Rule 145 of the CGST Rules – Recovery from a third person

Rule 145 of the CGST Rules – Recovery from a third person

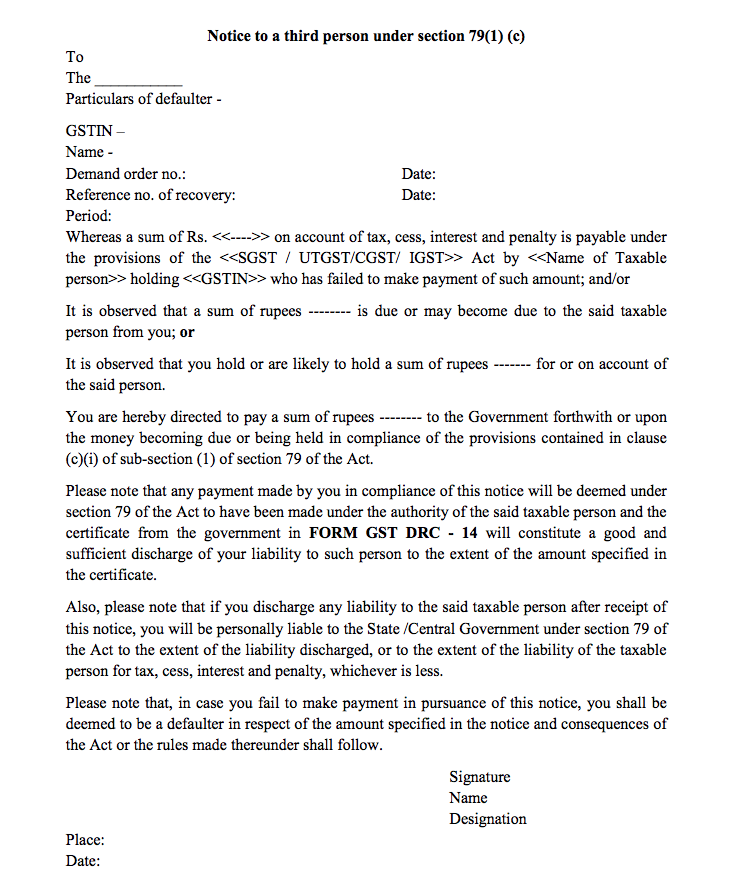

Rule 145 of the CGST rules- “(1) The proper officer may serve upon a person referred to in clause (c) of sub-section (1) of section 79 (hereafter referred to in this rule as―the third person‖), a notice in FORM GST DRC-13 directing him to deposit the amount specified in the notice.

Related Topic:

Rule 86B of CGST Rules-caution before you proceed

(2) Where the third person makes the payment of the amount specified in the notice issued under sub-rule (1), the proper officer shall issue a certificate in FORM GST DRC14 to the third person clearly indicating the details of the liability so discharged.”

What is Rule 145 of CGST Rules?

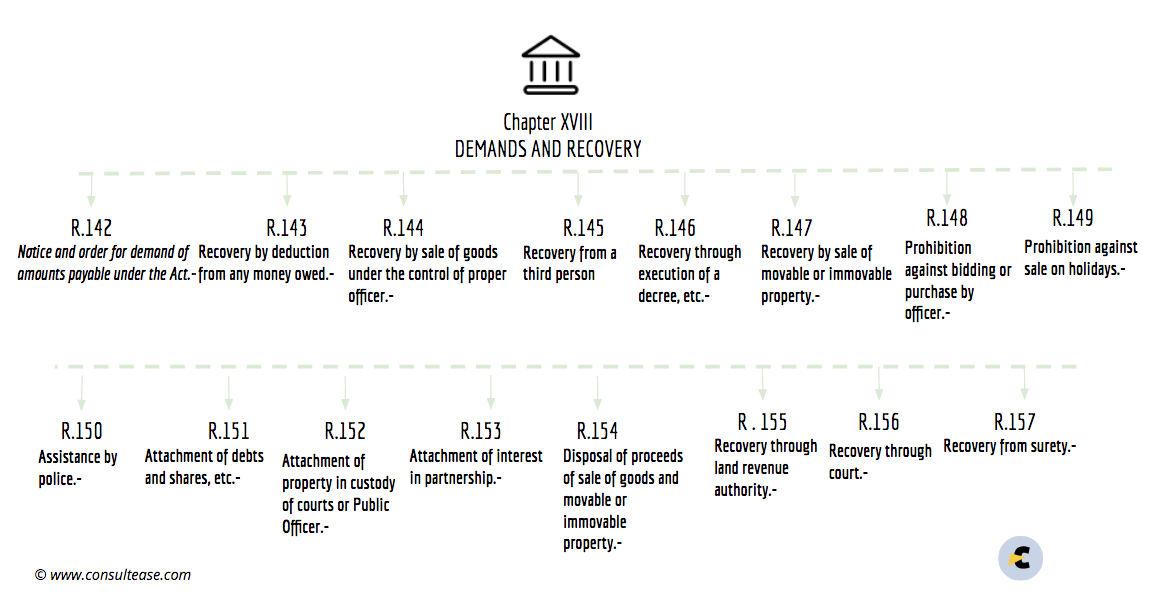

It is part of the demand and recovery chapter of CGST rules. That is chapter no. XVIII. Office can recover a demand from a third person. Any person in possession of any amount belonging to the taxpayer. Or a debtor of the taxpayer. e.g. A tenant of the taxpayer as in the case of Kabeer reality. Bank or insurance companies can also be required to pay to the department in place of taxpayers.

Format of FORM GST DRC-13

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.