FAQs on GSTR-9 by Indirect Tax Committee (ICAI)

FAQs on GSTR-9 by Indirect Tax Committee (ICAI)

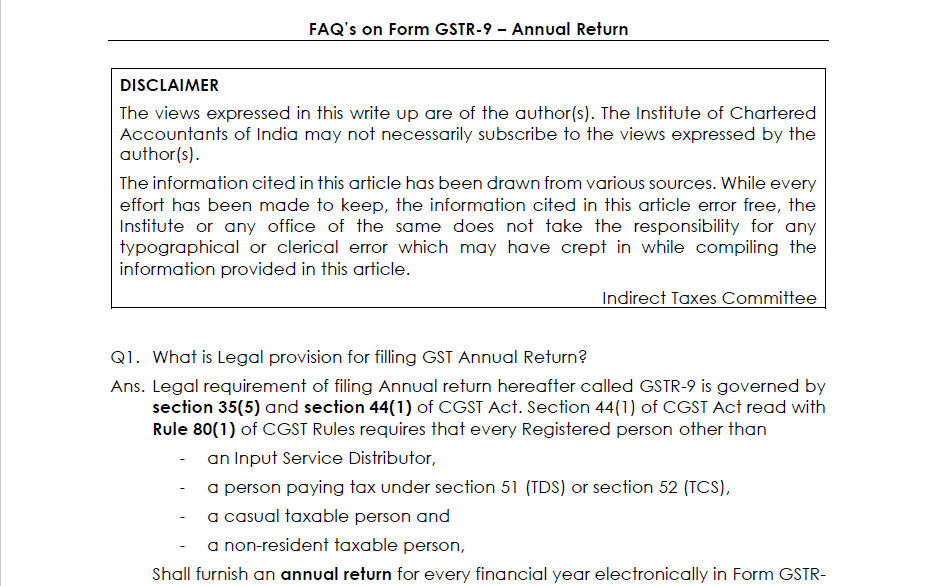

The confusion and the questions related to the Annual Return(GSTR-9) are raised by the taxpayers. So, the Indirect Tax Committee of ICAI has issued the FAQs on GSTR-9 Annual Return. The basic purpose of the FAQs on GSTR-9 is to make the taxpayer and professionals aware regarding the GSTR-9(Annual Return).

Following are the FAQs on GSTR-9:

Q1. What is Legal provision for filling GST Annual Return?

Ans. Legal requirement of filing Annual return hereafter called GSTR-9 is governed by section 35(5) and section 44(1) of CGST Act. Section 44(1) of CGST Act read with Rule 80(1) of CGST Rules requires that every Registered person other than

– an Input Service Distributor,

– a person paying tax under section 51 (TDS) or section 52 (TCS),

– a casual taxable person and

– a non-resident taxable person,

Shall furnish an annual return for every financial year electronically in Form GSTR-9 through the common portal (www.gst.gov.in) either directly or through facilitation center on or before the thirty-first day of December following the end of such financial year.

Further, as per section 35(5) of CGST Act, every registered person whose turnover during a financial year exceeds the prescribed limit (Rs. 2 cr.) shall get his accounts audited by a chartered accountant or a cost accountant and shall submit a copy of the audited annual accounts, the reconciliation statement (GSTR-9C) under sub-section (2) of section 44 and such other documents in such form and manner as may be prescribed. Reconciliation statement – GSTR-9C is reconciliation of data as per books of accounts and data as reported in GSTR-9.

Q2. Who is required to file GSTR-9? Is there any threshold limit of Turnover for exemption to file GSTR-9?

Ans. As per Legal provision of Section 44(1) of CGST Act, every registered person shall be required to file GSTR-9. Hence, irrespective of the Turnover, every registered person under GST is required to file GSTR-9.

Q3. Who is not required to file GSTR-9?

Ans. Following persons are not required to file GSTR-9:

– an Input Service Distributor,

– a person paying tax under section 51 (TDS) or section 52 (TCS),

– a casual taxable person and

– a non-resident taxable person.

Person paying tax under section 52 (TCS) is required to file GSTR-9B but since, provision of section 52 is applicable from 01st October 2018 only, they are not required to file GSTR-9B for the year 2017-18.

