Section 43 of CGST Act: Matching,reversal and reclaim in reduction in output tax liability(Updated Till July 2024)

Section 43 of the CGST Act as amended by the Finance Act 2023

Note: Section 43 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended portion is depicted with a different color.

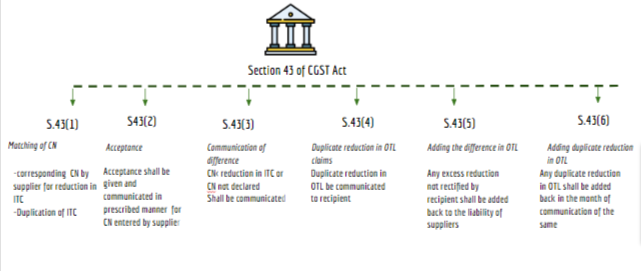

Section 43 of CGST Act provides for matching,reversal and reclaim in reduction in output tax liability.

“(1) The details of every credit note relating to outward supply furnished by a registered person (hereafter in this section referred to as the “supplier”) for a tax period shall, in such manner and within such time as may be prescribed, be matched––

(a) with the corresponding reduction in the claim for input tax credit by the corresponding registered person (hereafter in this section referred to as the “recipient”) in his valid return for the same tax period or any subsequent tax period; and

(b) for duplication of claims for reduction in output tax liability.

(2) The claim for reduction in output tax liability by the supplier that matches with the corresponding reduction in the claim for input tax credit by the recipient shall be finally accepted and communicated, in such manner as may be prescribed, to the supplier.

(3) Where the reduction of output tax liability in respect of outward supplies exceeds the corresponding reduction in the claim for input tax credit or the corresponding credit note is not declared by the recipient in his valid returns, the discrepancy shall be communicated to both such persons in such manner as may be prescribed.

(4) The duplication of claims for reduction in output tax liability shall be communicated to the supplier in such manner as may be prescribed.

(5) The amount in respect of which any discrepancy is communicated under subsection (3) and which is not rectified by the recipient in his valid return for the month in which discrepancy is communicated shall be added to the output tax liability of the supplier, in such manner as may be prescribed, in his return for the month succeeding the month in which the discrepancy is communicated.

(6) The amount in respect of any reduction in output tax liability that is found to be on account of duplication of claims shall be added to the output tax liability of the supplier in his return for the month in which such duplication is communicated.

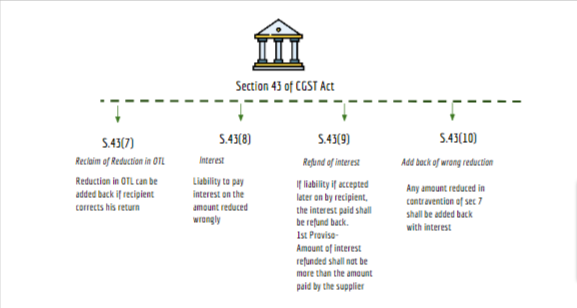

(7) The supplier shall be eligible to reduce, from his output tax liability, the amount added under sub-section (5) if the recipient declares the details of the credit note in his valid return within the time specified in sub-section (9) of section 39.

(8) A supplier in whose output tax liability any amount has been added under subsection (5) or sub-section (6), shall be liable to pay interest at the rate specified under subsection (1) of section 50 in respect of the amount so added from the date of such claim for reduction in the output tax liability till the corresponding additions are made under the said sub-sections.

(9) Where any reduction in output tax liability is accepted under sub-section (7), the interest paid under sub-section (8) shall be refunded to the supplier by crediting the amount in the corresponding head of his electronic cash ledger in such manner as may be prescribed:

Provided that the amount of interest to be credited in any case shall not exceed the amount of interest paid by the recipient.

(10) The amount reduced from output tax liability in contravention of the provisions of sub-section (7) shall be added to the output tax liability of the supplier in his return for the month in which such contravention takes place and such supplier shall be liable to pay interest on the amount so added at the rate specified in sub-section (3) of section 50.”

Chart of the Section :

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.