify, by notification, the transactions that are to be treated as—

(a) a supply of goods and not as a supply of services; or

(b) a supply of services and not as a supply of goods.

Related Topic:

Interplay of Section 129 & 130 of CGST Act

Section 7 of CGST is for the definition of Supply. It is the taxable event of GST.

Related Topic:

Amended Section 10 of the CGST Act: Composition Levy

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.