Q4. What is Form GSTR-9A and who is required to file it?

Ans. GSTR-9A is Annual return for a supplier who was under composition scheme as per section 10 of CGST Act anytime during the relevant financial year.

Q5. What is Form GSTR-9B and who is required to file it?

Ans. GSTR-9B is Annual return for person paying tax under section 52 which is person who is required to collect tax. Since provision of section 52 is applicable from 01st October 2018 only, such persons are not required to file GSTR-9B for the year 2017-18.

Q6. Which Annual return is to be filed by taxable person if he was earlier registered as composition taxpayer but later he switched over from composition scheme and his status as on 31st March 2018 is a regular taxpayer?

Ans. In such case, he shall be required to file GSTR-9A for the period he was registered as composition taxpayer and for the remaining financial year, he shall be required to file GSTR-9. Hence, he shall be required to file both the Annual Return GSTR-9A and GSTR-9.

Q7. Whether a Taxpayer shall be required to file GSTR-9 even though his registration has been cancelled before 31st March 2018? Whether answer remains the same if his application for cancellation was pending as on 31st March 2018?

Ans. As per Legal provision of Section 44(1) of CGST Act, every registered person shall be required to file GSTR-9. Hence, even if the status of taxpayer is not registered as on 31st March 2018 but he was registered between July-17 to March-18, he shall be required to file GSTR-9 providing details for the period during which he was registered.

Similarly, if a taxpayer had applied for cancellation of registration but the application was pending as on 31st March 2018, he shall be required to file GSTR-9.

Q8. Whether Taxpayer shall be required to file GSTR-9 even though he was having Nil Turnover during the year 2017-18?

Ans. Yes, every registered person is required to file GSTR-9 irrespective of Turnover. However, facility to file GSTR-9 on single click may be provided in such case.

Q9. What is the Due date of filling GSTR-9?

Ans. As per section 44(1) of CGST Act, every registered person is required to file annual return on or before 31st December of the year succeeding the financial year in form GSTR-9. For the FY 2017-18, due date of filling GSTR-9 is 31st December 2018.

Q10. Whether transactions for the period April-17 to June-17 are also to be included in GSTR-9 for FY 2017-18?

Ans. No, instructions forming part of GSTR-9 which was notified by Notification No. 39/2018 dated 04th September 2018, clearly mentions that only details for the period July 2017 to March 2018 are to be provided in GSTR-9.

Q11. If a Taxpayer has obtained more than one GST Registration even though he has a single PAN, then whether GSTR-9 is to be filed at Entity level or GSTIN wise?

Ans. As per Legal provision of Section 44(1) of CGST Act, every registered person shall be required to file GSTR-9. Hence, if a Taxpayer has obtained multiple GST Registrations whether in one state or more than one state, it shall be treated as a distinct person in respect of each such registration as per section 25(4) of CGST Act. Hence, GSTR-9 is required to be filed separately for each such GSTIN.

Q12. What is the difference between GSTR-9 and GSTR-9C?

Ans. As per section 35(5) of CGST Act, every registered person whose turnover during the financial year exceeds prescribed limit (Rs. 2 cr.) shall get his accounts audited by a chartered accountant or a cost accountant and shall submit a copy of the audited annual accounts, the reconciliation statement under sub-section (2) of section 44 which is called GSTR-9C and such other documents in such form and manner as may be prescribed. Hence, requirement of GST Audit u/s 35(5) would arise only if prescribed limit of turnover exceeds Rs. 2 cr. and certified reconciliation statement -GSTR-9C shall require to be submitted.

On the other hand, GSTR-9 is an Annual return which is required to be filed by every registered person irrespective of threshold limit of turnover.

Q13. Which are the parts of information sought in GSTR-9?

Ans. GSTR-9 contains total 6 parts spread out within 19 Tables. Details required in each part is as below:

Part-I: Basic information of Tax payer from Table 1 to 3

Part-II: Details on which tax is to be paid in Table 4 & 5

Part-III: Details of Input tax credit from Table 6 to 8

Part-IV: Details of tax paid and payable in Table 9

Part- V: Details of transactions of 2017-18 reported during April-18 to Sep-18 in Table 10 to 14

Part-VI: Other information from Table 15 to 19

Q14. What will be source of information for filling up GSTR-9?

