GST Implications on Transfer of Development Rights in Real Estate Projects

GST Implications on Transfer of Development Rights in Real Estate Projects:

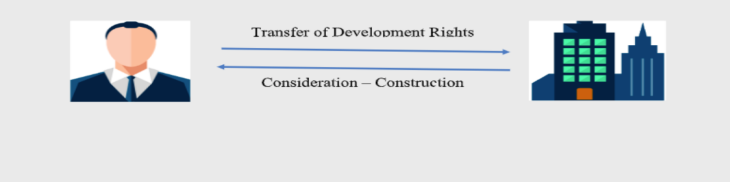

THE CONCEPT of transfer of development rights

- The landowner transfers his development right over a piece of land to the builder/ developer for consideration to be received in the form of construction services.

- The developer constructs and sells the superstructure with undivided portion of land to independent buyers under agreement before or after completion of the construction of the superstructure.

- The consideration is usually dependent upon the value of the portion of land upon which rights are given to the builder/ developer to construct flats/ units and sell on his own account.

- The ownership of land vests with the landowner only until the flats/ units are completed and are transferred to the ultimate buyer with the undivided portion of land.

transfer of development rights

Taxability of transfer development rights under GST:

As per Section 7 (1) of CGST Act, supply includes all forms of supply of goods and/or services for a consideration in the course or furtherance of business except for the activities mentioned under Schedule III to the said Act. Entry 5 of Schedule III specifically includes land and constructed property sold after obtaining completion certificate. Therefore, it is beyond doubt that transfer of land would not form a supply and is outside the purview of GST. However, it is noteworthy that what has been specifically excluded transfer of “land” and “building, for which whole consideration is received after obtaining completion certificate” from the ambit of GST. Exclusion of “immovable property” or transfer of rights / possession in immovable property has not been excluded.

Further, the terms goods and services have also been defined as follows under GST regime- “Goods” means every kind of movable property other than money and securities. “Services” means anything other than goods, money and securities. In the light of above definitions immovable property clearly does not fall under the definition of “goods’ but the definition of “services” is very broad to cover anything that is not goods, money or securities, under its ambit. In the light of above, we can construe that transfer of development rights are transfer of rights in immovable property, which is not excluded from the ambit of services under GST regime and hence, would be exigible to GST unless a specific exclusion is given for the same.

Nature of Supply for transfer of development rights:

As per provision of GST laws, where the location of supplier and place of supply are in different States or Union Territory then it will become as an inter-state supply and IGST will be leviable on such supply. On the contrary, if location of supplier and place of supply are in same state then, it will be construed as intra-state supply and CGST and SGST will be levied. Specifically further, as per Section 12 (4) of IGST Act, the place of supply of services, directly in relation to immovable property or provided by way of grants of right to use immovable property, shall be the location at which the immovable property is located. Therefore, when the landowner (location of supplier) and project location (place of supply) are in different states, the supply will be treated as inter-state supply and will attract IGST otherwise CGST and SGST will be levied.

Time of Supply for transfer development rights

Under GST regime, the supplier is liable to pay GST by 20th day of succeeding month in which time of supply of goods or services falls. If GST is not deposited on or before such date, interest may be attracted on such delayed payment of tax. Ordinarily, the services of transfer of development rights are understood to be supplied on the date on which the rights are transferred and the land owner may be expected to issue an invoice with respect to said supply of service within 30 days from the date of transfer of development rights. The time of supply is determinable accordingly in terms of Section 13(2) of CGST Act. However, w.e.f. 25th day of January, 2018, a Notification 4/2018 CT (Rate) was issued to fictionally define the time of supply in case of transfer of development rights by the landowner to developer/ builder and supply of construction services by the developer/ builder on the area allotted in favor of the landowner in consideration thereof. Therein, it was stipulated that the liability to pay tax on supply of TDR services against the consideration received in the form of construction service by registered persons who supply development rights to a developer/ builder, shall arise at the time when the said developer, builder, construction company or any other registered person, as the case may be, transfers possession or the right in the constructed complex, building or civil structure, to the person supplying the development rights by entering into a conveyance deed or similar instrument (for example allotment letter).

