Section 89 of CGST Act: Liability of Directors of Private Company (Updated till July 2024)

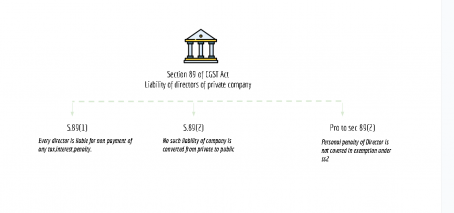

summary chart of section 89 of CGST Act:

Section 89 of CGST Act : Liability of directors of private company

“(1) Notwithstanding anything contained in the Companies Act, 2013, where any tax, interest or penalty due from a private company in respect of any supply of goods or services or both for any period cannot be recovered, then, every person who was a director of the private company during such period shall, jointly and severally, be liable for the payment of such tax, interest or penalty unless he proves that the non-recovery cannot be attributed to any gross neglect, misfeasance or breach of duty on his part in relation to the affairs of the company.

(2) Where a private company is converted into a public company and the tax, interest or penalty in respect of any supply of goods or services or both for any period during which such company was a private company cannot be recovered before such conversion, then, nothing contained in sub-section (1) shall apply to any person who was a director of such private company in relation to any tax, interest or penalty in respect of such supply of goods or services or both of such private company:

Provided that nothing contained in this sub-section shall apply to any personal penalty imposed on such director.”

(As given in CGST Act)

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.