Ans. GSTR-9 is merely a compilation of data filed in GSTR-3B and GSTR-1. As per the instructions of the form GSTR-9, it is stated that information of outward supplies ‘may’ be derived from Form GSTR 1. Hence, so far as Outward supplies and tax payable in the annual return is concerned, the same are to be extracted from Form GSTR 1 only.

Inward supplies, input tax credit and the net tax paid in cash are to be gathered from Form GSTR 3B.

But before filing GSTR-9, Value as per GSTR-3B and GSTR-1 must align. If there are any differences, then the same must be adjusted to subsequent returns filed up to September-18 as per circular 26/26/2017-GST dated 29th December 2017.

It seems that the inherent assumption that has been taken while drafting the form is that Form GSTR 3B and Form GSTR 1 are in consonance with each other which may not be always true.

In case the values as per Form GSTR 3B and GSTR 1 are not matching with each other, one may arrive at a differential value of tax payable and tax paid as per annual return. A clarification may be expected from the Government regarding the manner of payment of any additional liability (if any). However, if one faces such a situation, then the additional tax liability may be paid through Form GSTR 3B of the subsequent month/Form DRC-03.

Q15. If taxpayer has identified some information which are missed to be reported in GSTR-3B or GSTR-1, whether the same can be added while filing GSTR-9?

Ans. As discussed above, it seems that GSTR-9 is a merely compilation of data filed in GSTR-3B and GSTR-1 and no other information can be incorporated in GSTR-9. GSTR-9 requires details from monthly/quarterly returns on ‘as is’ basis. Even if a taxpayer has identified data fed in GSTR-1 / GSTR-3B as incorrect, still the same data is to be taken for reporting in annual return. The actual data present in the financial statements and the books of accounts of the entity is not to be considered at all for the purpose of reporting in annual return. So, the intent of the form is not to allow rectification of data filed in the monthly/Quarterly returns but only aggregation of such data in respect of the financial year.

Q16. If no other information can be furnished in GSTR-9 over and above what is stated in GSTR-1 and GSTR-3B, then how can the taxpayer pay the tax liability in case he identifies certain liabilities which are missed to be reported?

Ans: If there is any additional liability missed to be reported in GSTR-1 / GSTR-3B pertaining to 2017-18, the same will be reported in subsequent GSTR-1 / GSTR-3B up to September 2018. However, if the same is missed to be reported in GSTR-1 / GSTR-3B up to September 2018, as of now there is no clarity provided by Government whether the same can be paid through GSTR-3B or DRC-03.

Q17. If GSTR-9 is a compilation of the earlier returns (GSTR-1 / GSTR-3B) filed, then whether GSTR-9 will be auto-populated?

Ans: No clarification in this regards has been received from Government but it seems that system computed GSTR-9 in PDF format will be available auto populating figures to the extent possible which can be used to prepare GSTR-9 on portal.

Q18. What is difference between Legal Name and Trade Name?

Ans. Legal name is a name given by statue which is generally found in PAN. Trade name is a name from which entity is known generally brand name. Person may have legal name which is different from Trade name e.g. “Maggi” could be a trade name while its legal name is Nestle Limited. Legal name and trade name will be auto populated from GST Registration.

Q19. Which information shall be provided in Table 4?

Ans. As per heading of Table-4,

– Details of Advances on which tax is payable,

– Inward supply on which tax is payable on RCM basis and

– outward supply on which Tax is payable

Which was already reported in returns filed during the financial year that is for the period July-17 to March-18 is to be reported in Table-4 of GSTR-9. Please note that expression return filed during the financial year will have to be read as return filed for the financial year. Even belated returns filed for the period July-17 to March-18 is to be consider for providing information in Table-4.

Table-4K and 4L also contains details of supplies / tax declared through Amendments. In this Table, amendments related to invoices of July-17 to March-18 declared in GSTR-1 of July-17 to March-18 will be reported in Table-4 of GSTR 9;

and

Amendments related to invoices of July-17 to March-18 declared in GSTR-1 of April-18 to September-18 will only be reported in Part V Table 10 & 11 of GSTR 9.

