section 80 of CGST Act: payment in installment(Updated till July 2024)

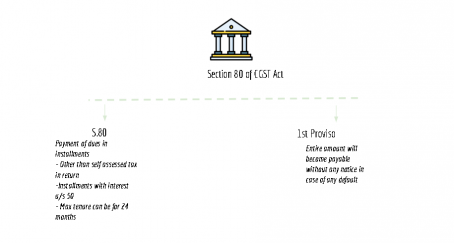

section 80 of CGST Act

section 80 of CGST Act provide for the payment of tax and other dues in installment.

“On an application filed by a taxable person, the Commissioner may, for reasons to be recorded in writing, extend the time for payment or allow payment of any amount due under this Act, other than the amount due as per the liability self-assessed in any return, by such person in monthly instalments not exceeding twenty four, subject to payment of interest under section 50 and subject to such conditions and limitations as may be prescribed:

Provided that where there is default in payment of any one instalment on its due date, the whole outstanding balance payable on such date shall become due and payable forthwith and shall, without any further notice being served on the person, be liable for recovery.”

(As given in section 80 of CGST Act)

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.