Meaning thereby, the date on which an allotment in favor of the landowner by the developer/ builder conferring a right upon him to possess earmarked space in the complex to be constructed by the developer/ builder is the time when the liability to issue invoice for transfer of development rights as a supply of services arises upon the landowner

Alternatively, if no earmarking/ scheduling by allotment of units is done to either parties at the time of development agreement and only the area allocable to each of them is mutually settled, in such case, by virtue of Notification 4/2018 C.T (R) referred above, the liability to pay GST on the supply of TDR by landowner shall stand deferred to the time when specific allotment/ conveyance is executed.

To sum up, the Notification 4/2018 C.T. (R) is in a way, a liberal and wide notification which does not impede the right of the parties to the agreement to decide as to when the rights under any agreement are transferred. All said and done, it ultimately depends on the intent of the parties to the agreement, as to when the development rights are transferred/ intended to be transferred to the developer/ builder and to what extent in order to properly determine the date of raising an invoice and time of supply for the same. However, this is possible only if the intent of parties and the cause of action against such intent is clearly stated in the development agreement, failing which the default or general presumptions or the most conservative/ pro revenue approaches may be taken in course of audit/ scrutiny / assessment proceedings of the Department.

Liability of Parties to Pay Against GST on Transfer of land Development Rights (TDR):

In the past it has been generally seen that landowners remain unregistered and express indifference and inability to raise Invoice for TDS or do any compliance regarding GST. It has also been popular trend to treat developer/ builder as the sole responsible person for all compliance even regarding landowner, if landowner is not a company or firm engaged in real estate business. However, it is high time, landowners entering into development agreement registered themselves under GST and discharged their duties under the law to avoid loss of ITC benefits while suffering wrath of the Department for non-compliance on their part under the GST law. Initially, when Section 9(4) of CGST Act was operating where registered person was liable to discharge GST if inward supply was from unregistered persons, developers/ builders were expected to meet the responsibilities under reverse charge method. The revenue of the Department was protected and the adverse consequences upon the unregistered landowner were reduced, if not mitigated fully. But since deferment of Section 9(4) w.e.f 13.10.2017, the responsibility of payment of tax on supply of TDR services is upon the landowner directly and if he remains unregistered, developer/ builder cannot pay it under RCM, and since landowner has not paid the tax, the quantum of ITC that becomes available to the developer / builder also reduces to such extent and outflow of GST on total project increases consequentially, which can become a yardstick for inviting anti profiteering investigations as well in some deserving cases.

Another point to be noted in this regard is that payment of advance is not supply of service. If an advance consideration is paid by any party, it may entail liability to pay GST but only under a receipt voucher to be issued by the person receiving the advance. An invoice may be issued when the services are intended to be supplied as per intent of the parties laid in the agreement.

Security Deposit by Developer/ Builder:

Some landowners demand security deposit from developers to secure their position after conferring the rights to the developer/ builder which may be refunded when the parties intend to, generally when the landowner feels secure that the construction of his share has been satisfactorily progressing or completed or his revenue share from reasonable number of units booked by developer/ builder starts flowing in. These security deposits are generally fully refundable but without any adjustment against amounts payable by one party to another.

Input Tax Credit of transfer of land development rights to Developer:

The developer/ builder is eligible to claim input tax credit of GST paid on development rights under invoice issued by landowner, if the same is used for making taxable supply i.e. construction of immovable property intended to be sold before issuance of first occupancy/ completion certificate.

Proportionate input tax credit to the extent attributable to the units that are sold after issuance of first occupancy/ completion certificate is not available. But because any such project spans over a number of years, and credit already stands availed and utilized in earlier years, it is not clarified yet that whether the proportionate credit needs to be worked out only in respect of the year in which the first Occupancy/ Completion Certificate is issued, or the law intends to bring back all utilized credit of past years to the extent attributable to number of units that remain unsold until date of completion certificate. This is a very sensitive and critical aspect, and proper clarification in this regard should be issued.