E.g. Tax payer has filed GSTR-1 for the month of August-17. Now he has identified one invoice to be amended in August-17 return. If such amendments have been made up to March-18 return, then the same will be reported in Table-4K/4L of GSTR-9. However, in case such amendment is made in GSTR-1 of April-18, then the same will be reported in Table 10 or 11 as the case may be.

Q20. Where to report DN / CN issued to unregistered person?

Ans. Unlike B2B supplies, DN/CN issued to unregistered person is to be adjusted against outward supply and net supply and is to be furnished in Table 4A. Even credit note raised against transaction reported as B2C in GSTR-1 is also to be adjusted in Table-4A.

Q21. Whether supply made to registered person (B2B) as required in Table-4B also includes outward supply on which tax is payable by recipient on reverse charge basis?

Ans. No, only outward supply made to registered person on which tax is payable on forward charge basis by supplier will be reported in Table 4B. Outward supplies under reverse charge shall be reported in Table-5C. e.g. in case of GTA operator filing his GSTR-9, he is required to report outward supply in Table-5C.

Q22. Where to report stock transfer made to another branch situated in another state if both are registered?

Ans. Since both branches are registered persons for a particular state, these transactions are to be reported in supplies made to registered person (B2B) Table 4B.

Q23. Tax payer has made two type of exports, one with payment of tax and the other without payment of tax. Where to report both these transactions?

Ans. Export with payment of tax is to be reported in Table-4C. This table warrants details of transactions where tax is payable. Exports without payment of tax is to be reported in Table-5A. Same principle will hold good for supply to SEZ also.

Q24. What is the meaning of deemed exports to be reported in Table-4E?

Ans. As per Notification No. 48/2017-central tax dated 18th October 2017, following supplies are to be regarded as deemed exports:

– Supply of goods against advance authorization

– Supply of capital goods against EPCG authorization

– Supply of goods to EOU (export-oriented undertakings)

– Supply of gold by bank/PSU specified in Notification No. 50/2017-Customs dated 30th June, 2017

Since such supplies are notified as deemed export from 18th October 2017 only, supply before that will not be termed as deemed export.

Q25. Whether all advances on which tax is paid but subsequently got adjusted against invoices shall also to be reported in Table-4F?

Ans. No, only outstanding advances as on 31st March 2018 on which tax was paid but invoice not issued against the same are to be reported in Table-4F.

Q26. Whether advances received during pre-GST regime but against which invoice is not yet issued is to be reported in Table-4F?

Ans. No, only advances on which GST has been paid but remained unadjusted as invoice not issued is to be reported in Table-4F.

Q27. Which information shall be to be provided in Table 4G for Inward supply on which tax is to be paid on reverse charge basis?

Ans. Tax paid on reverse charge basis under these sections are to be reported in Table 4G. There are two type of reverse charge transactions, one is specific reverse charge on certain supplies u/s 9(3) of CGST Act / 5(3) of IGST Act and another is general reverse charge which was effective till 12th October 2017 applicable on procurement of inward supply from unregistered person u/s 9(4) of CGST Act / 5(4) of IGST Act.

Download the PDF of FAQs on GSTR-9 by Indirect Tax Committee, by clicking the below image:

Q28. Whether credit note / debit note issued during 18-19 in respect of transactions of July-17 to March-18 is to be reported in Table 4I and 4J?

Ans. No, only credit note / debit note issued between July-17 to March-18 is to be reported in 4I and 4J. If credit note / debit note is issued between April-18 to September-18, then the same would be reported in Table-10 / Table 11 of GSTR-9. Please note that financial credit note which doesn’t comply with requirement of section 34(1) is not to be added in Table 4I or Table 11.

Q29. How are amendments made in supply to be reported in GSTR-9?

Ans. Amendments in supply is to be reported in Table-4K, 4L, 5J, 5K, 10 and 11 depending on nature of transaction. E.g. If value of original B2B supply is Rs.1000 but which was reported as Rs.100 in GSTR-1 and subsequently amendments has been made in next GSTR-1 with correct value then Rs.100 will be reported in Table-4B and Rs.900 will be reported in Table-4K.

