Section 61 of CGST Act: Scrutiny of returns (updated till on July 2024)

Section 61 of CGST Act: Scrutiny of returns

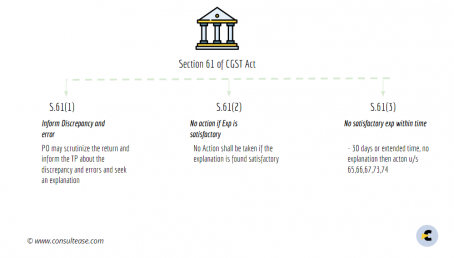

Section 61 of CGST Act provide for the scrutiny of returns.Proper officer is given power to scrutinize the returns with the data provided to verify their correctness.

“(1) The proper officer may scrutinize the return and related particulars furnished by the registered person to verify the correctness of the return and inform him of the discrepancies noticed, if any, in such manner as may be prescribed and seek his explanation thereto.

(2) In case the explanation is found acceptable, the registered person shall be informed accordingly and no further action shall be taken in this regard.

(3) In case no satisfactory explanation is furnished within a period of thirty days of being informed by the proper officer or such further period as may be permitted by him or where the registered person, after accepting the discrepancies, fails to take the corrective measure in his return for the month in which the discrepancy is accepted, the proper officer may initiate appropriate action including those under section 65 or section 66 or section 67, or proceed to determine the tax and other dues under section 73 or section 74.”

(As given in CGST Act)

Summary chart of section 61 :

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.