Section 30 of CGST Act: Revocation of cancellation of registration (updated till on July 2024)

Section 30 of CGST Act as amended by the Finance Act 2023

Note: Section 30 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended portion is depicted with a different color.

Text On Section 30 of CGST Act:

“(1) Subject to such conditions as may be prescribed, any registered person, whose registration is cancelled by the proper officer on his own motion, may apply to such officer for revocation of cancellation of the registration in the prescribed manner within thirty days from the date of service of the cancellation order. [such manner, within such time and subject to such conditions and restrictions, as may be prescribed]

(2) The proper officer may, in such manner and within such period as may be prescribed, by order, either revoke cancellation of the registration or reject the application:

Provided that the application for revocation of cancellation of registration shall not be rejected unless the applicant has been given an opportunity of being heard.

(3) The revocation of cancellation of registration under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act, as the case may be, shall be deemed to be a revocation of cancellation of registration under this Act.”

(As given in CGST Act)

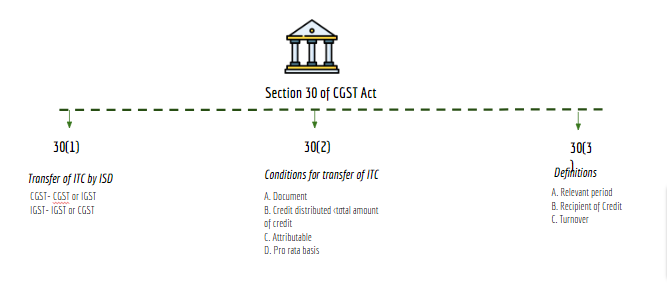

Charts of the section :

Go to Section 29 of CGST Act

Go to Section 29 of CGST Act

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.