Q30. Which information is to be provided in Table-5?

Ans. Details of outward supplies on which no tax is payable like Export or SEZ supply with LUT or Bond is to be reported in Table-5. Even outward supply on which recipient is liable to pay tax on RCM basis is to be reported here only.

Q31. Which information is to be reported in Table-6?

Ans. In Table-6, Input tax credit availed in GSTR-3B filed for the period July-17 to March-18 will be auto populated in Table-6A. Break up of such ITC will be reported in Table-6B to 6H. Further, Transitional credit which was not reported in GSTR-3B is to be reported in Table 6K and 6L. Details required in each table are as below:

– Table-6A: Auto populated ITC from GSTR-3B

– Table-6B: All other ITC details

– Table-6C: ITC of tax paid under reverse charge basis u/s 9(4) or 5(4)

– Table-6D: ITC of tax paid under reverse charge basis u/s 9(3) or 5(3)

– Table-6E: IGST paid on import of goods

– Table-6F: IGST paid on import of services

– Table-6G: ITC received from ISD

– Table-6H: ITC reclaimed which was reversed earlier

– Table-6K: ITC of TRAN-I

– Table-6L: ITC of TRAN-II

Q32. GSTR-3B doesn’t require ITC to be bifurcated into Input, Input service and capital goods whereas Input tax credit details as per Table-6 requires such break up. How to report the same?

Ans. Basically GSTR-9 is prepared based on earlier process of filling GSTR-1, GSTR-2 and GSTR-3. In GSTR-2, there was a requirement to bifurcate ITC into Input, Input service and capital goods. However, as GSTR-2 was not required to be filed till now, one will have to carry out additional exercise to identify category of ITC into Input, Input service and capital goods from books of account.

Q33. Whether any ITC pertains to FY 2017-18 but claimed subsequently in GSTR-3B of April-18 to September-18 will be reported in Table-6?

Ans. No. Even though ITC belongs to FY 2017-18, the same will not be reported here. Only ITC claimed up to March-2018 in GSTR-3B will be reported here.

Q34. Whether ITC of TRAN-II filed after March-18 will be reported in Table-6L?

Ans. No. ITC of TRAN-II credited in electronic credit ledger up to 31st March 2018 only be reported in Table-6L. Same way any reversal which have impact on electronic credit ledger up to 31st March 2018 is to be reported in Table-7G.

Q35. Which information is provided in “Any other ITC availed but not specified above” in Table-6M?

Ans. Any other ITC which is not specifically included in 6B to 6L will be reported here. This will include ITC claimed through Form ITC-01, ITC-02, and TRAN-III credit.

Q36. What is scope of Table-7 so far as Table 7A to 7D is concerned?

Ans. ITC reversed as per various rules in GSTR-3B filed for the period up to March-18 is to be reported in Table-7.

– Table-7A: As per Rule-37.

As per proviso to section 16(2) of CGST Act read with Rule 37 of CGST Rules, Amount of ITC reversed on non-payment of value of supply along with tax within a period of 180 days from date of invoice is to be reported.

– Table-7B: As per Rule-39.

Rule 39 deals with the procedure for distribution of input tax credit by Input Service Distributor (ISD). If any supplier gives credit note to the ISD then input tax credit is required to be reduced and shall be apportioned to each recipient in the same ratio in which the input tax credit contained in the original invoice was distributed.

– Table-7C: As per Rule-42

Rule 42 of CGST Rules describes manner of determination of input tax credit in respect of inputs or input services and reversal thereof. If Input and Input service is used partly for business purpose and party for non-business purpose or such input and input service is used for effecting taxable supply and exempt supply, then ITC reversal is required as per Rule-42. ITC reversed as per Rule-42 is to be reported in Table-7C.

– Table-7D: As per Rule-43

On similar lines of Rule 42, Reversal of input tax credit of capital goods is required when capital goods are used partly for business purpose and partly for non-business purpose or such capital goods are used for effecting taxable as well as exempt supply. ITC reversed on capital goods as per Rule-43 is to be reported in Table-7D.

