Important changes for Exporters related to refund

Table of Contents

- Important changes for Exporters:

- Amendment in rule 89(4): Export price up to 1.5 times of domestic price will be eligible for refund:

- When similar goods are supplied in the domestic market by the exporter:

- When similar goods are not supplied by the same supplier:

- Realization of export proceeds within the time period provided in FEMA:

- Download amended rules related to export:

Important changes for Exporters:

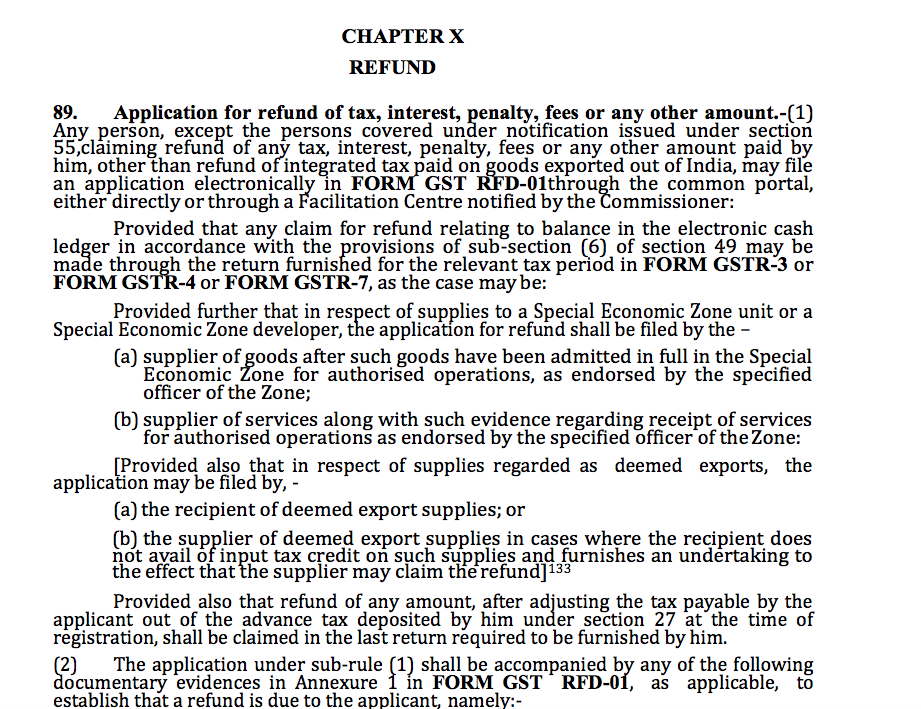

CBIC via notification no.16/2020-Central Tax ,dt. 23-03-2020 amended CGST rules. Here we have compiled important changes in refund related to the export of Goods. The value of export goods is restricted to the calculation of export refunds. It is applicable only in case where the refund of ITC is claimed. When we export on LUT without payment of IGST.

Amendment in rule 89(4): Export price up to 1.5 times of domestic price will be eligible for refund:

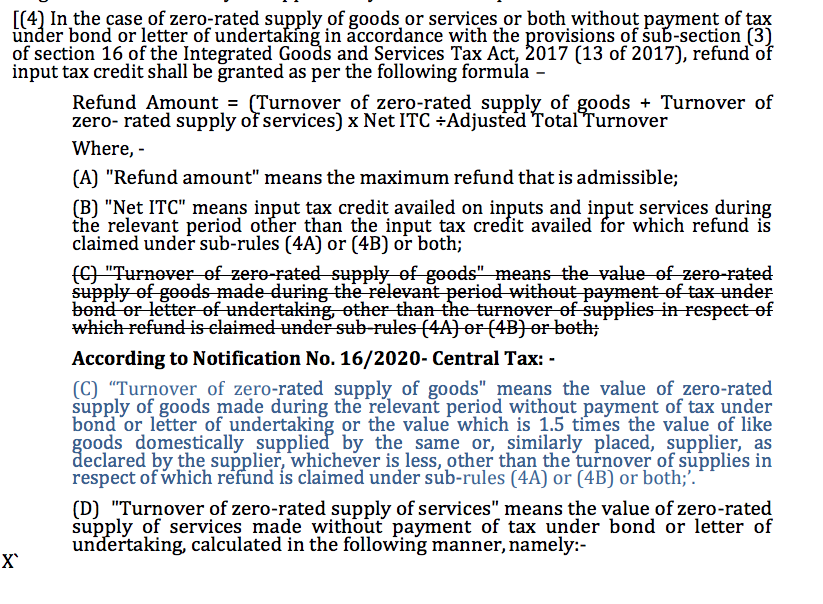

Amendment in rule 89(4) has changed the definition of export of goods. As you can see in the image above, “Turnover of zero-rated supply of Goods’ is changed. The value of export goods is curtailed to 1.5 times of domestic value. There can be various scenarios. We will discuss them in this post.

-

When similar goods are supplied in the domestic market by the exporter:

In this case, the value of goods exported is curtailed to 150% of value of the same goods sold in the domestic market.

Illustration:

Mr. A exported 500 plastic bottles @10Rs per bottle. In domestic market he sol the same bottle for Rs. 7.

Now at the time of calculation of the refund value of the zero-rated supply of goods will be:

Lower of Export value and 150% of sales in domestic market.

= Rs. 10 or Rs. 7*1.5=10.50

Rs 10 is lowe of two. It will be the value of Export goods.

Let us take the second scenario:

Now let us suppose the value of domestic supply is Rs. 5

Value of zero-rated supply of Goods is:

Lower of Rs. 10 or 5*1-5=7.5

Now the value of export goods is Rs. 7.5

When similar goods are not supplied by the same supplier:

In this case, the value of the same goods sold by another supplier will be taken into account.

Illustration:

Rice is exported by A ltd @ 100Rs per KG. They have zero-rated supply only. No domestic supply is made by them. The same type of Basmati rice is sold by Daawat Basmati @ Rs. 150 per Kk in the domestic market.

Now for export of 100 KG value of zero-rated supply of Goods is:

lower of Rs. 100 or Rs.150*1.5

Rs 100 is lower hence will be the value.

Realization of export proceeds within the time period provided in FEMA:

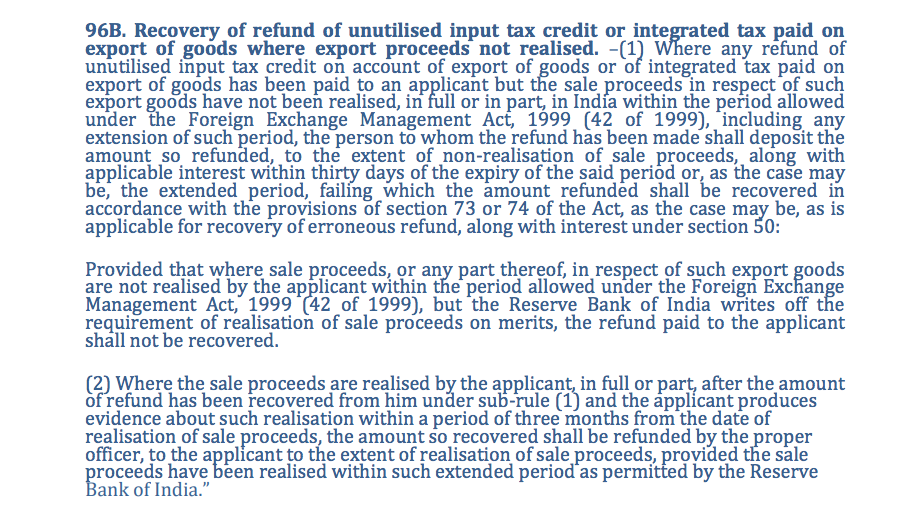

Rule 96(b) is inserted by this notification in CGST rules. This change will make the export refund harder. It requires the receipt of foreign exchange within the prescribed period. In case the consideration in forex is not received in foreign exchange, a refund will be paid back to govt, with interest. Although the refund paid back to govt can be re availed once the consideration is received at a later date. The only condition is it should be informed to the CBIC with 3 months of realization.

Download amended rules related to export:

REFUND (1)

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.