Proportionate Credit to the extent attributable to the units that are used by the developer/ builder on its own account like for self occupancy/ leasing/ renting purpose is also not available to the developer/ builder, since as per Section 17(5)(d) of the CGST Act, no input tax credit is available for goods or services received by a taxable person for construction of an immovable property on his own account, other than plant and machinery, even when used in course or furtherance of business.

Thus, the developer should be able to bifurcate input tax credit utilized for making taxable supply and nontaxable supply. It may again be noted that Input Tax credit cannot be availed by recipient against receipt voucher issued by the supplier, and invoice is essential for availing any input tax credit by the recipient.

Input Tax Credit of Construction Services to Landowner:

If landowner desires to sell any or all the units allotted to him, the GST paid on construction services availed by the landowner on the units allotted to him from the developer/ builder can be availed as Input Tax Credit and may be set off against liability of GST on the units if the landowner books/ sells such units directly to buyers. However, such liability shall arise upon the landowner only if the landowner books/ sells such units against consideration in full or in part before the completion certificate or first occupancy is issued/ recorded on the project. If the landowner sells his share of units after completion/ first occupancy, the GST suffered on the construction services received from the developer/ builder shall be a cost to the landowner, as no ITC would become available to him in such case.

Valuation of transfer of land development rights:

Under this model, usually the lump sum consideration received/ receivable by the landowner against the transfer of development right is dependent upon cost of land and no additional or liquid consideration is generally received by the landowner at the time of transferring the possession of land to the developer under Power of Attorney including the power to transfer the title of land to the ultimate buyer of the constructed building/ complex.

As per Notification 11/2017 C.T. (Rate), in case of supply of services in the nature of construction of a complex, building, civil structure or a part thereof, including a complex or building intended for sale to a buyer, involving transfer of property in land or undivided share of land, as the case may be, the value of supply of service and goods portion in such supply shall be equivalent to the total amount charged for such supply less the value of land or undivided share of land, as the case may be, in such supply shall be deemed to be one third of the total amount charged for such supply. The term “total amount” has been defined as the sum total of,

(a) consideration charged for aforesaid service; and

(b) amount charged for transfer of land or undivided share of land, as the case may be.

However, the valuation of transfer of development rights has nowhere been provided for, separately. The issue is an issue of huge debate and dispute across the industry. There is one school of thought which propagates that the value, in the case of flats given to landowner is the consideration for these flats i.e., development rights in the land given to the developer/ builder and should be equal to the value of similar flatscharged by the builder/developer from independent buyers based on the concept of open market value of goods or services or both of like kind and quality as prescribed under Rule 27 (c). Because there is no fixed price for flats and price keeps on changing as construction progresses and bookings are received, the determination of value of similar flats shall be at which point of time is another question which could never be answered. The landowner may take the value of the first flat booked, whereas, the Department may wish to take the value of the flat which is sold for highest value. A mean or an average may be more dynamic options which may not have been established but cannot be ruled out either.

The second school of thought advocates that the value of the supply of services in the form of development rights shall be the value of the land when the same is transferred and the point of taxation will also be determined accordingly.

The third school of thought is a more rational and reasonable one which acknowledges the confusion and non-ascertain ability of the value under Rule 27 (a) or (b) or (c ) and hence identifies it as a case under Rule 27(d) and thereby considers the application of Rule 31 read with the proviso thereto. This seems to be the most appropriate method under a prescribed rule, which accommodates the application of the most appropriate method of valuation based on the reliability, reasonability and authenticity of the value determinable under any of the Rules or combination thereto with or without such adjustments as may be appropriate based on the privacy of contract, conduct of parties and record of transactions in each case, be it area sharing model or revenue sharing model or combinations/ variations of more than one model.

CA Raginee Goyal

CA Raginee Goyal

Gauhati, India