Q37. Whether Ineligible ITC as reported in Table-4D of GSTR-3B is to be reported in Table-7E of GSTR-9?

Ans. No, Net ITC as per GSTR-3B does not take into consideration ineligible ITC as reported in Table-4D of GSTR-3B. So auto populated figure of Net ITC in Table-6A of GSTR-9 does not contain ineligible ITC. Since, taxpayer has not availed such ineligible ITC at all, there is no requirement to reverse it.

However, if taxpayer later on identified certain ITC claimed to be ineligible at the time of filing GSTR-9 then such amount is to be reported in Table-7E of GSTR-9.

Q38. Which information is to be furnished in “other reversals” as mentioned in Table-7H?

Ans. Credits is required to be reversed as per rule 44 of the CGST Rules, 2017 in case of special circumstances read with section 18(4) and section 18(6) of the CGST Act, 2017. Any other credit reversal made up to March-18 not specified in Table-7A to 7G is to be reported in Table-7H. However, credit reversal pertaining to 2017-18 but reversed after March-18 is to be reported in Table-12.

Q39. Which information are contained in GSTR-2A Table-3 and Table-5 which are auto populated in Table-8A of GSTR-9?

Ans. Table-3 of GSTR-2A contains details of inward supplies received from registered person other than supplies attracting Reverse charge and Table-5 of GSTR-2A contains details of Debit note / credit note received during the current period.

Q40. What is the purpose of Table-8?

Ans. Basically Table-8 calculates total ITC that is deemed to be lapsed during the financial year 2017-18 which is sum total of the below two items:

a) Difference of ITC as per GSTR-2A and ITC actually availed

GSTR-2A reflects total ITC passed on to taxpayer but out of that taxpayer might not have claimed some ITC voluntarily (to be reflected in Table-8E) or he might not have claimed the same because it is ineligible (to be reflected in Table-8F).

b) Difference of IGST paid on Import and IGST credit availed

Further, at the time of Import, Taxpayer would have paid IGST but he might not have claimed full IGST paid as input tax credit.

Sum total of above differences are input tax credit which will not be available to taxpayer in 2017-18 is what Table-8 want to draw down.

Please note that there might be a situation where some ITC available in GSTR-2A but taxpayer may not have claimed it up to March-2018 but claimed during April-18 to Sep-18, that credit is also to be reported in Table-8C. This ITC will not form part of total ITC to be lapsed.

Unlike normal Input tax credit, government has not provided mechanism to report IGST on Import paid during 2017-18 but claimed in April-18 to Sep-18 which taxpayer can legally claim. More clarification from the government is expected in this regard.

Q41. Whether total ITC lapsed as per Table-8K will reduce ITC from Electronic credit ledger?

Ans. No, total ITC lapsed is only informative and it will not have any impact on Electronic credit ledger.

Q42. Which period information is to be provided in details of tax payable and paid in Part-IV Table-9?

Ans. Tax payable and paid details are to be extracted from GSTR-3B for the period July-17 to March-18.

Q43. What is the scope of Part-V Table-10 to 13?

Ans. Table 10 to 13 plays a very important role in GSTR-9. Any changes in supply of July-17 to March-18, made through Amendments, credit note or debit notes which was reported in GSTR-1 of April-18 to September-18 is to be reported in Table-10 if the same is resulting into increase in value of supply. However, if it is resulting in to reduction in value of supply then the same is to be reported in Table -11.

Important point to note here is that only credit note or debit note issued during April-18 to September-18 for supply effected during July-17 to March-18 is to be reported in Table-10 and 11, as the case may be.

Similarly, if any input tax credit belongs to the period July-17 to March-18 but which has been claimed in GSTR-3B of April-18 to September-18 is to be reported in Table-12 and 13. If the same is resulting into reversal of Input tax credit, then it will form part of Table 12 and it will be reported in Table-13 if the same is resulting into addition of input tax credit.

Important point to note here is that only additional or reduction in ITC belongs to July-17 to March-18 is to be reported in Table-12 and 13 as the case may be.

Q44. How differential tax payable is calculated as per Table-14?

