Summary of CGST bill passed in parliament

CGST Bill passed in parliament: Salient features

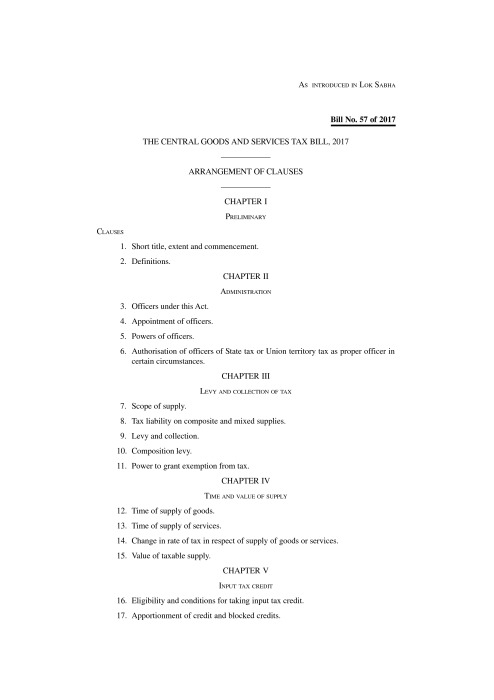

CGST bill passed in parliament on 29th March 2017. It contains XXI chapters,174 sections and Three schedules.

Chapter wise details of CGST bill

|

Chapter in CGST bill |

Sections covered |

Provisions |

|

Chapter I |

Section 1&2 |

Preliminary |

|

Chapter II |

Section 3 to 6 |

Administration |

|

Chapter III |

Section 7 to 11 |

Levy and collection of tax |

|

Chapter IV |

Section 12 to 15 |

Time and value of supply |

|

Chapter V |

Section 16 to 21 |

Input tax credit |

|

Chapter VI |

Section 22 to 30 |

Registration |

|

Chapter VII |

Section 31 to 34 |

Tax invoice , debit and credit notes |

|

Chapter VIII |

Section 35 and 36 |

Account and records |

|

Chapter IX |

Section 37 to 48 |

Returns |

|

Chapter X |

Section 49 to 53 |

Payment of taxes |

|

Chapter XI |

Section 54 to 58 |

Refund |

|

Chapter XII |

Section 59 to 64 |

Assessment |

|

Chapter XIII |

Section 65 and 66 |

Audit |

|

Chapter XIV |

Section 67 to 72 |

Inspection, search, seizure and arrest |

|

Chapter XV |

Section 73 to 84 |

Demands and recovery |

|

Chapter XVI |

Section 85 to 94 |

Liability to pay in certain cases |

|

Chapter XVII |

Section 95 to 106 |

Advance ruling |

|

Chapter XVIII |

Sections 107 to 121 |

Appeals and revision |

|

Chapter XIX |

Section 122 to 138 |

Offences and penalties |

|

Chapter XX |

Section 139 to 142 |

Transitional provisions |

|

Chapter XXI |

Section 143 to 174 |

Misc including job work |

Schedules in CGST bill:

There are three schedules in CGST bill:

ScheduleI : Supply without consideration

ScheduleII: Activities to be treated as supply of Goods or supply of services.

ScheduleIII: Activities or transactions which shall be treated neither as supply of Goods nor services. We can say these supplies will out of the scope of GST.

Earlier there were five schedules. Schedule IV and V are removed and their provisions are shifted to the relevant sections.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.