Section 24 of CGST Act: Compulsory registration (updated till on July 2024)

Table of Contents

Section 24 of the CGST Act as amended by the Finance Act 2023

Note: Section 24 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended portion is depicted with a different color.

Text On Section:

Notwithstanding anything contained in sub-section (1) of section 22, the following categories of persons shall be required to be registered under this Act,––

(i) persons making any inter-State taxable supply;

(ii) casual taxable persons making taxable supply;

(iii) persons who are required to pay tax under reverse charge;

(iv) person who are required to pay tax under sub-section (5) of section 9;

(v) non-resident taxable persons making taxable supply;

(vi) persons who are required to deduct tax under section 51, whether or not separately registered under this Act;

(vii) persons who make taxable supply of goods or services or both on behalf of other taxable persons whether as an agent or otherwise;

(viii) Input Service Distributor, whether or not separately registered under this Act;

(ix) persons who supply goods or services or both, other than supplies specified under sub-section (5) of section 9, through such electronic commerce operator who is

required to collect tax at source under section 52;

(x) every electronic commerce operator;

(xi) every person supplying online information and data base access or retrieval

services from a place outside India to a person in India, other than a registered person;

and

(xii) such other person or class of persons as may be notified by the Government

on the recommendations of the Council.

(As given in CGST Act)

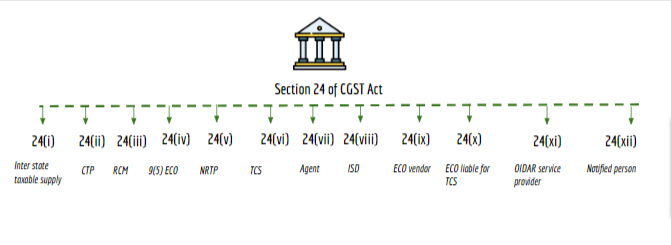

chart of the Section:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.