Ans. As discussed above, when there is a change in supply effected during July-17 to March-18 adjustment is required to be reported in Table-10 and 11. Such amount of net tax payable will be reported in Table-14.

Q45. GST Refund is claimed before March-18 but sanctioned in April-18. How to report such kind of situation in Part VI Table-15?

Ans. GST Refund claimed during July-17 to March-18 is to be reported in Table-15A. If refund is sanctioned after March-18 then that is not to be reported in Table-15B. Same principle will hold good for other refund and demand details. Cutoff date to report transactions here is 31st March 2018.

Q46. Refund of erstwhile law was claimed before July-17 but received in GST regime. Whether the same is to be reported in Table-15B?

Ans. No. Non-GST refund claim as well as Non-GST demand is not to be reported in table-15.

Q47. Taxpayer has received a notice from its jurisdiction range office that there is a tax difference between GSTR-1 vs GSTR-3B / GSTR-3B vs GSTR-2A. Whether such tax differences are to be reported in total demand of tax in Table-15E?

Ans. No, demand of tax for which an order confirming the demand has been issued by adjudicating authority shall be reported in Table-15E. Only notice received asking for reasons / reconciliation of tax differences between returns filed cannot be said to be an order confirming demand of tax. So, the same will not be reported in Table-15E.

Q48. What is deemed supply under section 143?

Ans. As per section 143(3) and (4) of CGST Act, when input and capital goods are sent to job-worker for job work but are not received back within the stipulated time (1 year for input and 3 years for capital goods) from the date of it being sent, same will be deemed as supply in the hands of the supplier on the day on which the input or capital goods were sent by the principal. However, since time limit of 1 year and 3 year will not get triggered as on 31st March 2018, there will not be any transaction to be reported in Table-16B.

Q49. Goods sent to job worker before July-17 and returned between the periods July-17 to March-18. Whether this transaction is to be reported in Table-16B?

Ans. No, this situation gets covered by section 141 of CGST Act and not by section 143 of CGST Act. Hence, they are not required to be reported. If goods are returned within stipulated time as provided in section 141 then no tax shall be payable. However, if goods are returned beyond the stipulated time as provided in section 141 then input tax credit availed by the Principal shall be recovered as arrears of tax under CGST Law and no input tax credit of such tax paid shall be allowed under the CGST Law.

Q50. How to extract details of HSN wise summary of inward supplies where the same is not required to be reported in GSTR-3B?

Ans. GSTR-9 is prepared based on earlier process of filling GSTR-1, GSTR-2 and GSTR-3. In GSTR-2, there was a requirement to report details of HSN wise summary of inward supplies. However, as GSTR-2 was not required to be filed till now, one will have to carry out an additional exercise to identify and report HSN wise summary from the books of accounts.

Q51. Whether GSTR-9 can be revised?

Ans. No such option has been provided in the law till now.

Q52. How much late fee is payable for late filing of GSTR-9?

Ans. As per section 47(2) of CGST Act, Late fee for belated filing of GSTR-9 is Rs.100 per day subject to maximum of 0.25% of turnover in a state/UT. Similar provision is there in SGST Act also. Hence, in total there will be late fee of Rs.200 per day subject to 0.50% of turnover in a state on late filing of GSTR-9.

Q53. What are the consequences of the failure to file GSTR-9?

Ans. If one fails to file GSTR-9 then first late fees will be payable as discussed above. A notice may be issued u/s 46 requiring him to furnish such return within stipulated time.

Acknowledgments

We thank CA. Hiren Pathak for drafting this FAQs on GSTR-9 and CA Subham Khaitan for reviewing the same. For any queries, you may connect with the authors at idtc@icai.in.

– Indirect Taxes Committee

DISCLAIMER

The views expressed in this write up are of the author(s). The Institute of Chartered Accountants of India may not necessarily subscribe to the views expressed by the author(s).

The information cited in this article has been drawn from various sources. While every effort has been made to keep, the information cited in this article error free, the Institute or any office of the same does not take the responsibility for any typographical or clerical error which may have crept in while compiling the information provided in this article.

Indirect Taxes Committee

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.